- Home

- Todays Market

- Indian Stock Market News February 2, 2023

Sensex Today Ends Volatile Session Higher | ITC, Britannia Surge 5% | Adani Enterprises Cracks 27% Thu, 2 Feb Closing

After opening the day on a negative note, Indian share markets witnessed volatile trading activity throughout the session and managed to bounce back during closing hours.

Benchmark indices ended on a mixed note with Sensex closing in green due to upbeat global sentiment and tracking positive sentiment following budget 2023.

Meanwhile, the Nifty 50 index ended in the red as Adani Group shares tumbled once again. Nifty index has several Adani stocks, so it ended on a negative note.

At the closing bell, the BSE Sensex stood higher by 224 points (up 0.4%).

Meanwhile, the NSE Nifty closed lower by 6 points.

ITC, Britannia, and HUL were among the top gainers today.

Adani Enterprises, Adani Ports, and UPL on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,639, down by 61 points, at the time of writing.

Broader markets settled on a positive note. The BSE Midcap ended 0.2% higher while the BSE SmallCap index rose 0.4%.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

India's Potentially Decade-Long $10 Trillion Bull Run...

Our Co-Head of Research Tanushree Banerjee believes India is going on a decade-long $10 trillion bull run.

And she has discovered 7 mega trend that could potentially be among the top wealth creators in this upcoming bull run.

At our upcoming event, Tanushree will reveal all the details of this mega opportunity, including the golden buying window to enter India's potentially decade-long $10 trillion bull run.

Click Here to Get Full Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Sectoral indices ended on a mixed note with stocks in the FMCG sector, and IT sector witnessing buying.

While stocks in power sector, oil & gas sector and energy sector witnessed selling.

Shares of Britannia, Blue Star, and ITC hit their 52-week highs today.

Asian share markets ended the day on a positive note. The Hang Seng rose 0.5%, while the Shanghai Composite index ended flat. The Nikkei edged 0.2% higher.

US stock futures are trading on a mixed note. Dow futures are trading down by 0.1% and Nasdaq futures are trading up by 1.3%.

The rupee is trading at 82.23 against the US$.

Gold prices for the latest contract on MCX are trading higher by 1.5% at Rs 58,783 per 10 grams.

Meanwhile, silver prices for the latest contract on MCX are trading up by 2.7% at Rs 71,780 per kg.

Speaking of stock markets, markets have remained under pressure after the American short seller Hindenburg Research issued a report on Adani group stocks.

The top Adani group stocks have taken a hit. However, this is not new ...the same thing happened before with Vakrangee.

In January 2018, Co-head of Research at Equitymaster Tanushree Banerjee observed how the market capitalisation of Vakrangee crossed pharma behemoth Lupin's marketcap. A perfect case of an exciting business gaining dominance over a boring one!

Mind you, Vakrangee was already a 1,000 bagger then!

It was not difficult to see why investors were scampering to get a share of the pie. Nothing about Vakrangee seemed to surprise the streets.

What happened next? Watch the below video to know more...

Adani group stocks hit lower circuit

After global bankers Citigroup and Credit Suisse stopped accepting securities of Adani companies as collateral for margin loans, most Adani group shares were today locked in their respective lower circuit limits.

Adding to that, the surprise move to withdraw the Rs 200 bn FPO weighed on Adani Enterprises as it slipped 25% to hit a new low of Rs 1,815.05 today.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

This Silvery-white Metal is a Potential Fortune Maker

This silvery-white metal goes inside almost all the electronic gadgets that you use: mobile phone, laptop, Bluetooth speakers.

Not only that... this metal also goes inside equipment used by large data centres, telecom towers, railways, planes, EVs.

We're talking about Lithium. Lithium is the new oil.

Our research has found the best way to tap into this rising demand of lithium in India.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Apart from this, shares of Adani Transmission and Adani Green Energy hit their 10% lower circuit limit. While shares of Adani Ports considered the group's cash cow, lost 14% today to hit a fresh 52-week low.

