- Home

- Todays Market

- Indian Stock Market News April 5, 2016

Markets Crash After RBI Rate Cut Tue, 5 Apr Closing

Indian equity markets plunged more than 2% in today's trade as the Reserve Bank's 25 basis point repo rate cut failed to boost the market sentiment. The RBI said it would maintain an 'accommodative stance' on monetary policy, meaning it was open to more rate cuts in the future depending on macroeconomic conditions. While the Cash Reserve Ratio has been kept unchanged, Statutory Liquidity Ratio (SLR) of scheduled banks, has been reduced by 25 basis points.

At the closing bell, the BSE Sensex closed lower by 516 points, the NSE Nifty finished lower by 156 points. The S&P BSE Midcap and the S&P BSE Small Cap closed down by 1.5% and 1.4% respectively. Barring consumer durables, all the sectoral indices languished in red. Losses were largely seen in banking and auto stocks.

Asian markets finished mixed as of the most recent closing prices. The Shanghai Composite gained 1.45%, while the Nikkei 225 led the Hang Seng lower. They fell 2.42% and 1.57% respectively. European markets are trading lower today with shares in Germany off the most. The DAX is down 2.61%, while France's CAC 40 is off 1.89%. London's FTSE 100 is lower by 1.48%. The rupee was trading at 66.32 against the US$ in the afternoon session.

Power Grid Corporation finished on an optimistic note (up 0.3%) after its board approved investment proposals worth Rs 33.24 billion, including Rs 8.44 billion generation projects in Odisha and Rs 8.10 billion solar park in Karnataka. The board has accorded approval to several projects including investment approval for substation extensions for transmission system associated with Vindhyachal V project of NTPC at an estimated cost of Rs 2.87 billion.

Reportedly, the board has also approved investment of Rs 465.7 million in projects associated with Western Region Strengthening Scheme, Rs 477.7 million investment in transmission system for Gadarwara STPS of NTPC and Rs 409.1 million in transmission system for ultra-mega solar park in Anantpur district in Andhra Pradesh.

The board also gave investment approval for associated transmission system for Nabinagar 11 TPS (3X660 MW) at an estimated cost of Rs 7.9 billion with commissioning schedule of 38 months progressively from date of investment approval. The other proposal approved by the board include eastern region strengthening scheme at a cost of Rs 4.54 billion.

In another development, NTPC has received its board's approval for investment in Mandsaur Solar PV Project (5x50 MW) in the state of Madhya Pradesh at an appraised estimated cost of Rs 15.02 billion. The company has also received approval to invest in Bhadla Solar PV Project (4x65 MW) in the state of Rajasthan at an appraised estimated cost of Rs 16 billion. NTPC finished down by 3% on the BSE.

The power sector is hit by falling utilization levels. The State Electricity Boards (SEBs) that buy power from generators are reeling under huge losses and bloated debt. As per the annual report from the Ministry of Power, the Power Load Factor has fallen from a peak of 78.6% in FY08 to about 65% upto November 2014. The capacity additions in the power sector also have fallen by 39% in the last two years.

According to a leading financial daily, Yes Bank has entered into an agreement with T-Hub to assist Indian start-ups focusing on financial technology (fintech) space. Under the agreement, the bank and T-Hub plan to set up a Centre of Excellence (CoE) for fintech start-ups. This association will help create a conducive business environment and support system for a large number of fintech start-ups.

T-Hub is a unique public-private partnership initiative between Telangana, IIIT-H, ISB, NALSAR, and key private sector leaders. Apart from fintech, the bank will also work closely with start-ups in segments such as agri-tech, healthcare, e-commerce, etc.

Meanwhile, the bank has also raised Rs 5.45 billion worth of bonds on a private placement basis to meet its Basel III capital requirements. The issue was closed on March 31, 2016. The issue was rated 'AA+ hyb' by ICRA and 'AA+' by CARE. The stock price of the bank finished the day down by 4.7% on the BSE. Banks, particularly public sector banks (PSBs), have reported their worst financial performance in the December 2015 quarter. Most of them reported a sharp fall in earnings with a number of them slipping into the red.

Banking stocks languished in red today with ICICI bank and SBI bearing majority of the brunt.

And here's an update from our friends at Daily Profit Hunter...

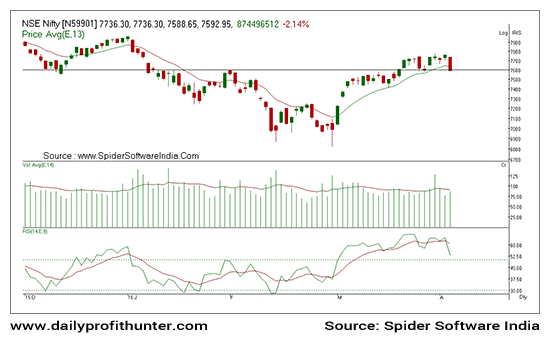

Nifty opened on with a downward gap today at 7,736 and traded on a flattish note until the monetary policy was announced. The index witnessed a rise in volatility immediately after the policy announcement which failed to cheer the market participants. The index dropped more than 100 points after the event and ended the day with a loss of 165 points. Currently the index is placed near the short term support level of 7,600 however, it seems like a tough task for the bulls to hold above the same given that many stocks seem to be running out of steam. Whether the index holds above the next major support level of 7,400 remains to be seen...

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Markets Crash After RBI Rate Cut". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!