- Home

- Todays Market

- Indian Stock Market News January 24, 2017

Sensex Trades in the Green; Power Stocks Witness Buying Tue, 24 Jan 01:30 pm

After opening the day on a flat note, the Indian share markets have gained momentum and are now trading in the green. Sectoral indices are trading on a mixed note with stocks in the power sector and the auto sector trading on a positive note, while stocks in the IT sector and the FMCG sector leading the losses.

The BSE Sensex is trading up by 154 points (up 0.6%) and the NSE Nifty is trading up by 53 points (up 0.6%). Meanwhile, the BSE Mid Cap index is trading up by 0.6% while the BSE Small Cap index is up by 0.6%. The rupee is trading at 68.14 to the US$.

Shares of MOIL were down as much as 4% intraday as the government started to sell its 10% stake in the mining company through an offer for sale (OFS) as part of its divestment plan. The government currently holds 75.58% in MOIL, formerly known as Manganese Ore India Ltd.

The floor price for the OFS was set at Rs 365 per share, which is at a 4.6% discount on Monday's closing price of Rs 382.7 per share. Retail investors, for whom 20% of the OFS would be reserved, will get a further discount of 5%. Retail investors are those who put in bids for less than Rs 2 lakh.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The government plans to sell up to 13.3 million shares through the OFS, fetching the exchequer around Rs 4.5 billion.

The two-day OFS has opened for institutional bidding today and retail investors will be able to subscribe on January 25.

At the time of writing shares of MOIL were trading down 2.2%.

The government is exploring ways at shoring up its revenues and is leaving no stone unturned in exhausting its options through buybacks, steep dividends from PSUs, and other instruments.

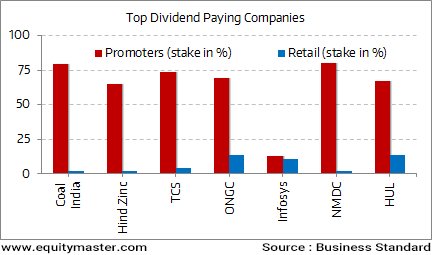

Promoters Get the Major Chunk of the Dividend Pie

Earlier this fiscal, the government had raised about Rs 7.9 billion crore through share buyback of MOIL. The government has so far raised about Rs 300 billion through minority share sale by way of OFS, share buyback and CPSE ETF so far in the current fiscal.

Moving on to news from stocks in the IT Sector. IT and engineering services firm Cyient, formerly known as Infotech Enterprises, announced acquisition of US-based Certon Software Inc., in an all cash transaction.

Shares of the company were trading up by as much as 6% intra day after the announcement.

Cyient's wholly owned subsidiary Cyient Inc., USA signed a definitive agreement to acquire 100% equity in Certon Software Inc., Melbourne, Florida, USA, in an all cash transaction. This transaction will further strengthen the automation in its key vertical Aerospace and Defense in line with strategy for growth.

The company said there are no regulatory approvals needed for the transaction, which is likely to conclude in the next 30 days.Certon Software Inc. was incorporated in 2006 and it performs independent verification and validation services to firms seeking certification for safety-critical systems, embedded software, and electronic hardware. The entity has presence in United States of America.

In related news, in an announcement last week, Cyient said that it had commenced operations in Warangal, from the Incubation Centre of the Telangana State Industrial Infrastructure Corporation (TSIIC).

Cyient has established a Centre of Excellence (CoE) in TSIIC Incubation Centre to help its communications business expand operations for its global client base. The CoE will undertake fibre and co-axial network planning and design, MDU engineering, cell site design and drafting, RF planning, and network optimisation services," it said in a BSE filing.

The facility, spread over a five-acre area, would support Cyient's worldwide digital technology initiatives in areas like Internet of Things, analytics, and Smart Cities.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades in the Green; Power Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!