- Home

- Todays Market

- Indian Stock Market News February 8, 2017

Sensex Finishes Flat as RBI Maintains Status Quo Wed, 8 Feb Closing

Share markets in India plunged in red as Reserve Bank of India did not deliver the expected 25 basis points cut in repo rate before recovering to finish flat.

At the closing bell, the BSE Sensex stood lower by 45 points, while the NSE Nifty finished flat. Meanwhile, the S&P BSE Mid Cap & the S&P BSE Small Cap finished up by 0.5% and 0.2% respectively. Gains were largely seen in consumer durables and realty sector. Meanwhile, bank stocks and FMCG stocks lead the losses.

Bharat Heavy Electricals Ltd share price surged 2.8% in today's trade after the company posted net profit of Rs 935.4 billion for the quarter ended December 31, 2016 as compared to net loss of Rs 10.84 billion for the same quarter in the previous year. Total income of the company increased by 17.52% at Rs 64.61 billion for the quarter under review as compared Rs 54.98 billion for the corresponding quarter previous year.

Asian markets finished higher today with shares in Hong Kong leading the region. The Hang Seng gained 0.66% while Japan's Nikkei 225 was up 0.51% and China's Shanghai Composite rose 0.44%. European markets are mixed today. The CAC 40 is up 0.46% while the DAX gains 0.12%. The FTSE 100 is off 0.09%.

The rupee was trading at Rs 67.29 against the US$ in the afternoon session. Oil prices were trading at US$ 51.60 at the time of writing.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Steel Authority of India (SAIL) share price finished the trading day on an encouraging note (up 0.6%) after it was reported that the company is planning to spend up to Rs 40 billion on the modernization and expansion of its plants in the coming fiscal.

The company would fund the capital expenditure through debt. In 2015-16, the public sector undertaking (PSU) had spent Rs 44.83 billion as capital expenditure. Crude steel production of SAIL, which was at 14.3 million tonnes (MT) in FY16, would increase to 21.4 MTPA post expansion in FY17.

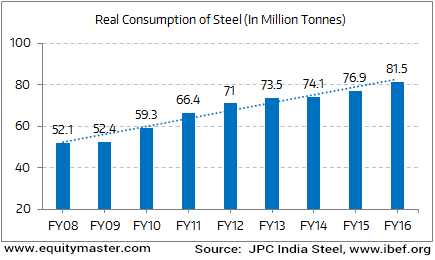

Steel Demand has Outpaced Supply Over the Last 5 Years in the Country

In another development, a strong performance from the Indian operations helped Tata Steel beat market estimates during the December quarter with an Rs 2.32 billion consolidated net profit compared with a loss of Rs 27.47 billion a year ago.

Tata Steel reportedly overcame strong demand related issues in its European business and skirted the effect of demonetisation of high-end currencies in November in India by rationalizing its operating cost and focusing on value added products in the UK.

Total deliveries during the quarter were higher by 5.2% on year at 6.11 m tonnes. Indian deliveries grew 27% on year and 14% sequentially far outperforming the domestic markets which grew by 2% on year and 3% sequentially.

The company is also confident of resolving the pension issue with the UK union which has recommended its members to support the ballot process that is currently on to close the BSPS to future accruals.

Tata Steel share price finished the trading day down 0.5% on the BSE.

Moving on to news from pharma sector. According to an article in The Economic Times, Indian pharma exports in the current financial year may see a near double-digit growth and might end up on the lines with that of last year.

Indian Pharma exports stood at US$16.9 billion in the last financial year, growing at 9.4% with US$5.7 billion to USA and US$3.3 billion to Africa, as per the statistics supplied by Pharmexcil. The exports stood at $15.4 billion in 2014-15.

As per the reports, there may not be much impact of Brexit on pharma exports in either Britain or Europe as the situation has stabilized with regard to exports to those geographies.

Meanwhile, Indian pharma industry leaders have reiterated their concerns over constant reduction in the healthcare budget of the Central government and an increasing pressure on price reduction which is resulting in squeezed margins.

India spends about 1% of its gross domestic product (GDP) on public health, compared to 3% in China and 8.3% in the United States. Despite this low budget allotment, the contribution has been decreasing or kept stagnant in India since several years.

Pharma stocks finished the day on a negative note with Panacea Biotech and Wockhardt Ltd leading the losses.

Along with keeping an eye on valuations, it's also important that you have a process in place. Many of you have already tasted the fruits of one of Rahul Shah's processes with his Microcap Millionaires service.

At the Equitymaster Conference 2017, Rahul asked attendees to mark 10 February, 2017, on their calendars. Why? Because he announced that he will send out his first Profit Velocity report to subscribers.

Profit Velocity is a system-based strategy.

With Profit Velocity, Rahul has created a system to help subscribers potentially fetch gains several times those of the benchmark index. Our Founder Member opportunity, which closes at midnight of 10th February, offers a whopping 60% discount on the usual membership fees for Profit Velocity.

So don't miss out. Act now to get your own system in place.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Finishes Flat as RBI Maintains Status Quo". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!