- Home

- Todays Market

- Indian Stock Market News March 17, 2017

Sensex Pares Gains; ITC Ltd Soars Fri, 17 Mar 01:30 pm

After opening the day on a positive note as the Goods and Services Tax (GST) Council on Thursday approved State GST and Union Territory GST laws, share markets in India pared their early gains and are currently trading marginally above the dotted line. Sectoral indices are trading on a mixed note with stocks in the FMCG sector leading the gains, while stocks in the capital goods sector are trading in red.

The BSE Sensex is trading up by 70 points (up 0.2%), and the NSE Nifty is trading up by 7 points (up 0.1%). Meanwhile, the BSE Mid Cap index is trading down by 0.3%, while the BSE Small Cap index is trading down by 0.1%. The rupee is trading at 65.36 to the US$.

In news from stocks in the telecom sector. According to a leading financial daily, Idea Cellular Ltd, and Vodafone India are on the cusp on an initial agreement to merge the two entities.

The two firms plan to announce a preliminary agreement as soon as this month. The initial accord is unlikely to spell out the merged entity's shareholding structure as imperative processes including due diligence are still underway.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

According to the article, Billionaire Kumar Mangalam Birla will be the chairman of the new entity. Vodafone could decide to sell part of its stake in the merged company, while the Birla's would likely offer to buy shares from other investors after the merger to bring their holding to about 26%.

In a statement made in January, Idea and Vodafone Plc confirmed merger talks between the two telecom majors. Aditya Birla Group - Idea's controlling holder - and Vodafone would have equal rights in the new company. The deal however, would exclude Vodafone's 42% stake in Indus Towers Ltd.

A transaction may require the carriers to shed some spectrum and subscribers to ensure regulatory approval under India's competition rules.

According to the merger and acquisition rules, an entity should not hold more than 25% spectrum allocated in a telecom circle and 50% on spectrum allocated in a particular band in a service area. The merger entity should also not have more than 50% revenue and subscriber market share.

A potential merger between Vodafone India with Idea Cellular would change the industry order. The combined entity would have 43% revenue share in the market by FY19E against 33% of Bharti Airtel and 13% for Reliance Jio.

The entry of Reliance Jio and the fierce tariff war it has triggered have set off brisk activity in the industry for fundraising and consolidation, as the incumbents look for ways and means to fend off the competition.

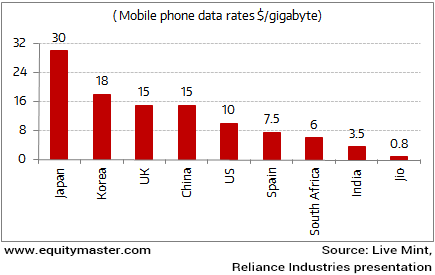

Jio's Data Pricing Disrupts the Telecom Apple Cart

Reliance Jio's disruptive pricing, seemingly hasn't left other market players with much of a choice but to accelerate consolidation moves to sustain the pricing wars.

Idea Cellular share price was trading down by 3% in the afternoon session.

In news from stocks in the FMCG sector. ITC Limited share price soared over 7.5% in intraday trade today after the GST Council on Thursday cleared a proposal to cap the cess on tobacco and cigarettes.

The stock was trading close to its lifetime high of Rs 292 per share. The gain today was the highest since 23 May 2016. ITC's share price has surged over 17% since beginning of the calendar year, mostly on positive regulatory cues in the Union Budget.

The GST council gave its nod to the two remaining pieces of supporting legislation for implementing the reform paving the way for introduction in Parliament and state legislatures.

The cess levied, in the case of cigarettes and chewing tobacco, could be either 290% or Rs 4,170 per thousand sticks or a combination of both. These cess rates are an enabling provision and the actual tax incidence could be lower, depending on the decision of the GST council.

The current upper limit is slightly lower than the current maximum current specific excise duty of Rs 4,426 levied on king size cigarettes with length above 75mm.

Again, the current limits are upper limits for levy, and the government may tax these goods slightly below the ceiling limits.

The government is looking at GST rollout from July 1.

The GST will subsume a host of indirect taxes levied by the center and the states, including excise duty, service tax, value-added tax, entry tax, luxury tax and entertainment tax. A transparent tax regime may very well be beneficial to the investors, individuals and businesses.

If you wish to understand GST and its implications on you in further detail. Vivek Kaul has a detailed special report on outlining the key things to watch out for. You can download this special report - GST & You, for free right here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Pares Gains; ITC Ltd Soars". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!