- Home

- Todays Market

- Indian Stock Market News January 22, 2021

Sensex Trades Over 300 Points Lower; Dow Futures Down by 101 Points Fri, 22 Jan 12:30 pm

Share markets in India are presently trading on a negative note.

The BSE Sensex is trading up by 357 points, up 0.7% at 49,267 levels.

Meanwhile, the NSE Nifty is trading down by 86 points.

Bajaj Auto and Hero MotoCorp are among the top gainers today. Axis Bank and Hindalco are among the top losers today.

The BSE Mid Cap index is trading down by 0.3%.

The BSE Small Cap index is trading down by 0.4%.

On the sectoral front, stocks from the metal sector, are witnessing most of the selling pressure.

On the other hand, stocks from the automobile sector, are witnessing most of the buying interest

US stock futures are trading lower today, indicating a negative opening for Wall Street.

Nasdaq Futures are trading down by 39 points (down 0.3%) while Dow Futures are trading down by 101 points (down 0.3%)

The rupee is trading at 73.04 against the US$.

Gold prices are trading down by 0.3% at Rs 49,311 per 10 grams.

Gold prices slid today in Indian markets amid weak global cues. On MCX, gold futures dipped 0.1% to Rs 49,394 per 10 grams. In the previous session, gold had dipped 0.2%.

Note that gold prices have seen wild swings this year amid higher US bond yields, strengthening dollar and US stimulus announcement.

To know more about gold, check out our article on how to invest in gold here: How to Invest in Gold?

Speaking of stock markets, India's #1 trader, Vijay Bhambwani, talks about what happens behind the scenes in his trade recommendations, in his latest video for Fast Profits Daily.

In the video below, Vijay shares details of what he actually looks at when recommending and monitoring a trade.

Tune in here to find out more:

Moving on to stock specific news...

Among the buzzing stocks today is Bajaj Auto.

Bajaj Auto on January 21 reported its highest-ever profit and turnover during the December quarter (Q3FY21). The company's standalone net profit went up by 23% year-on-year (YoY) to Rs 15.5 billion, while revenues rose 17% to Rs 87.3 billion.

The company said it has posted its highest-ever turnover during the December quarter and for the first time exceeded the Rs 90 billion mark to reach Rs 92.7 billion, a rise of 16%. Revenue from consolidated operations of the company was up 17% at Rs 89.1 billion while consolidated profit after tax stood at Rs 17.1 billion.

The company's operating margin during the quarter was higher at 19.8% compared to 18.3% in the year-ago period. The improvement in margins was driven by higher operating leverage and better product mix. However, these margins could get impacted during the last quarter of FY21 as steel and aluminium costs have gone up and the company would not be able to pass this onto customers.

Bajaj Auto's CFO, Soumen Ray, said that there was a shift in the market towards premiumisation and this as well as growth in the export markets contributed to profit and margins.

The company achieved its highest-ever exports of 687,000 units during the quarter. This growth was despite shortage of containers and the company could have achieved even more substantial growth in the export markets. Export revenues during the quarter was at Rs 40.8 billion.

Bajaj also expanded its market share in the domestic motorcycle market to 18.6% during the December quarter from 17.5% in the September quarter.

We will keep you posted on more updates from this space. Stay tuned.

At the time of writing, Bajaj Auto share price was trading up by 10.8% on the BSE.

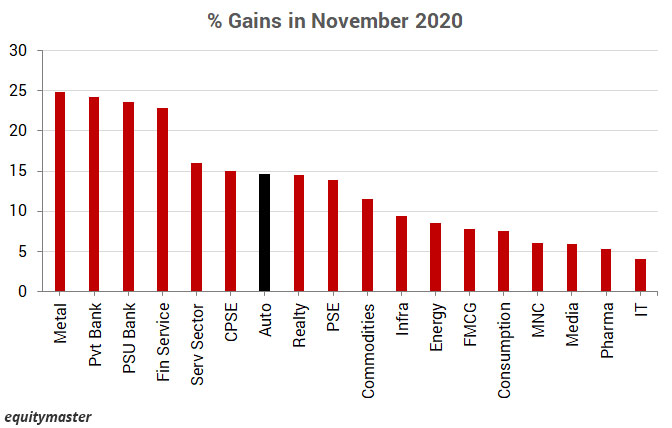

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The auto index entered the greed phase in September 2019 and is expected to stay there until December 2021. This means there is still a lot of fuel left for automobile stocks.

How automobile stocks perform in the coming months remains to be seen.

Moving on to news from the software sector...

Q3FY21 Results: Net Profit Falls 12% to Rs 950 Million

Cyient, a global engineering and technology solutions company, on January 21 reported its consolidated financial results for the December quarter (Q3FY21).The Hyderabad based IT firm reported an 11.9% year-on-year (YoY) decline in net profit at Rs 954 million for the quarter. It had posted a net profit of Rs 1.1 billion in Q3FY20. The company's net profit, however, saw a growth of 13.8% quarter-on-quarter (QoQ).The company's consolidated revenue during the third quarter stood at US$ 141.4 million, a growth of 4.7% QoQ (4.1% in constant currency) and de-growth of 8.9% YoY.

The revenue for the Design Led Manufacturing (DLM) business stood at US$ 26 million and grew by 24.8% QoQ and 72.4 % YoY. The operating margin at 11.2% is higher by 14 basis points (bps) QoQ and 154 bps YoY, mainly driven by operational efficiency and better DLM margins.

"We continue to focus on improving operational efficiency and executing actions to bring growth back in the business. We won a number of large deals which sets us up for a stronger performance in the coming quarters. Our Order Intake (OI) for the quarter has increased by 7% YoY backed by strong growth in key clients and digital opportunities," Krishna Bodanapu, Managing Director and Chief Executive Officer, said.

"Our outlook for FY21 remains unchanged wherein we expect a double-digit de-growth in revenue, he added.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Over 300 Points Lower; Dow Futures Down by 101 Points". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!