- Home

- Todays Market

- Indian Stock Market News February 3, 2017

Share Markets in India Open Flat; Pharma Stocks Gain Fri, 3 Feb 09:30 am

Asian markets are lower today as Chinese and Hong Kong shares fall. The Shanghai Composite is off 0.72% while the Hang Seng is down 0.76%. The Nikkei 225 is trading down by 0.38%. Stock markets in the US ended their previous session on a negative note.

Meanwhile, share markets in India have opened the trading day on a flat note. The BSE Sensex is trading lower by 10 points while the NSE Nifty is trading lower by 6 points. The BSE Mid Cap index and BSE Small Cap index have opened the day up by 0.5% & 0.3% respectively.

The rupee is trading at 67.45 to the US$. Sectoral indices have opened the day on a mixed note with consumer durables and information technology stocks witnessing selling pressure. While, healthcare and PSU stocks are among the top gainers on the BSE.

Pharma stocks have opened the day on a positive note. Elder Pharma and JB Chemicals are the most active stocks in this space. According to an article in Livemint, Cipla's wholly owned subsidiary, Goldencross Pharma has completed the sale of its 100% equity stake in Four M Propack, India (Four M Propack) to Shriji Polymers (India) (Shriji Polymers). Four M Propack Ltd makes plastic bottles & containers for pharmaceutical industry.

Consequently, Four M Propack ceases to be a subsidiary of GoldenCross with effect from 1 February 2017. Goldencross Pharma has sold the stake for a total consideration of Rs 192 million.

One must note that, earlier in January, Goldencross Pharma had entered in to a definitive agreement to sell its 100% equity stake in Four M Propack to Shriji Polymers for a consideration of Rs 135 million and an additional sum derived on the basis of the value of mutual funds, cash and bank balance, tax refunds, etc. at the time of closing estimated at around Rs 57 million.

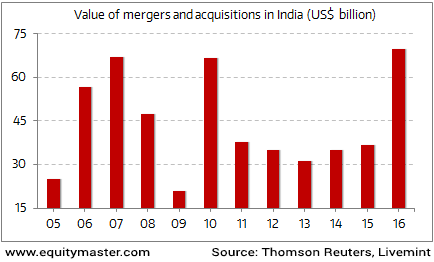

Merger and acquisition activity in India is on a high. The value of M&As that have taken place this year - at US$ 69.75 billion - are the highest on record for the country. This even beats the previous record of US$ 66.96 billion set in 2007.

Indian M&A activity at an All Time High in 2016

Especially, the M&A activity in the Indian pharma space has been on the rise in recent times. At the end of the day, whether the company is able to derive value from the acquisitions and augment the overall performance will be the key thing to watch out for. Hence, the acquisition (Subscription Required) of Four M Propack help Shriji Polymers to consolidate its position in the pharmaceutical plastic packaging segment remains to be seen.

To know more about the company's financial performance, subscribers can access to Cipla's latest result analysis (subscription required) and Cipla stock analysis on our website.

Moving on to the news from

Reportedly, the acquisition is made on a slump sale basis for about US$1.3 million. The UGS business will be housed in Tata Power's strategic engineering division (SED) once the deal is completed. SED is a supplier of defence equipment and solutions.

Further, acquisition of the UGS business will provide synergies to the existing business of Tata Power SED and has scope for growth and expansion, the company stated. However, going ahead, whether the takeover of Nelco's UGS business segment further enhance tata power's presence in the defence segment and provide synergy and alignment in servicing the customers will remain to be seen.

Also, last month, Tata Power agreed to acquire 100% stake in Ideal Energy Projects that owns a 540 MW of thermal power project in Nagpur district of Maharashtra. With this acquisition, the total generating capacity of Tata Power will increase to 8,885 MW, taking the company an inch closer to reach its target.

Tata Power share price opened the day up by 1.2%

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Share Markets in India Open Flat; Pharma Stocks Gain". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!