- Home

- Todays Market

- Indian Stock Market News February 21, 2017

Sensex, Nifty Edge Up; Consumer Durables & Energy Stocks Rally Tue, 21 Feb Closing

After trading flat in the noon session, <>Indian share markets witnessed buying momentum in the final hour of trade to finish on a firm note. At the closing bell, the BSE Sensex stood higher by 100 points, while the NSE Nifty finished up by 29 points. Meanwhile, the S&P BSE Mid Cap finished & the S&P BSE Small Cap finished up by 0.5% respectively. Gains were largely seen in consumer durables stocks, bank stocks and energy stocks.

Asian stock markets finished mixed as of the most recent closing prices. The Nikkei 225 gained 0.68% and the Shanghai Composite rose 0.41%. The Hang Seng lost 0.76%. European markets too are trading mixed. The DAX is higher by 0.50%, while the FTSE 100 is leading the CAC 40 lower. They are down 0.16% and 0.06% respectively.

The rupee was trading at Rs 66.98 against the US$ in the afternoon session. Oil prices were trading at US$ 54.31 at the time of writing.

According to an article in The Economic Times, Britannia signed a memorandum of understanding with Greece's Chipita for a joint venture in India. Britannia will hold the majority stake in the venture that will involve an initial manufacturing investment of about US$11 million.

Britannia will set up facilities next to its existing plants to optimize logistics costs, and leverage its existing strengths of supply-chain and distribution networks.

The tie-up with Chipita is the first joint venture Britannia will formalize after its tie-up with New Zealand's Fonterra Dairy was dissolved in 2009 on account of lukewarm market response and losses. Britannia's venture with French food and dairy giant Groupe Danone SA was also terminated the same year after a protracted legal battle.

Reportedly, savory snacks in India are expected to register a 12% compounded annual growth rate over until 2020, with sales reaching Rs 445 billion. This growth is expected to be driven by increase in consumer's purchasing power, product innovation and expansion in lower tier cities and rural areas.

Britannia share price finished down by 0.7%.

In another development, now out of the Maggi crisis, Nestle India is looking to diversify into new segments like premium coffee business, pet care, skin health and cereals while it looks at 2017 as a "year of aggression". It is also planning to consolidate its offerings and add new categories so as continue with double digit growth.

The company, as part of diversification, has launched 35 products in last six months and may remove some of those which are not performing well.

As per the company's Chairman, Nestle has taken Rs 1 billion hit on sales due to demonetisation and the sector will take another six months to overcome the impact of the government's move to scarp old high value notes.

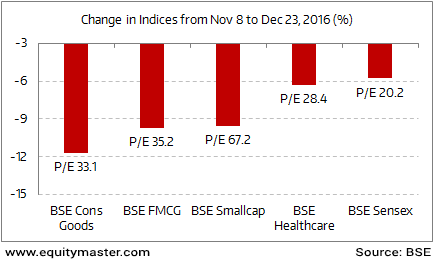

Demonetisation Effect: Defensive Sectors Corrected As Much As Smallcaps

The FMCG segment is expected take at least two more quarters for a complete recovery as the lag in demand is not on just the industry only but also on the downstream demand as well.

Nestle share price finished the day up by 1.9% on the BSE.

Moving on to news from stocks in oil & gas sector. According to an article in The Livemint, the total debt of India's biggest energy companies stood at the lowest in eight years on account lower oil prices and scrapping of fuel subsidies.

As per the reports, total debt at Indian Oil Corp., the nation's largest refiner, stood at Rs 419 billion at the end of September, down from Rs 863 billion rupees in March 2014. Liabilities at Hindustan Petroleum Corp., the third-biggest fuel retailer, shrunk 65% in the same period.

Also, Bharat Petroleum Corp.'s US$600 million bond sale in January drew bids for three times the amount, helping the company price the 10-year debt at the tightest spread over US treasuries by any Indian company in a decade.

An improving credit profile is allowing refiners to raise long-term funds at cheaper rates to fund expansion. It is to be noted that India is overtaking Japan as the world's third largest oil user.

Brent oil prices have fallen by half in the past three years, providing the government with a window to free up controls. Diesel and gasoline subsidies have helped the energy companies as they no longer have to sell the fuels below cost. This frees up cash to invest in infrastructure for faster growth.

Hindustan Petroleum plans to spend US$8 billion over the next five years to help expand and upgrade its 60-year-old refineries.

Oil & gas stocks finished the trading day on a firm note with Reliance Industries and Hindustan Oil Exploration Company leading the gains.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex, Nifty Edge Up; Consumer Durables & Energy Stocks Rally". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!