- Home

- Todays Market

- Indian Stock Market News February 21, 2017

Sensex Trades Marginally Lower; Telecom Stocks Witness Selling Tue, 21 Feb 11:30 am

After opening the day on a flat note, the Indian share markets witnessed choppy trades and are presently trading marginally lower. Sectoral indices are trading on a mixed note with stocks in the telecom sector and FMCG sector witnessing maximum selling pressure. Consumer durables stocks are trading in the green.

The BSE Sensex is trading down 49 points (down 0.2%) and the NSE Nifty is trading down 12 points (down 0.1%). The BSE Mid Cap index is trading up by 0.3%, while the BSE Small Cap index is trading up by 0.2%. The rupee is trading at 66.99 to the US$.

Indian stock markets are likely to witness volatility amid derivatives expiry during the week. Also, the ongoing UP assembly elections are said to weigh on stock market sentiments.

Along with that, cues from the Fed indicating an interest rate hike in its upcoming meet has made global stock markets trade on a volatile note. But as per Asad, the Fed's promise of more interest rate increases will lead to the end of easy money and will create big trends that traders can profit from.

Speaking of trading, Apurva Sheth has released a detailed report on what he believes could be an extremely effective four-step stock trading strategy. Get your hands on this report right now.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

As per an article in the Economic Times, the yearly SBI Composite Index (YoY) for February 2017 improved to 49.5 compared to last month's index of 47.0. The data indicated some improvement in the manufacturing activity.

However, the index declined sequentially, thereby indicating that full-fledged recovery in output may take some more time. The monthly Index declined marginally to 49.2 in February 2017 from 50.9 in January 2017.

Much of the fall in manufacturing activity is seen on the back of government's notebandi move.

Last week, the Reserve Bank of India (RBI) Governor Urjit Patel stated that India's growth will bounce back after a sharp notebandi-driven slowdown.

However, if one has to go by the ground realities, the economy is still facing troubles from notebandi. The government will continue with its lies and tell us that all is well on the notebandi front, but that doesn't make the situation any better for the common man.

In other major news, the country's highest valued company on the stock market - Tata Consultancy Services Ltd (TCS) - has announced a share buyback plan of up to Rs 160 billion. This is recorded as the biggest share buyback ever in the Indian capital market.

The proposed shares represent 2.85% of the total paid up equity share capital at Rs 2,850 per equity share. The buyback price is 13.7% higher than TCS's current market price.

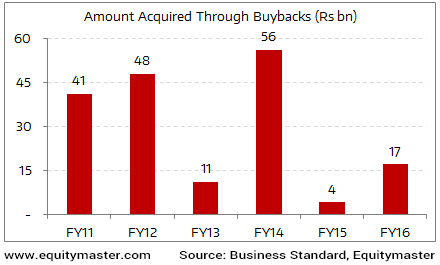

The number of companies going for share buybacks has been on the rise lately. The trend picked pace from FY16, where a total of sixteen companies went for buybacks. The chart below shows the value of shares purchased through buybacks over the years. FY16 was comparatively a poor year in this regard. But on a YoY basis, the figure was higher by about 4x.

FY16 Sees an Uptick in Buyback of Shares

As regards FY17, many companies have already taken the plunge, while some are in the process. And going by the momentum, more could follow in the coming days.

So what should long-term investors do?

Doing nothing during a buyback may not be satisfying to many investors. Receiving cash may seem to be a better option. But remember, if you really are a long-term investor, buybacks could increase the value of your existing shares. The reduced number of outstanding shares will boost per share earnings as well as RoE. And in the long run, these two measures matter more than anything else.

In all, we believe investors should consider buybacks on a case-by-case basis.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Marginally Lower; Telecom Stocks Witness Selling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!