- Home

- Todays Market

- Indian Stock Market News April 5, 2017

Sensex Opens Lower; IT & FMCG Stocks Drag Wed, 5 Apr 09:30 am

Asian equity markets are higher today as Chinese and Hong Kong shares show gains. The Shanghai Composite is up 1.06% while the Hang Seng is up 0.05%. The US and European equities closed mostly flat in their previous trading session.

Meanwhile, share markets in India have opened the day on a negative note. The BSE Sensex is trading down by 71 points while the NSE Nifty is trading down by 16 points. The BSE Mid Cap index and BSE Small Cap index have opened up by 0.3% & 0.2% respectively.

Sectoral indices have opened the day on a mixed note with consumer durable stocks and realty stocks leading the pack of gainers. While stocks from information technology sector and fast moving consumer goods sector have opened the day in red. The rupee is trading at 64.91 to the US$.

Titan share price surged 5% after Titan announced that its business has witnessed sales traction during the period across all divisions, including jewellery, watches and eyewear, and is expecting a good year ahead.

Titan's profit growth slowed to 13% in the October to December quarter, dented by the government's notebandi decision. The company had posted 25% profit growth in the first and second quarters of the financial year 2016-17.

In the latest development, a leading financial daily reported that, the government has exceeded the tax collection estimates for 2016-17 fiscal at Rs 17.1 trillion aided by steady growth in direct taxes and a sharp jump in excise and service tax receipts.

The robust growth comes despite the economy getting hit by a temporary cash crunch because of the government's notebandi decision in November. The revised estimates (RE) provided in Budget on February 1 had projected tax collections of Rs 16.97 trillion.

Total net tax revenue grew at 18% to Rs 17.10 trillion, which is highest in last 6 years. In terms of gross revenue collections, the growth rate in corporate tax stood at 13.1% while that of personal income tax was 18.4%.

Further, Direct tax collections up to March 2017 stand at Rs 8470 billion which is 14.2% higher than the net collections for the corresponding period last year. As regards to indirect taxes, Central Excise collections grew 33.9% to Rs 3.83 trillion during 2016-17.

The better-than-expected growth may also in part be because finance minister Arun Jaitley has been conservative in his original tax revenue estimation, given global economic uncertainties. However, the robust revenue collections raise hopes for the government to rein in the fiscal deficit within 3.5% of GDP in 2016-17, the reports noted.

Moving on to the news from stocks in pharma sector. As per an article in a leading financial daily, Cipla has received approval from the US food and Drug Administration (USFDA) for its generic Abacavir and Lamivudine tablets used for treatment of human immunodeficiency virus (HIV) infection.

The product is a generic version of ViiV Healthcare Company's Epzicom tablets in the strengths of USP 600 mg/300 mg. According to IMS Health, Epzicom tablets had US sales of approximately US$346.3 million for the 12-month period ending February 2017.

One must note that, Aurobindo last week got an approval for generic Epzicom tablets. Cipla, Aurobindo and Mylan are the largest producers of antiretroviral medications globally.

Meanwhile, Cipla's arm Medpro South Africa (Pty) Limited has signed an agreement to acquire 100% stake in Anmarate (Pty) Limited, South Africa, for Rs 26 million. Anmarate is engaged in manufacturing and distribution of pharmaceutical products.

Reportedly, the acquisition would help strengthen the market position of the company. The transaction is expected to be completed before 14 April 2017.

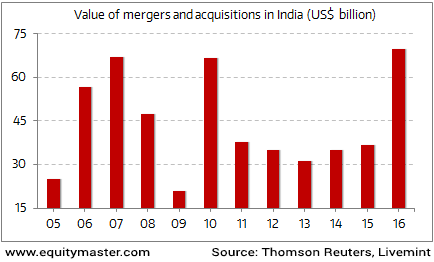

Merger and acquisition activity in India is on a high. The value of M&As that have taken place this year - at US$ 69.75 billion - are the highest on record for the country. This even beats the previous record of US$ 66.96 billion set in 2007.

Indian M&A activity at an All Time High in 2016

Especially, the M&A activity in the Indian pharma space has been on the rise in recent times. At the end of the day, whether the company is able to derive value from the acquisitions and augment the overall performance will be the key thing to watch out for.

To know more about the company's financial performance, subscribers can access to Cipla's latest result analysis and Cipla stock analysis on our website.

Cipla share price opened the day up by 1%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Lower; IT & FMCG Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!