- Home

- Todays Market

- Indian Stock Market News February 2, 2023

Sensex Today Trades Flat | Adani Stocks Selloff Deepens | Adani Green, Adani Transmission Fall 10% Thu, 2 Feb 10:30 am

Asian share markets jumped today after Fed Chair Jerome Powell said a disinflationary process was underway, boosting risk appetite and hopes that the US central bank will soon end its monetary tightening streak.

The Nikkei is up 0.1% while the Hang Seng is trading higher by 0.4%. The Shanghai Composite is up 0.3%.

The S&P 500 and the Nasdaq closed sharply higher on Wednesday after Federal Reserve chair Jerome Powell acknowledged that inflation was starting to ease, in remarks he made following a quarter-point rate hike by the US central bank.

The Dow Jones ended flat while the tech heavy Nasdaq Composite ended higher by 2%.

Here's a table showing how US stocks performed yesterday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 101.43 | 1.56 | 1.56% | 102.19 | 98.42 | 152.1 | 83.45 |

| Apple | 145.43 | 1.14 | 0.79% | 146.61 | 141.32 | 179.61 | 124.17 |

| Meta | 153.12 | 4.15 | 2.79% | 153.58 | 147.06 | 328 | 88.09 |

| Tesla | 181.41 | 8.19 | 4.73% | 183.81 | 169.93 | 384.29 | 101.81 |

| Netflix | 361.99 | 8.13 | 2.30% | 365.39 | 349.91 | 451.98 | 162.71 |

| Amazon | 105.15 | 2.02 | 1.96% | 106.24 | 101.24 | 170.83 | 81.43 |

| Microsoft | 252.75 | 4.94 | 1.99% | 255.18 | 245.47 | 315.95 | 213.43 |

| Dow Jones | 34,092.96 | 6.92 | 0.02% | 34,334.70 | 33,581.42 | 35,824.28 | 28,660.94 |

| Nasdaq | 12,363.10 | 261.17 | 2.16% | 12,458.88 | 12,010.73 | 15,265.42 | 10,440.64 |

Back home, Indian share markets are trading on a flat note.

Benchmark indices are volatile today tracking the selloff in Adani group stocks and post Budget 2023 announcements.

At present, the BSE Sensex is trading higher by 104 points. Meanwhile, the NSE Nifty is trading lower by 4 points.

ITC, IndusInd Bank, and UltraTech Cement are among the top gainers today.

Tata Steel, Bajaj Finance, and HDFC are among the top losers today.

Broader markets are trading on a positive note. The BSE Mid Cap index is trading higher by 0.3%, while the BSE Small Cap index is up 1%.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Looking to Buy Midcap Stocks?

If you're looking to buy some high-quality midcap stocks, then our co-head of research Rahul Shah has got some great recommendations.

You can get instant access to these stocks by subscribing to his popular stock research service, Midcap Value Alert.

The great news is... as part of Equitymaster's 28th anniversary celebrations... you have the chance to access this service at a huge 80% OFF

Get Full Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Sectoral indices are trading on a mixed note. Stocks in the IT sector, telecom sector and FMCG sector witness buying.

Meanwhile stocks in the oil and gas sector, power sector and energy sector witness selling.

Shares of Ratnamani Metals and Polycab India hit their 52 week high today.

The rupee is trading at Rs 81.77 against the US dollar.

In the commodity markets, gold prices trade higher by Rs 748 at Rs 58,700 per 10 grams.

Meanwhile, silver prices are trading higher by 2.25 Rs 71,360 per 1 kg.

Speaking of the current stock market scenario, the report by Hindenburg Research has put Adani group stocks under immense selling pressure. Although some of the group stocks have recovered, there are others that are still bleeding.

So, is it a good time to consider adding Adani stocks to your portfolio or are they still expensive?

Co-head of research at Equitymaster, Rahul Shah wonders whether the Adani correction has created a great buying opportunity.

Tune in to the video below to know more...

