- Home

- Todays Market

- Indian Stock Market News April 9, 2016

Global Markets Remain Volatile Sat, 9 Apr RoundUp

Asian Markets ended the week on a negative note. The stock market in Japan was the worst hit with indices falling as much as 2.12% during the week. The negative interest rates as adopted by Bank of Japan (BOJ) have failed to convince the corporates that the inflation in the country will take off. Further, negative interest rate is leading to yen appreciating against dollar. This means the exports are likely to get impacted. All this data dragged the indices southwards.

Further, European markets ended the week on a mixed note. The stock markets in United Kingdom (UK) ended the week higher by 1%. However, stock markets in Germany ended the week lower by 1.8%. The European Central Bank (ECB) policymakers expect the euro area growth momentum to be slower than previously anticipated. As a result, the central bank lowered rates to fresh record low and increased the asset purchase program by 20 billion euro to 80 billion euro a month in March.

Back home, BSE Sensex ended the week lower by 2.4%. The markets were expecting a rate cut higher than 0.25%. However, Reserve Bank of India (RBI) in its monetary policy restricted the cut to 0.25%, which triggered the fall in the indices.

Key World Markets During the Week

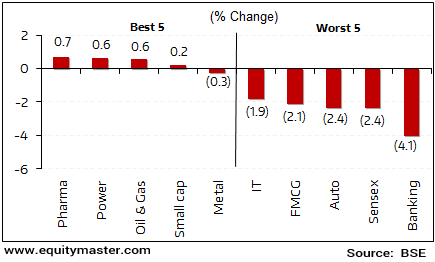

Major sectoral indices ended the week on a negative note. Banking and automobile were among the worst hit sectors.

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

Reserve Bank of India (RBI) in its monetary policy on Tuesday, slashed repo rate (rate at which banks borrow money from the RBI) by 0.25%. Post this reduction, the repo rate now stands at 6.5%.

In a recent column in Vivek Kaul's Diary, Vivek had made a case of 0.25% rate cut. Some of his reasons were that RBI should adopt a wait and watch policy to monitor whether banks pass on the cut to lenders before going for a further slash in the repo rate. To know more about Vivek's views on interest rates and RBI's policies, please click here.

Transmission of rate cuts has been an issue which the RBI has looked to address in their policy this time around.

Here is what the RBI has done to ease liquidity concerns amongst the banks.

Reduced the cash proportion of banks' reserve requirements that must be kept with the central bank (from 95% to 90%).

Raised the Reverse repo rate by 0.25% - the rates lenders charge to the central bank.

Announced open market operation to buy bonds to inject Rs 150 bn into the system this week.

The first measure will help the banks have more free cash at its disposal. A cut in the repo rate while increasing the reverse repo rate implies that banks will pay less when they borrow from the RBI and get paid more when they park their excess funds with the RBI.

One of the major issues the central bank addressed yesterday was about liquidity deficit. To put it simply, the banks are currently facing cash shortage to the tune of greater than 1% of net demand and time liabilities. This could be about Rs 1.5 trillion. Thus the central bank will look to infuse cash in the system by conducting open market operations. In this process the RBI looks to buy the bonds from the banks and in turn provide the banks much needed cash.

The policy was more focused on addressing liquidity shortage and easing the transmission mechanism. It will be important to watch out how the banks react to these measures and whether they would now be in a position to pass on the benefits to its customers. Whether or not the banks are able to lend more will depend on whether the banks reduce their lending rates commensurately.

Movers and Shakers During the Week

| Company | 1-Apr-16 | 8-Apr-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top Gainers During the Week (BSE A Group) | ||||

| The Ramco Cements | 401 | 443 | 10.4% | 450/281 |

| CRISIL | 1,778 | 1,947 | 9.5% | 2365/1750 |

| Biocon Ltd | 491 | 536 | 9.3% | 545/397 |

| Jet Airways | 567 | 615 | 8.6% | 796/249 |

| Century Textiles | 540 | 576 | 6.6% | 793/404 |

| Top Losers During the Week (BSE A Group) | ||||

| Hindustan Zinc | 185 | 160 | -13.3% | 200/117 |

| Ipca Labs | 573 | 499 | -12.8% | 888/480 |

| Bharat Forge | 865 | 771 | -10.8% | 1354/721 |

| Oriental Bank | 96 | 87 | -9.9% | 235/75 |

| Adani Port & SEZ | 243 | 219 | -9.8% | 375/170 |

Source: Equitymaster

Now let us move on to some of the key corporate developments in the week gone by.

As per an article in Livemint, weather scientists have spotted signs of a normal rainy season this year. Indian Institute of Tropical Meteorology, under the ministry of earth sciences, has signalled a better than normal monsoon in the June-September monsoon season. The institute stated that there is a 54% probability that rainfall during the monsoon season this year will be 10 mm-per-day more than normal.

Provided the estimates are accurate, this seems to be a positive development considering that India has faced two consecutive years of drought. As the south-west monsoon accounts for more than 70% of the annual rainfall in India, better than normal rainfall will boost agriculture productivity.

Further, a normal monsoon will also aid in reviving the rural demand. Rural demand has remained subdued for a while now. A normal monsoon will lead to higher disposable income, which in-turn will boost the rural consumption. To add to this, a normal monsoon will also help to keep the inflation at low levels. The possibility of a good monsoon would also increase the chances of the country's central bank retaining its easy money policy. All eyes are now on the much awaited Indian Meteorological Departments (IMD) monsoon forecast, which is scheduled to be out by the end of this month.

