- Home

- Todays Market

- Indian Stock Market News January 16, 2016

Global Markets Continue to Collapse Sat, 16 Jan RoundUp

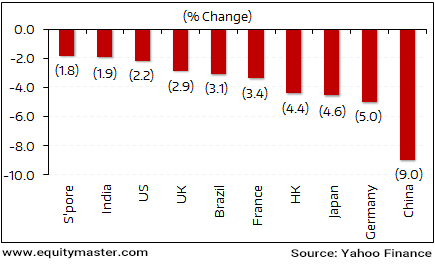

Major global markets witnessed sharp selling activity for the second week in row. Investors panicked as concerns about the Chinese economic growth became widespread. On the other hand, disappointing US data too caused further distress across the indices. Consequently, leading to sharp plunge during the last trading day of the week.

Due the huge correction in commodity prices, the currencies of commodity exporting nations have also come under severe pressure. Consequently, the oil prices tumbled to 12 years low, falling below US$ 30 per barrel.

The China stock markets witnessed maximum selling pressures and lost another 9% in a week's time. On the other hand, UK stock markets tumbled to 3 year lows, sending FTSE 100 to its lowest levels since November 2012.

While, even the Indian markets were not spared yet the Indian indices held up reasonably well this week, as compared to the global peers.

Key world markets during the week

Vivek Kaul - co-editor of Daily Reckoning has recently written couple of essays on what exactly is happening in the dragon nation and why the situation could get much worse. Read this compelling piece.

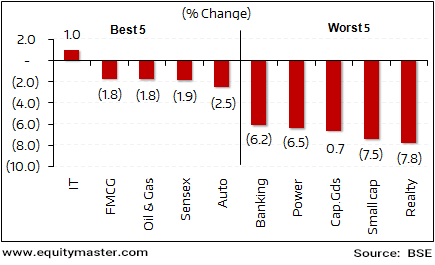

BSE indices during the week

Barring stock markets from Information Technology sector, major indices closed on a disappointing note. Stocks from Realty and Capital Goods sector were the worst performers. The Small cap and Midcap stocks were too battered in the week gone by.

Now let us discuss some key economic and industry developments during the week gone by.

As per an economic daily, India's demand for fuel rose 8.3% during the month of December on a YoY (year-on-year) basis. The rise in demand was driven by higher gasoline consumption as passenger vehicles sales rose on the back of year-end deals and discounts in December.

Data from the Petroleum Planning and Analysis Cell (PPAC) of the oil ministry showed that India consumed 15.8 million tonnes of fuel last month. Consumption of gasoil or diesel, which comprises about 40% of refined fuels used in India, rose 5.4% to 6.5 MT (million tonnes) during the period. Sales of petrol, surged 11.8% from a year earlier to 1.8 MT. This was seen as passenger car sales in the month rose nearly 13% and the fuel became cheaper on the back of plunging crude prices. Cooking gas or liquefied petroleum gas (LPG) sales increased 6.2% to 1.7 MT, while naphtha sales were 24.8% higher at 1.1 MT. Lastly, sales of bitumen, used on roads, were up 11.2%, while fuel oil use rose 12.6% during December.

As per an article in Economic Times, the government is considering to allow power companies to index rupee debt with global currencies in order to draw cheaper long-term loans from foreign investors. The consideration comes as domestic players in the industry have demanded to allow indexing of a portion of the debt of the power plants.

Power minister Piyush Goyal is open to consider the same and had stated in Tokyo that indexing a portion of the tariff to a basket of global currency can reduce foreign risks and thereby tariffs. The minister also said that Japanese banks and corporations are willing to invest in Indian energy sectors, with existing investors such as SoftBank, which has committed US$ 20 billion, indicating to increase its investments.

One shall note that, six leading banks of Japan are going to meet the Power Minister to discuss opportunities for investing in Indian energy sector including in ultra-mega power projects, renewable energy projects, rural electrification, and transmission and distribution projects. The meetings are part of an ongoing India-Japan energy dialogue led by the Confederation of Indian Industry.

Brent crude dipped below US$30 a barrel on Wednesday for the first time in more than 10 years, a day after the U.S. benchmark took a similar fall. Brent traded as low as US$29.96 a barrel before settling down 55 cents, the lowest settlement since April 2004. Brent has fallen for eight straight trading sessions, the longest losing streak since July 2014. This has affected the merchandise exports in the country. During the first six months of the year the total exports fell by 16.4% in comparison to the same period in 2014. Between July and November 2015, exports have fallen by 19.7%, in comparison to July and November 2014.

