- Home

- Todays Market

- Indian Stock Market News February 16, 2017

Sensex & Nifty Finish Firm Led by Realty & Pharma Stocks Thu, 16 Feb Closing

Stock markets in India continued to trade on a firm note in the afternoon session. At the closing bell, the BSE Sensex stood higher by 146 points, while the NSE Nifty finished up by 53 points. Meanwhile, the S&P BSE Mid Cap finished & the S&P BSE Small Cap finished up by 1.3% and 1.4% respectively. Gains were largely seen in pharma stocks and realty stocks.

Asian stock markets finished mixed and showed caution on account of weaker US$ despite a strong overnight lead from Wall Street. The Shanghai Composite gained 0.52% and the Hang Seng rose 0.47%. The Nikkei 225 lost 0.47%. European markets are lower today with shares in London off the most. The FTSE 100 is down 0.41% while France's CAC 40 is off 0.37% and Germany's DAX is lower by 0.21%.

The rupee was trading at Rs 67.05 against the US$ in the afternoon session. Oil prices were trading at US$ 52.89 at the time of writing.

Bharat Forge share price surged 6.2% in today's trade after it was reported that the company's subsidiary - Kalyani Strategic Systems (KSSL), the defense arm of Kalyani Group and Israel Aerospace Industries (IAI) have signed a Memorandum of Understanding (MoU) to incorporate a Joint Venture Company (JVC) in India.

As part of the MoU, IAI and KSSL are aiming to expand their presence in the Indian defense market and to Build, Market and Manufacture specific Air Defense Systems and Ground to Ground & Ground to Sea Munitions.

Claim This Report Now. Hurry!

In this report, we reveal an easy-to-implement four step process that could boost your trading profits.

If you act right now, you can download it FREE.

Go ahead, grab your copy today. This is a limited period opportunity

Please read our Terms Of Use.

The MoU is the first step of a process to establish a JVC between the two companies. The JVC will integrate strategic state-of-the-art defense systems for the Indian ministry of defense in accordance with the Indian Government's 'Make in India' policy.

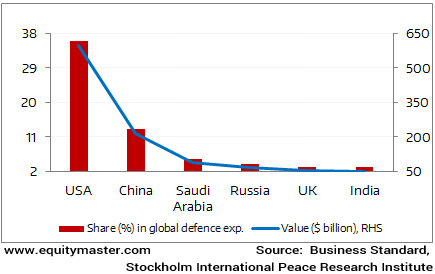

India Among Top Defence Spenders in the World in 2015

Meanwhile, Bharat Forge is expecting accelerated revenue from non-auto segments like defense, railways, aerospace in the coming quarters aimed at becoming net debt free next year.

The company will set aside a sum of Rs 3 billion towards capital expenditure for FY18. The capital allocation will be used for setting up machining facility for aerospace and for passenger vehicle segment where the company is moving to machined products from forged products.

The company also announced its financial results for the quarter ended December 31, 2016, reporting a drop of 21.5% in net profit at Rs 1.28 billion compared to Rs 1.63 billion reported in the same quarter last year.

The company expects a strong pick-up in business in the current quarter, especially in the automotive space as there will expectedly be pre-buying of commercial vehicles due to the onset of Bharat Stage IV emission norms from 01 April 2017.

In other news, credit rating agency, India Ratings and Research (Ind-Ra) in its latest report has maintained stable outlook on large public sector banks and private sector banks supported by high levels of capital. At the same time, it retained its negative outlook on mid-sized and smaller state-run banks due to limited access to capital and large non-performing assets.

According to a leading financial daily, Ind-Ra in its report 'Indian Banks Outlook for FY18' said that there is an increasing divide between the large and smaller PSBs, with the former having some access to growth capital, better market valuation, and also some non-core assets to divest while the latter would only receive bailout capital if required and would need to ration their capital consumption over next two years.

It said that while the large public sector banks with better access to capital and private sector banks with their robust capitalization will navigate another year of low growth and high credit costs with a stable outlook, mid-sized and smaller state-run banks will find it increasingly difficult to grow given increasing capital requirements and large funding gaps impeding their ability to compete on spreads.

The rating agency however said that long term ratings of all public sector banks remain resilient on expectations of continued government support. The report also said that Indian banks will need Rs 910 billion in Tier-I capital until March 2019 to grow at a bare minimum pace of 8 to 9% compound annual growth rate including a residual Rs 200 billion from the government's bank recapitalization program 'Indradhanush'.

And here's a note from Profit Hunter...

The Nifty 50 Index rebounded strongly after yesterday's losses. The index is up 50 points today with a number of finance stocks seeing strong buying interest. One that caught our eye was India Infoline Holdings Ltd (IIFL).

It's is up 8% today and is trading at a lifetime high. Let's take a deeper look at the chart.

The stock has gone up almost vertically from Rs 253 after finding support from its 200-day exponential moving average (EMA).

Today, the stock developed a strong bullish candle on the daily chart, but we view this candle with caution. It has a long upper shadow, meaning the bulls couldn't hold the prices up. The RSI indicator is also trading at an extremely overbought level.

But on the flip side, we see heavy volumes and the stock at its life high, indicating strong buying interest.

Whether the bulls will be able to maintain the buying interest or we we'll see selling based on the indicators above remains to be seen in coming sessions.

IIFL at its Lifetime High

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex & Nifty Finish Firm Led by Realty & Pharma Stocks". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!