- Home

- Todays Market

- Indian Stock Market News March 23, 2017

Sensex Remains Firm; Energy Stocks Lead Gains Thu, 23 Mar 01:30 pm

After opening the day on a positive note, share markets in India have continued the momentum and are trading marginally above the dotted line. Sectoral indices are trading on a positive note with stocks in the oil and gas sector and stocks in the metals sector leading the gains.

The BSE Sensex is trading up by 86 points (up 0.3%), and the NSE Nifty is trading up by 32 points (up 0.4%). Meanwhile, the BSE Mid Cap index is trading up by 0.8%, while the BSE Small Cap index is trading up by 0.9%. The rupee is trading at 65.44 to the US$.

In news from stocks in the PSU sector. The government is set to meet its divestment target for the first time in many years as it moves closer to its target of Rs 455 billion from its divestment program by the end of this fiscal.

The initial divestment target of Rs 565 billion earmarked in the last years Union Budget, was subsequently revised to Rs 455 billion.

Officials estimate that disinvestment would bring in receipts of at least Rs 440 billion, if not the full targeted amount.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The Centre's total receipts from disinvestment are also estimated to be at an all-time high this fiscal.

As it stands, the government raised over Rs 393 billion in the current fiscal, through minority share sale by way of offer for sale, share buyback and CPSE ETF so far.

Instead of opting the traditional way of going for pure disinvestment issues such as listing, follow on offers and strategic sales that were expected to improve the functioning of public sector units (PSU), the Centre has relied more heavily on share buybacks and the PSU exchange traded fund.

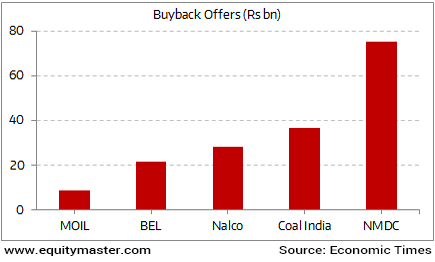

Big Buybacks of Public Sector Units

Aiding this would be the share buyback announcements by public sector Oil India Ltd and Engineer's India Ltd that are expected to raise Rs 15.2 billion and Rs 6.6 billion respectively.

Announced as part of the capital restructuring guidelines for state run firms in May 2016, share buybacks by PSUs including Nalco, NMDC and Coal India Ltd have already helped bring in Rs 156 billion.

Earlier this fiscal, the government had also raised about Rs 7.9 billion through share buyback of MOIL

According to data with the Department of Investment and Public Asset Management, it has raised Rs 393.6 billion this fiscal as disinvestment proceeds including stake sale of SUUTI holdings in L&T and ITC.

With direct tax collections slightly subdued, meeting the disinvestment target would also provide significant relief to the Exchequer in bridging the fiscal deficit that is estimated at 3.5% of the GDP in 2016-17.

Moving on to news from stocks in the power sector. NTPC share price was in focus today as the country's largest power producer commissioned a slew of power plants across the country.

The state-run power producer commissioned 20 mega-watt (MW) of Bhadla Solar Power Project in Rajasthan, as well as second Unit of 250 MW of Bongaigaon Thermal Power Project (3 X 250 MW) in Assam.

Last month, NTPC had commissioned 115 MW capacity out of 260 MW of Bhadla Solar Power Project.

With these added capacities, the installed capacity on standalone basis has become 42,177 MW and that of NTPC group has become 49,143 MW.

NTPC intends to become a 130 GW company by 2032 with a with diversified fuel mix and 600 billion units' company in terms of generation. The company wants share of renewable energy (including hydro) to be 28%.

On the company's renewable energy plans, NTPC said that it will add 500 MW solar capacity by the end of March 2017. NTPC plans to achieve this target through another 250 MW plant in Madhya Pradesh.

In addition to this, the company also plans to set up a 50 MW wind power plant in Gujarat this year.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Firm; Energy Stocks Lead Gains". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!