- Home

- Todays Market

- Indian Stock Market News April 8, 2021

Sensex Ends 84 Points Higher, Nifty Ends at 14,874; JSW Steel and Tata Steel Among Top Gainers Thu, 8 Apr Closing

Indian share markets witnessed volatile trading activity throughout the day today and ended higher.

Benchmark indices gained 0.6% in today's session, weighed up by metal stocks amid rising coronavirus cases in the country.

At the closing bell, the BSE Sensex stood higher by 84 points (up 0.2%).

Meanwhile, the NSE Nifty closed higher by 56 points (up 0.4%).

JSW Steel and Tata Steel were among the top gainers today.

IndusInd Bank, on the other hand, was among the top losers today.

The SGX Nifty was trading at 14,947, up by 59 points, at the time of writing.

The BSE Mid Cap index and the BSE Small Cap index ended up by 0.6% and 0.7%, respectively.

On the sectoral front, gains were largely seen in the metal sector.

Shares of Dr Lal Pathlabs and Tata Steel hit their respective 52-week highs today.

Bharti Airtel and Ashok Leyland were among the top buzzing stocks today.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Midcap Stocks Research at Less than Its Launch Price

When we launched our midcap stocks research service, Midcap Value Alert, last year...

Almost 1,000 Indians subscribed within just one week of its launch.

And since then, thousands more have subscribed to Midcap Value Alert to get our best midcap stock recommendations.

The great news is... as part of Equitymaster's 28th anniversary celebrations... we've decided to offer Midcap Value Alert at a price that's even lower than its launch price.

Get Full Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Asian stock markets were trading on a mixed note today after minutes from the Federal Reserve's latest meeting reiterated its commitment to keep interest rates low until the US economy made a more secure recovery.

The Shanghai Composite ended up by 0.1% and the Nikkei ended down by 0.1%,, while the Hang Seng ended up by 1.2%.

US stock futures are trading on a positive note today with the Dow Jones Futures trading up by 16 points.

The rupee is trading at 74.32 against the US$.

Gold prices for the latest contract on MCX are trading up by 0.5% today at Rs 46,578 per 10 grams.

Speaking of the stock markets, in this video, Rahul Shah talks whether Bharti Airtel will emerge as the next big thing in the Indian stock market.

While the company's growth in recent years is nothing to write home about, its future seems brighter than ever.

But are the valuations running ahead of fundamentals or does the stock still seem reasonably priced from a long term perspective?

Rahul answers these questions in the video below. Tune in to find out more:

Moving on to news from power sector...

Tata Power was among the top buzzing stocks today.

On April 7, 2021, Tata Power Solar Systems issued a statement regarding the expansion of its manufacturing facility in Bengaluru, taking the total capacity to 1,100 megawatts (MW), from 700 MW that existed earlier.

The announcement was made on a day when the Union Cabinet approved the Rs 4.5 billion production-linked incentive scheme for solar manufacturing to reduce import dependency. The company has increased its cell manufacturing capacity from 300 MW to 530 MW and panel making capacity to 580 MW from 400 MW.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Small Businesses Set for Huge Potential Long-Term Growth

Would You Like Details on Such Stocks?

Discover More

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Tata Power's CEO and MD, Praveer Sinha said that they are happy to expand their production capacity to meet the increased demand for products. Around 31 years of strong experience in providing high quality solar products with continuous involvement in new technology has helped them maintain a leadership position in both solar manufacturing and EPC services.

The company's expansion is based on the significant increase in demand for its solar modules. The expansion comes amid the Indian government's positive intention to make the country a manufacturing hub and reduce its dependence on other countries as far as imports of solar cells and modules are concerned.

Note thatTata Power's share price dropped to Rs 27 apiece in May 2020 and is currently trading at Rs 105 per share with investors having witnessed a triple digit return so far. The total market capitalization of this company stands at Rs 33.6 billion.

How this pans out remains to be seen. Meanwhile stay tuned for more updates from this space.

In news from the indian pharma sector...

Zydus Cadila said that it has sought regulatory approval for its hepatitis drug Pegylated Interferon to treat Covid-19.

Once approved, the drug company's Covid-19 portfolio could have a new arsenal, along with Remdesivir. Earlier, the company reaped benefits from Hydroxychloroquine (HCQ), which was prescribed for emergency use in the treatment of Covid-19. Cadila Healthcare was the main beneficiary, along with IPCA Laboratories for having one of the largest production capacities for HCQ in India.

The drug company is also planning to launch 40 plus products, including 8-10 complex offerings, in FY22. It is also developing a portfolio of New Chemical Entities (NCEs), which could help boost growth prospects.

According to a leading financial daily, sales in Indian markets remained strong throughout the year, with domestic formulations marking a strong 21% year-on-year growth, helped by speciality business and Covid portfolio during Q3FY21. The company's domestic growth during January and February was also ahead of the industry average, providing encouragement.

Apart from Cadila Healthcare, the company's consumer wellness business which is separately listed as Zydus Wellness is also seeing good traction. It is managed by strong brands like Sugar-Free, Nutralite, and Everyuth along with Complan, Glucon-D, Nycil.Market paticipants remain optimistic about Cadila's business prospects. The stock gained more than 2% in today's intraday session.

Speaking about the novel coronavirus, , it has affected many businesses aggressively in the past which led to a massive stock market downfall in March 2020.

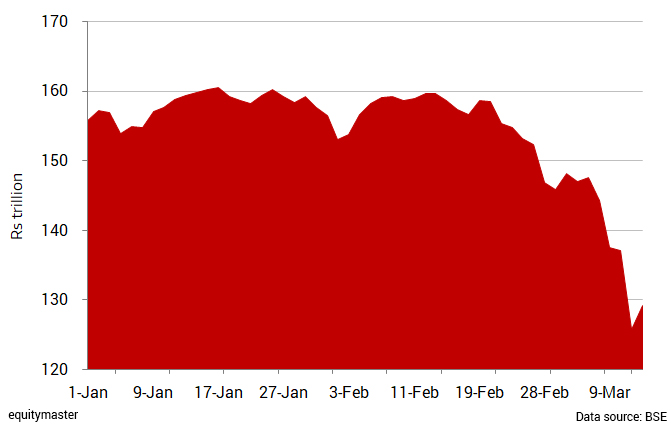

It triggered a humongous wipeout of investors wealth in the first wave, as can be seen in the chart below.

Coronavirus Triggers Massive Wipeout of Investor Wealth

As we can see, through most of January and February, the total market capitalization hovered between Rs 150-160 trillion.

It was only in the last week of February 2020 that a massive sell-off started on rising fears of the coronavirus outbreak escalating into a global pandemic.

The total market capitalization of BSE-listed companies closed at about Rs 146 trillion.

By 13 March 2020, this figure plunged even lower to Rs 129 trillion.

Do you think that second wave will cause similar disruptions for the stock market as the first wave of Covid-19?

We will keep you updated on that in the coming days. Stay tuned!

And to know what's moving the Indian stock markets today, check out the most recent share market updates here

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 84 Points Higher, Nifty Ends at 14,874; JSW Steel and Tata Steel Among Top Gainers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!