- Home

- Todays Market

- Indian Stock Market News March 19, 2016

Major Global Markets Close on a Firm Footing Sat, 19 Mar RoundUp

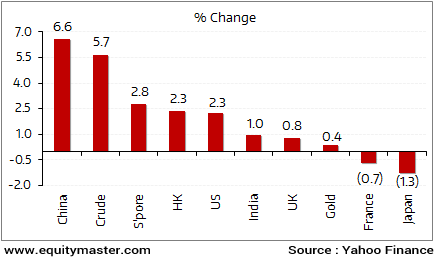

Barring stock markets in Japan (down 1.3%) and France (down 0.7%), major global indices have closed the week on an encouraging note. Stocks in China and Singapore topped the gainers. The US indices continued to surge for the fifth week in row and for the first time in 2016 closed positive for the year till date.

The US Federal Reserve's dovish stance on interest rates weighed on the dollar. Subsequently, commodity prices too moved up, with crude closing up 5.7% for week. A better US economic outlook and easing recession fears have drawn investors to equities.

Backed by the global rally in markets, the Indian indices also closed the week on a firm note. The BSE Sensex ended the week up 1%. Since Arun Jaitley presented the 2016 budget, foreign institutional investors (FIIs) and foreign portfolio investors (FPIs) have poured US$1.77 billion into the Indian markets.

Key World Markets During the Week

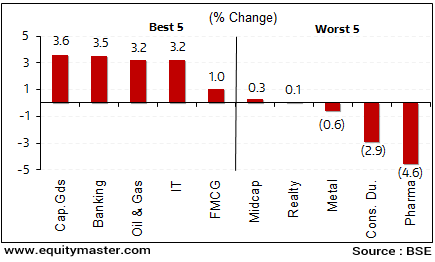

All sectoral indices ended mixed for the week. Buying interest was witnessed in capital goods, and banking stocks, while pharma, and consumer durables led the losses.

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

The government in its effort to improve the ease of doing business in the country, has introduced a bill in the Lok Sabha to further amend the Companies Act.

The bill seeks to simplify private placement process and remove restrictions on layers of subsidiaries and investment companies. Further, the bill aims to amend CSR (corporate social responsibility) provisions to bring greater clarity and exempt certain class of foreign entities from the compliance regime under the Act. The bill also proposes to allow unrestricted object clause in the Memorandum of Association (MoA) dispensing with 'detailed listing of objects, self-declarations to replace affidavits from subscribers to memorandum and first directors' and is looking to omit provisions relating to forward dealing and insider trading from the Act.

As per an article in Livemint, Indian merchandise exports contracted for the 15th month in a row in February. The contraction was on account of tepid global demand and volatile global currency market. Exports contracted by 5.7% in February. However, this is still better when compared to other emerging economies like China, wherein exports contracted by 25.4% in the same month. China's exports fared far worse than expected. In order to boost exports, the government has implemented an interest stabilization scheme and has raised the duty drawback rates for exporters. The increase in duty drawback rates will help exporters recover higher input tax outgo that they pay during the process of making final product. While, the interest stabilization scheme will allow exporters to receive bank loans at lower rate of interest.

Movers and Shakers During the Week

| Company | 11-Mar-16 | 18-Mar-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top Gainers During the Week (BSE A Group) | ||||

| Ambuja Cement | 201 | 222 | 10.6% | 266/185 |

| Mphasis Ltd | 448 | 491 | 9.5% | 534/363 |

| Shree Cement | 11,276 | 12,332 | 9.4% | 13,345/9350 |

| BHEL | 104 | 113 | 9.4% | 290/90 |

| Syndicate Bank | 61 | 66 | 9.2% | 118/49 |

| Top Losers During the Week (BSE A Group) | ||||

| Lupin Ltd | 1,858 | 1,559 | -16.1% | 2,127/1,539 |

| Jaypee Infratech | 9 | 9 | -9.3% | 20/9 |

| Eicher Motors | 19,996 | 18,403 | -8.0% | 21,618/13,930 |

| Astrazeneca Pharma | 1,259 | 1,162 | -7.7% | 1,348/850 |

| Suzlon Energry | 14 | 13 | -7.7% | 31/13 |

Source: Equitymaster

Now let us move on to some of the key corporate developments in the week gone by.

As per an article in Livemint, Mahindra & Mahindra (M&M) is aiming to enter the business of farm equipment rentals. The company plans to open up a venture named 'Trringo'. This venture will offer a digital platform and connect those who are looking to hire tractors with those willing to rent their self-owned machines. A location based mapping system will be installed which will help to bring the two parties together and route them to the closest franchisee. The concept is similar to that of Ola and Uber. Further, it will operate on a franchisee-based model. Reportedly, M&M will set up this venture as a startup and will invest a sum of Rs 100 million. The model will generate revenues from royalty paid by franchisee and a commission fee on each tractor let out by the franchise. The market size of the tractor hiring market is pegged at Rs 150 billion. It's one of several startups that the company plans to launch, as it seeks to tap the burgeoning e-commerce space.

As per a leading financial daily, drug major Lupin stated that it has received nine observations relating to inadequacy and adherence to operating norms for its manufacturing plant in Goa from the US Food and Drug Administration (USFDA). The observations are on aspects such as inadequacy and adherence to standard operating procedures (SOPs). The company is in the midst of putting together a response to address the FDA's observations. One shall note that the company's Goa facility supplies over 100 products to various regulated markets including the US and EU (European Union). The plant has filed more than 115 abbreviated new drug applications (ANDAs) in the US market. The company has also made filings for markets like the EU, Japan and Brazil from the Goa facility.

According to the market research agency AIOCD (All Indian Origin Chemists & Distributors Ltd.) and Pharmasofttech AWACS Pvt Ltd, the domestic sales of the pharmaceutical companies are likely to get impacted by an estimated 4.5%. The fall is estimated on account of two factors.

First being, the government's decision to ban 344 fixed dose combination (FDC). Reportedly, the ban on specified FDCs can result in a cut of 3.1% in industry sales. Further, revenues of companies such as Pfizer and Glenmark will be significantly impacted due to the FDC ban.

Second is the price revision of existing drugs under price control. The price revision is based on the Wholesale Price Index (WPI). The WPI is in the negative territory and is expected to remain low for a longer period. Thus, there are likely to be more price cuts in the future. Reportedly, this too will affect the revenues.

Going forward, investors should not get swayed away by short-term trends in the economy and the stock markets. Instead they should follow a bottom up approach and pick up fundamentally strong businesses when they are trading at attractive valuations.

And here's an update from our friends at Daily Profit Hunter...

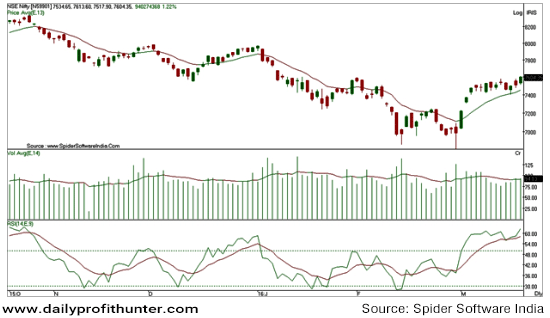

The index remianed in a tight range for second week in a row after a big move of 450 points in the first week of March. The index has ended the week at the higher end of the 7,400-7,600 range. This suggests that bulls are in a stronger position now and if the breakout sustains then they can push the index further up in the near term. However, they just have a short three day week as markets will be shut on Thursday and Friday in the coming week. You can read the detailed market update here...

Indian Indices Continue Their Uptrend

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Major Global Markets Close on a Firm Footing". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!