- Home

- Todays Market

- Indian Stock Market News February 20, 2017

Sensex Trades on a Positive Note; Metal Stocks Lead the Gains Mon, 20 Feb 01:30 pm

After opening the day on a flat note, share markets in India witnessed buying activity and are trading on a positive note above the dotted line. All the sectoral indices are trading in the green with metal and realty stocks leading the gains.

The BSE Sensex is trading up by 95 points (up 0.3%) and the NSE Nifty is trading up by 28 points (up 0.3%). Meanwhile, the BSE Mid Cap index is trading up by 0.6%, while the BSE Small Cap index is trading up by 0.8%. The rupee is trading at 66.96 to the US$.

According to an article in the Economic Times, UK's Vodafone and Aditya Birla group firm Idea Cellular are likely to finalise the mega merger deal within a month that will create India's largest telecom firm.

Idea Cellular is leading the gains on the Indian indices today, trading up by as much as 3.5% during the day's trade.

If the deal is successful, the combined entity will create India's largest telecom firm with a revenue share of around 40% and a subscriber base of over 380 million, according to India Ratings and Research.The proposed merger of Vodafone India and Idea will create an entity with a revenue of around Rs 775-800 billion besides eliminating duplication of spectrum and infrastructure capex.

Further, the spectrum of Vodafone India in seven circles and that of Idea in two, whose permits are expiring in 2021-22, is together valued at around Rs 120 billion as per last auction price. These permits are not in common circles, and hence there could be potential spectrum capex synergies between the two companies.

However, given the present spectrum holding, revenue and subscriber base, both the companies need to work on synergy to comply with the rules of TRAI.

According to the merger and acquisition rules, an entity should not hold more than 25% spectrum allocated in any telecom circle and 50% of spectrum allocated in a particular band in a service area. The merger entity should also not have more than 50% combined revenue and subscriber market share.

A potential merger between Vodafone India with Idea Cellular would change the industry order. The combined entity would have 43% revenue share in the market by FY19 against 33% of Bharti Airtel and 13% for Reliance Jio.

The entry of Reliance Jio and the fierce tariff war it has triggered have set off brisk activity in the industry for fundraising and consolidation, as the incumbents look for ways and means to fend off the competition.

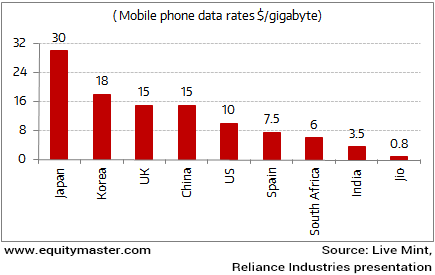

Jio's Data Pricing Disrupts the Telecom Apple Cart

Reliance Jio's disruptive pricing, seemingly hasn't left other market players with much of a choice but to accelerate consolidation moves to sustain the pricing wars.

Shares of Hindustan Unilever Ltd. (HUL) were in focus today US food company Kraft Heinz Co withdrew its proposal for a US$ 143 billion merger with larger rival Unilever Plc - HUL's parent company.

HUL's share price surged over 1.5% in intraday trading.

According to a leading financial daily, Kraft had made a surprise offer for Unilever to build a global consumer goods behemoth that was flatly rejected on Friday by Unilever.

Unilever rejected the takeover bid citing it to be fundamentally under-valued. Kraft withdrew its offer because it felt it was too difficult to negotiate a deal following the public disclosure of its bid so soon after its approach to Unilever.

A takeover would have created the world's second-largest consumer goods group by sales behind Nestle.

According to Thomson Reuters, a combination of the two entities would be the third-biggest takeover in history and the largest acquisition of a UK-based company. The combined entity would have US$ 82 billion in sales.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades on a Positive Note; Metal Stocks Lead the Gains". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!