Adani Power, and Adani Wilmar were locked in at a 5% lower circuit.

Amid the bloodbath, Adani stocks have fallen up to 62% from their all-time high levels.

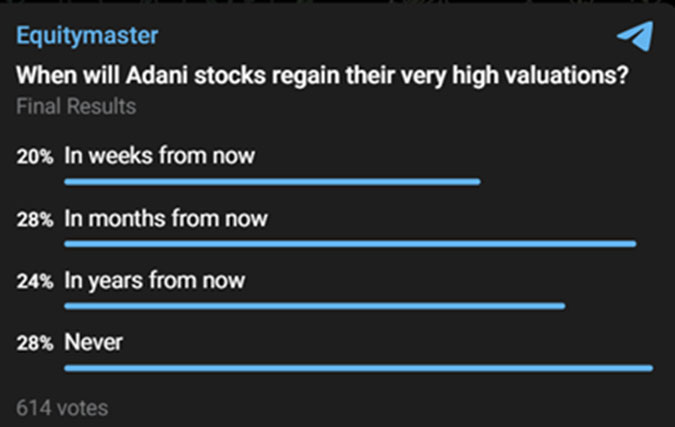

To understand what our readers are thinking about the wild movement in Adani group stocks, we ran a poll on?Equitymaster's telegram channel.

This is what we asked our readers:

Some think that the stocks would regain their valuations in a month.

While some think the Adani stocks will never gain their high valuation. This can be due to investors' doubts on the group following the Hindenburg report.

Check out the technical analysis which Brijesh has shared in this note: Adani Group Stocks: Beginning of an End?

HDFC Q3 results

Moving on to news from the finance sector, shares of HDFC were in focus today.

Private mortgage lender HDFC (Housing Development Finance Corporation), on Thursday, reported a standalone net profit of Rs 36.9 bn for the December 2022 quarter. This was 13.2% higher than Rs 32.6 bn profit reported in the year-ago period.

For the first nine months of FY23, HDFC's profit before tax stood at Rs 146. bn compared to Rs 126.2 bn in the corresponding period of the previous year.

The lender's net interest income rose by 14% to Rs 48.7 bn for the December 2022 quarter from Rs 42.8 bn a year back.

Its loan book grew by 13% YoY on an asset under management (AUM) basis.

HDFC's assets under management (AUM) at the end of the December 2022 quarter stood at Rs 7 tn against Rs 6.1 tn in the previous year. Of this, individual loans comprised 82 per cent of the AUM.

Asset quality improved during the said quarter with the gross non-performing loans (GNPLs) falling to Rs 88.8 bn, down 2.3% YoY.

The gross individual NPLs stood at 0.86% against 1.4% last year, while the gross non-performing non-individual loans stood at 3.9%.

HDFC is a pioneer of housing finance in India, has always stood by its core value of integrity, trust, transparency, and professional service.

Why ITC share price is rising

Moving on to news from FMCG sector, share price of ITC rose 6% today.

Shares of cigarette-to-hotels major ITC hit a 52-week high of Rs 384.4 on Thursday after the hike in duty on cigarettes in Union Budget speech had a limited impact on the company.

The government has hiked the National Calamity Contingent Duty (NCCD) on cigarettes by 16%. NCCD accounts for about 10% of overall taxes on cigarettes.

But this would increase the prices of ITC's cigarettes only by 2-3%, which can be easily passed on to the investors, increasing the margin.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Investing in Small Companies Offer Huge Potential Long-Term Growth for Early Movers

Find out how you can access our Premium Research on India's Emerging Businesses

Full Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

For ITC, cigarettes constitute more than 80% of the company's net profit and about 45% of its topline.

ITC is one of the best dividend-paying stocks. We did an editorial back in January 2022 listing the best dividend stocks you can count on.

Apart from that, we also covered an editorial a couple of months ago explaining why the prospects for ITC look good. You can read it here - ITC: Load, Aim...Fire.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Ends Volatile Session Higher | ITC, Britannia Surge 5% | Adani Enterprises Cracks 27%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!