- Home

- Todays Market

- Indian Stock Market News March 17, 2017

Sensex Continues Momentum; FMCG Sector Up By 3.3% Fri, 17 Mar 11:30 am

After opening the day on a firm note, Indian share markets have continued their momentum and are presently trading in the green. Sectoral indices are trading on a mixed note with stocks in the FMCG sector leading the gains and those in the telecom sector leading the losses.

The BSE Sensex is trading up 100 points (up 0.3%) and the NSE Nifty is trading up 7 points (up 0.1%). The BSE Mid Cap index is trading down by 0.4%, while the BSE Small Cap index is trading down by 0.1%. The rupee is trading at 65.52 to the US$.

Most of the buying interest in domestic share markets is seen as the Goods and Services Tax (GST) Council on Thursday approved the State GST and Union Territory GST laws.

It also capped the proposed cess on aerated drinks and luxury automobiles at 15% and at 290% on cigarettes.

Nod for the above laws, along with changes in the Central GST and Integrated-GST laws, has paved the way for introduction of the legislations in Parliament and state assemblies as early as next week.

The above developments have set the stage for implementing the landmark tax reform by 1 July 2017.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

To get a detailed view on the Goods and Services Tax (GST), you can read Vivek Kaul's report, GST & You: What the Media DID NOT TELL YOU about the GST.

In the news from global financial markets, market participants are gauging how the negotiations between the Britain and the European Union (EU) will pan out.

While many expect the negotiations unlikely to start until June, there remain concerns about what effect the delay may have on global trade and the Eurozone.

Many are of the view that the delay would eat into the two-year negotiation window for Britain to reach a deal with the EU or crash out on WTO terms, which include tariffs on UK imports to the continent.

The above concerns come as Britain, earlier this week, lurched closer to leaving the EU when Parliament gave Prime Minister Theresa May the power to file for divorce from the bloc. Both the Houses of Parliament passed the Brexit Bill un-amended on Monday, leaving Britain free to trigger Article 50 by the end of March as planned.

Asad Dossani, editor, Daily Profit Hunter, is of the opinion that Brexit will never happen. He's written that British politicians are employing standard delay tactics and their aim is to prevent the Brexit from ever taking place. He's also written on how one can successfully trade political events such as Brexit.

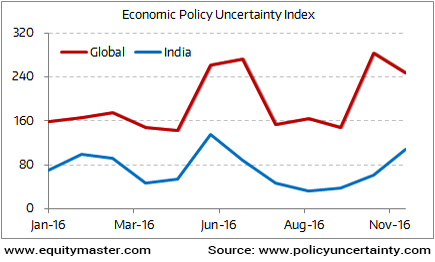

But if Britain divorces from the EU bloc, it'll have major implications for financial markets and exchange rates in the days to come. It will also lead to more global economic uncertainty which, by the way, stood at its all-time high during the start of this year as seen from the chart below:

Global Economic Uncertainty Index at All-Time High

But apart from above, Brexit can also affect the sustainability of India's long term growth story as it will hamper global trade.

Here's a snip from the recent edition of Vivek Kaul's Inner Circle (requires subscription) that explains why the EU is the epicenter of de-globalization and shows how it could affect Asia as well:

Also, Rahul Shah, editor at Equitymaster, has explained how you should prepare for a post Brexit world.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Continues Momentum; FMCG Sector Up By 3.3%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!