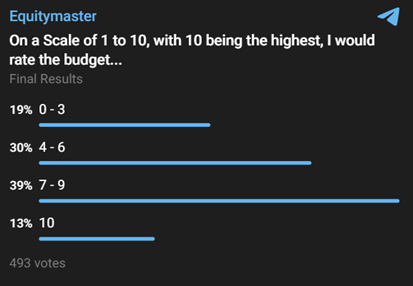

Also, to understand what our readers are thinking about the budget announced today we ran a poll on Equitymaster's telegram channel.

This is what we asked our readers:

With a response from over 400 participants, majority of investors rate budget in the scale of 7-9%.

Adani Enterprises FPO cancelled

The board of Adani Enterprises scrapped its Rs 200 billion (bn) (about Rs 20,000 crore) follow-on public offering (FPO), citing investor protection concerns, as a massive selloff in Adani group stocks continued for a fifth day after a scathing report alleging accounting fraud and stock manipulation was released by a US short seller.

Billionaire Gautam Adani's flagship is now working on returning the funds raised from investors lying in an escrow account.

The company's withdrawal comes on a day the shares of Adani Enterprises plunged nearly 29%, dealing a massive blow to institutional investors and family offices that rescued the offer on the last day.

Top Adani group stocks are under pressure even today.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Equitymaster's Premium Research:

Discover the Lucrative Opportunities in India's Emerging Business space

Read This Letter

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Titan Q3 results

One of the best Tata Group stocks will release its earnings today.

Backed by the healthy consumer demand during the festive season, the company saw a 12% on-year growth in combined sales in the standalone business during the December quarter, according to the provisional update it provided in January.

The positive consumer sentiment helped all categories clock healthy double-digit growth, despite a high base in the same period of last year.

Titan has been investors' favourite stock for a long time now.

The stock of Titan gained over 350% in six years after Tanushree Banerjee first recommended it to StockSelect subscribers in January 2005.

So, every lakh turned into Rs 4.5 lakh.

Holding on to the stock till date would have fetched Rs 1.4 crores!

And there is more to it.

You did not even need a big sum to accumulate these crores. Even a tiny investment of Rs 1,000 per month in the stock of Titan, since 2002, would have led to mouth-watering results.

Take a look at how the power of compounding has gone wild here...

The key lesson here is that it's possible to accumulate a few crores by investing small amounts in good businesses. Especially when the business is in distress and comes with margin of safety in valuations.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Want Low Risk Stocks with High Growth Potential?

Access Our Premium Research on Safe Stocks at 60% Off

Full Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Raymond Q3 results

Raymond on Wednesday reported a decline of 4.4% in its December quarter net profit at Rs 966 m, mainly on account of a one-time tax hit.

The company had posted a net profit of Rs 1,010.7 m during the October-December period of the previous fiscal.

Its revenue from operations rose 17.6% to Rs 21.7 bn during the quarter under review, as against Rs 18.4 bn in the year-ago period.

According to Raymond, it has recorded the highest-ever revenues in a quarter.

Total expenses were at Rs 19.8 bn, up 17.3% from Rs 16.9 bn earlier.

Raymond has exercised the option of lower corporate tax rate which has resulted in one-time net impact of Rs 735 m in the profit and loss account.

Its earnings before interest, tax, depreciation, and amortisation (EBITDA) was at Rs 3,510 m in the quarter under review.

This was the fifth straight quarter where Raymond registered strong performance and overall generated free cash flows to further deleverage the balance sheet to below Rs 10 bn of net debt levels.

Speaking of Raymond, did you know that it is one of the top stocks to watch this wedding season?

Rail Vikas Nigam bags new order

Rail Vikas Nigam has bagged orders worth Rs 418 m from Southern Railway to build railway infrastructure in the Chittoor district of Andhra Pradesh.

The company was incorporated as a public sector undertaking for the mandate to: ?undertake and execute successfully the project development, financing and implementation of projects related to rail infrastructure. Mobilize financial and human resources for project implementation.

Rail Vikas Nigam is one of the 5 penny stocks with high dividend yield.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Trades Flat | Adani Stocks Selloff Deepens | Adani Green, Adani Transmission Fall 10%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!