Movers and shakers during the week

| Company | 8-Jan-16 | 15-Jan-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top gainers during the week (BSE-A Group) | ||||

| Infosys | 1,063 | 1,140 | 7.3% | 1219/933 |

| Relaince Industries | 1,024 | 1,073 | 4.8% | 1087/797 |

| BPCL | 903 | 934 | 3.3% | 987/643 |

| Muthoot Finance | 3,328 | 3,421 | 2.8% | 254/152 |

| HPCL | 973 | 987 | 1.4% | 991/555 |

| Top losers during the week (BSE-A Group) | ||||

| Jindal Steel | 84 | 64 | -24.2% | 208/56 |

| IDBI Bank | 78 | 61 | -21.9% | 133/57 |

| Jaiprakash Asso. | 11 | 9 | -20.1% | 96/52 |

| Allahabad | 65 | 53 | -18.1% | 29/8 |

| Oriental Bank | 128 | 104 | -18.4% | 341/111 |

Source : Equitymaster

Now let us move on to some of the key corporate developments in the week gone by.

As per an article in leading financial daily, Competition Commission of India (CCI) has given approval to Strides Arcolab to acquire Sun Pharmaceutical's two business divisions. The consideration for the same is pegged at Rs 1.65 billion. The agreement was entered during September 2015, however was awaiting regulatory clearance. The two business divisions belonged to erstwhile Ranbaxy. The company was acquired by Sun Pharma around a year back. Post the acquisition of Ranbaxy, Sun Pharma is taking various steps to derive synergies from the acquired business. The divestment of these units is in line with the company's strategic plan.

As per a leading financial daily, Larsen & Toubro's (L&T) construction arm- L&T Constructions has won orders worth Rs 12.5 billion across various businesses. Under buildings & factories business, the company has secured a turnkey order worth Rs 9.8 billion. The same is from a global information technology major for the construction of IT Park in Bengaluru. The scope of work for this includes civil, structural, mechanical, electrical, plumbing, high-end finishes, data center and other associated works. The project is scheduled to be completed in 30 months.

Furthermore, under power transmission & distribution business, the company has bagged an international order worth Rs 2.5 billion. Larsen & Toubro (Oman) LLC, a subsidiary of the company, has bagged an order valued at OMR 16.03 million from Oman Electricity Transmission Company (OETC) for the construction of new 132kV grid stations on an engineering, construction and procurement basis.

Our StockSelect team just released a report on L&T (requires subscription).

As per a leading financial daily, Zydus Cadila has introduced a breast cancer drug in India under the brand Vivitra. The drug is a copy of Swiss giant Roche's product Herceptin. The drug had global sales of about Rs US$ 6.6 billion in 2014 for Roche.

To note, Roche, which sells the product in India as Herclon, has taken legal action against two Indian companies for making copies of the drug by contesting their claims of similar efficacy.

Zydus Cadila is the latest Indian company to start selling a version of trastuzumab in the country under the brand Vivitra. A government expert committee had approved Vivitra in October after recommending certain changes to the product information provided in the package. Each vial of Vivitra is priced at Rs 64,999 while other trastuzumab brands are sold in India at Rs 50,000.

The result season kicked off during the weak.

Two leading Information Technology company Infosys Ltd and TCS Ltd reported their December quarter earnings.

Infosys Ltd, reported, consolidated sales growth of 1.7% QoQ during 3QFY16. In US dollar terms, revenues were up 0.6% QoQ. Operating profits were down 0.9% QoQ. The operating margin came in at 24.9%. The other income was higher by 1.3% QoQ. The profit before tax (PBT) was down 0.5% QoQ in-line with the muted operating performance. The consolidated net profit came in at Rs 34.65 bn an increase of 2% QoQ.

TCS, reported net sales increased by 0.7% QoQ in 3QFY16. Volumes were up by 0.4% QoQ. The operating performance was muted. The operating margin fell from 28.7% in 2QFY16 to 28.2% in 3QFY16. On an absolute basis, the operating profit decreased by 1% QoQ. The other income decreased by 1.2% QoQ and came in at Rs 6,942 m for the quarter. The net profit came in at Rs 60,834 m. This was flat sequentially. The management has declared an interim dividend of Rs 5.5 per share. The record date for the same is 22 Jan 2016 and it will be paid out on 29 Jan 2016.

We believe global markets are likely to remain under pressure going forward. China is expected to release fourth-quarter GDP, industrial production and retail sales data in the early next week. This could bring more volatility in the markets. None of the concerns of global investors are likely to go away anytime soon. Indian markets too will continue to experience the fallout of this turmoil. However, long term investors need not be too concerned. Times like these could offer good opportunities to enter good quality stocks at reasonable valuations.

And here's an update from our friends at Daily Profit Hunter...

The losing streak continued in the second week of January. Nifty fell below the psychological mark of 7,500 and closed at an 18 month low of 7,437. The intraday oscillators are moving back in the bearish territory after a minor pullback suggesting bears are likely to keep prices under check on an immediate basis. All the bullish advances met selling pressure around 7,600 during the week. This level will act as a strong resistance going forward. You can (link to DPH commentary) read the detailed technical update on the market here...

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global Markets Continue to Collapse". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!