As per an article in Livemint, cigarette firms have halted production to protest against government's decision with regards to new graphical health warnings. The new norms require cigarette firms to display a graphic warning that covers 85% of the cigarette pack on both sides from the current 40%. Now, this is a significant increase... More than double the present norms.

The Global Adult Tobacco Survey, prepared by the World Health Organization (WHO), states that the number of people thinking of quitting smoking due to health warnings has increased from 46.3% in 2008 to 53% in 2012. Reportedly, it is expected the increase in the warning size on packs may further increase this percentage. Consequently it may have an impact on the sales volumes and overall turnover.

However, it would be imperative to note that most cigarettes in India are sold in a loose form. Hence, a person buying a cigarette may not notice or observe the packaging in which the graphic warning is printed. Hence, the impact of the increasing size of graphical warning may possibly be to a very small extent.

Tata Motor's launched its compact hatchback named 'Tiago' on Wednesday. This model could set off a price war in the small car segment. The base model starts at Rs 3.2 lakh for petrol version and Rs 3.94 lakh for the diesel variant (ex-showroom, Delhi). The base models is around Rs 80,000 cheaper than Maruti Suzuki's Celerio, Rs 90,000 less than the Wagon R and Rs 1.68 lakh less than Grand i10 Era in Delhi.

Reportedly, this disruptive pricing is expected to shake up the small-car market, which has so far been the dominated by companies like Maruti and Hyundai Motor India Ltd.

Tiago has a 1.2-litre Revotron petrol engine and a one-litre turbocharged Revotorq diesel motor. Tata Motors is producing the Tiago at its Sanand factory in Gujarat.

One in every two cars sold in India is a small car. Hence, this launch holds a significant importance to the company as it aims to move up on the priority list of individual buyers in this segment. Tata motors had recently launched two brands in the passenger vehicle category, Bolt and Zest. However both these brands have not seen enough traction. Tata motors business in India has come under pressure owing to the increasing competition. Thus, it will be interesting to see whether the company is able to gain better market share with this new launch.

Solar energy giant SunEdison Inc is looking to sell its interest in a solar project it won in November. The company had quoted a record low tariff of Rs 4.63 per unit to win the project. Further, the power from this plant was to be purchased by National Thermal Power Corporation (NTPC).

Reportedly, many projects quoted at tariff less than Rs 5 per unit are awaiting financial closure due to concerns with regards to project returns. Most of these projects do not have a cost escalation clause. A major part of the raw-materials are imported, which exposes the company to foreign exchange fluctuation risks. A drawback to not pass on the foreign exchange loss to the purchaser exposes the project to financial risks.

Investors are required to maintain caution with regards to companies investing in solar projects. The decision to invest should be based on whether the solar project will earn sufficient internal rate of return (IRR). It's best not to get carried away by the whole hoopla hovering around solar projects.

Bajaj Auto stated that the company has exported a record number of models of the quadricycle named 'Qute' in the fiscal year 2015-16.

Quadricycle is an alternative to the auto rickshaw that comes with four wheels instead of three. The vehicle can accommodate 4 passengers, provides a mileage of 35km per litre of fuel and has a top speed of 70km per hour.

However, several public interest litigations filed by auto rickshaw drivers had stalled the launch of the model in India. Bajaj has spent around Rs 5.5 billion to develop the quadricycle. It has created a capacity to produce 5000 vehicles a month at its Aurangabad facility in Maharashtra. Hence, the company relies on exports to boost the revenue from this model.

Recently, this model received a one-star safety rating from Brussel based Euro New Car Assessment Programme (ENCAP). The rating though low, outperforms the rating given to similar peer group's quadricycles in this segment.

Reportedly, the company exported 334 units of the model to 19 major markets in fiscal year 2015-16. Further, the company aims to export around 10,000 units in fiscal year 2016-17. That's, almost 30 times the sales of this model in 2015-16.

The subdued demand prevailing from key geographies such as Nigeria and Egypt has impacted the company's financials. The success of this model can help improve this situation.

We believe global markets are likely to remain under pressure going forward. None of the concerns of global investors are likely to go away anytime soon. Indian markets too will continue to experience the fallout of this turmoil. However, long term investors need not be too concerned. The upcoming budget will be the key trigger for the markets in the short term. Times like these could offer good opportunities to enter good quality stocks at reasonable valuations.

By now you know that on 22 April 2016, we will be celebrating our 20th anniversary. It is a time of ruminations and on this occasion we'd love to hear from you. In case you wish to share your experience with Equitymaster or read what some of our valued long time subscribers have to say about us, please do so here.

Here's what Anis Rahiman, an Equitymaster Reserve Member from Kerela, had to say about his experience with Equitymaster:

- Congratulations on the occasion of celebrating the completion of 20 glorious years of success.

- You have always been on the top of the list for serving the investors with your unselfish and reliable services. Formations like yours with a brilliant team of dedicated analysts and with a clear process can only aim for high results.

- With your commitment and sincerity you have time to time proved your worth and have gained the much deserved recognition and fame. With your services, your subscribers have gained a lot. You have always kept investors as your priority and have never resorted to any wrong means. Keep it up and wish you all the success for many more years to come.

And here's an update from our friends at Daily Profit Hunter...

The index lost its momentum in this week as it hit multiple resistances. It has closed below the 13 EMA for the first time after a month. It has also closed below the 7,600 level. It seems that the index is now trapped in a broad range of 7,800 to 7,400. Trading activity is likely to remain lackluster in the next week as markets will remain open only for three days and traders would avoid taking any major bets ahead of the long weekend. You can read the detailed market update here...

Indian Markets Slip on RBI’s 0.25% Rate Cut

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global Markets Remain Volatile". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!