- Home

- Todays Market

- Indian Stock Market News February 2, 2023

SGX Nifty Down 135 Points | Adani Group's Port Acquisition | Why Defence Stocks are Falling | Top Buzzing Stocks Today Thu, 2 Feb Pre-Open

On Wednesday, Indian share markets witnessed high volatility as Adani group stocks and insurance companies fell sharply in the second half, dampening overall sentiment.

Benchmark indices reversed gains made after the budget speech, and ended on a mixed note with Sensex closing in green, while Nifty ending in the red.

The fall was led by insurance companies after the country's Union budget proposed to limit tax exemptions for insurance proceeds, while Adani Group shares tumbled.

At the closing bell on Wednesday, the BSE Sensex stood higher by 158 points (up 0.3%).

Meanwhile, the NSE Nifty closed lower by 46 points (down 0.3%).

ITC, Tata Steel, and ICICI Bank were among the top gainers.

Adani Enterprises, Adani Ports, and Ambuja Cement on the other hand, were among the top losers.

Broader markets settled on a negative note on Wednesday. The BSE Midcap ended 0.9% lower while the BSE SmallCap index fell 1.1%.

Sectoral indices ended on a mixed note with stocks in the FMCG sector, and IT sector witnessing buying.

While stocks in power sector, oil & gas sector and power sector witnessed selling.

Shares of Polycab India, and M&M hit their 52-week highs.

If you're interested in knowing which shares to trade, read our guide on the best intraday stocks for today.

The rupee was trading at 81.91 against the US$.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Looking to Buy Midcap Stocks?

If you're looking to buy some high-quality midcap stocks, then our co-head of research Rahul Shah has got some great recommendations.

You can get instant access to these stocks by subscribing to his popular stock research service, Midcap Value Alert.

The great news is... as part of Equitymaster's 28th anniversary celebrations... you have the chance to access this service at a huge 80% OFF

Get Full Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Gold prices for the latest contract on MCX were trading higher by 1.1% at Rs 57,796 per 10 grams at the time of Indian market closing hours on Wednesday.

At 8:20 AM today, the SGX Nifty was trading down by 135 points or 0.8% lower at 17,560 levels.

Indian share markets are headed for a gap-down opening today following the trend on SGX Nifty.

Speaking of stock markets, the stock markets have been under pressure after the American short seller Hindenburg Research issued a report on Adani group stocks.

The top Adani group stocks have taken a hit. However, this is not new ...the same thing happened before with Vakrangee.

In January 2018, Co-head of Research at Equitymaster Tanushree Banerjee observed how the market capitalisation of Vakrangee crossed pharma behemoth Lupin's marketcap. A perfect case of an exciting business gaining dominance over a boring one!

Mind you, Vakrangee was already a 1,000 bagger then!

It was not difficult to see why investors were scampering to get a share of the pie. Nothing about Vakrangee seemed to surprise the streets.

What happened next? Watch the below video to know more...

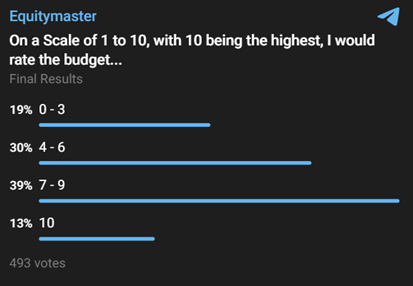

Also, to understand what our readers are thinking about the budget announced yesterday, we ran a poll on Equitymaster's telegram channel.

This is what we asked our readers:

With a response from over 400 participants, majority of investors rate budget in the scale of 7-9%.

Top Buzzing Stocks Today

Whirlpool of India share price will be in focus today.

The company declared its quarterly results yesterday. The electronics and kitchen appliances maker has recorded a standalone profit at Rs 107 million (m) (about Rs 10.7 crore) for the 31 December 2022 quarter, down 74% from the year-ago period, impacted by negative operating performance as well as a lower topline.

Standalone revenue from operations declined 18.3% on year to Rs 11.7 bn for the quarter.

Jubilant Foodworks share price will also be a top buzzing stock.

The company declared its quarterly results yesterday. The QSR company has recorded consolidated profit at Rs 804 m for the quarter ended 31 December 2022, falling sharply by 40% compared to the year-ago period weighed down by weak operating margin performance.

Consolidated revenue from operations at Rs 13.3 bn for the quarter grew by 10% year-on-year, primarily driven by growth in orders for Domino's.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Equitymaster's Premium Research:

Discover the Lucrative Opportunities in India's Emerging Business space

Read This Letter

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Silver lining for Adani group stocks?

The Adani Group has acquired the strategic Israeli port of Haifa for US$1.2 bn (about Rs 98.34 bn) and vowed to transform the skyline of this Mediterranean city as part of its decision to invest more in the Jewish nation, including opening an artificial intelligence lab in Tel Aviv.

Adani Group chairman Gautam Adani, whose business empire was rocked by allegations of fraud by US short seller Hindenburg Research, appeared alongside Israeli Prime Minister Benjamin Netanyahu for signing of the deal to takeover Haifa Port, and spoke of investment opportunities.

Prime Minister Netanyahu described the Haifa port deal with the Adani Group as an "enormous milestone", saying it will significantly improve connectivity between the two countries in many ways.

However, even this news failed to excite investors as Adani Ports share price crashed over 17%.

Defence stocks fall

Contrary to expectations, there was no big announcement for the defence sector in Union Budget 2023-24. While the ministry of defence has received the highest allocation among all ministries at Rs 5.9 tn, it is not a significant jump from Rs 5.3 tn allocated for this financial year.

The best defence stocks in India fell yesterday. Shares of Bharat Electronics, Bharat Dynamics, Hindustan Aeronautics, and Paras Defence tumbled more than 5% after Finance Minister Nirmala Sitharaman completed her budget speech.

Under its ambitious Atmanirbhar Bharat scheme, the government has banned imports of several items, including crucial parts used in defense equipment, which means they are being manufactured in India now.

The government has set a target of Rs 1.8 lakh tn worth of defence production by 2025.

Thus, market participants were hoping for more big bang announcements in this Budget.

Since you are interested in defence stocks, you might also be interested in top 5 defence companies in India by growth.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Want Low Risk Stocks with High Growth Potential?

Access Our Premium Research on Safe Stocks at 60% Off

Full Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Dixon Technologies share price rallies

Shares of Dixon Technologies gained 7% in the afternoon trade after finance minister Nirmala Sitharaman lowered the duty on mobile phone components and TV sets in her budget 2023-24.

The budget cut customs duty on mobile components like cameras and batteries and offered concession on lithium-ion batteries. Duty on open cells used televisions was cut to 2.5%, which is likely to make TVs cheaper and boost demand.

These announcements are seen benefiting contract manufacturers like Dixon Technologies, said market participants. The reduction in custom duty on certain mobile phone components and television parts will help promote their manufacturing in India.

The Economic Survey, released a day ahead of the Budget, said the electronic industry's significant growth drivers are mobile phones, consumer electronics, and industrial electronics.

This is a sign of relief for investors as Dixon Technologies share price was falling after posting poor quarterly results.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "SGX Nifty Down 135 Points | Adani Group's Port Acquisition | Why Defence Stocks are Falling | Top Buzzing Stocks Today". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!