- Home

- Todays Market

- Indian Stock Market News April 13, 2017

Sensex Opens Marginally Lower; Infosys Slips on Outlook Letdown Thu, 13 Apr 09:30 am

Asian equity markets are lower today as Chinese and Hong Kong shares fall. The Shanghai Composite is off 0.06% while the Hang Seng is down 0.08%. The Nikkei 225 is trading lower by 1.16%. The US equities closed lower in their previous trading session as investors assessed the geopolitical landscape.

Meanwhile, share markets in India have opened the day on a flat note with negative bias. The BSE Sensex is trading down by 51 points while the NSE Nifty is trading down by 10 points. The BSE Mid Cap index and BSE Small Cap index both have opened the day up by 0.1% & 0.2% respectively.

Infosys share price fell 2.1% after the IT major reported profit at Rs 36.03 billion for January-March quarter, degrowth of 2.8% against Rs 37.08 billion in previous quarter. Revenue fell 0.88% to Rs 171.2 billion compared with Rs 172.73 billion previous quarter.

The company offered a bleak outlook for the year ahead, with the full fiscal 2017-18 revenue growth guidance at 6.1-8.1%, lower than the industry average expected for the period. Further, the management has identified US$2 billion to be paid to shareholders via share buybacks or dividends. Meanwhile, Infosys also announced a dividend of Rs 14.75 per share.

Sectoral indices have opened the day on a mixed note with healthcare sector and realty sector leading the pack of gainers. While information technology stocks and metal stocks have opened the day in red. The rupee is trading at 64.69 to the US$.

Pharma stocks opened the day on a mixed note with Torrent Pharma and Indoco Remedies leading the losses. According to an article in a leading financial daily, Cipla's subsidiary, Cipla Medpro South Africa Pte has completed the acquisition of Anmarate (Pty) Ltd, South Africa. The deal is estimated at around ZAR 26 million.

Reportedly, the acquisition would help strengthen the market position of the company. The company acquired 4,000 shares of ZAR 1 each, representing 100% of the Anmarates share capital.

Further, the acquisition formed part of its strategy to acquire selected products in the growing therapeutic categories. Anmarate is engaged in manufacturing and distribution of pharmaceutical products.

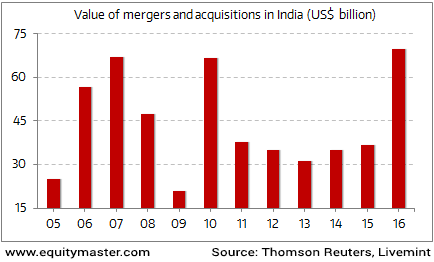

Merger and acquisition activity in India is on a high. The value of M&As that have taken place this year - at US$ 69.75 billion - are the highest on record for the country. This even beats the previous record of US$ 66.96 billion set in 2007.

Indian M&A activity at an All Time High in 2016

Especially, the M&A activity in the Indian pharma space has been on the rise in recent times. At the end of the day, whether the company is able to derive value from the acquisitions and augment the overall performance will be the key thing to watch out for.

To know more about the company's financial performance, subscribers can access to Cipla's latest result analysis and Cipla stock analysis on our website.

Cipla share price opened the day up by 0.8%.

Moving on to the news from stocks in oil & gas sector. As per an article in a leading financial daily, Oil India Ltd has raised US$500 million through overseas bonds to pay for the bridge loan it had taken to acquire stake in Russian oilfields.

Oil India International Pte Ltd (OIIPL), a wholly owned subsidiary of OIL, priced the 10-year notes at a coupon of 4% per annum payable half year. The notes will be listed on the Singapore Stock Exchange.

Reportedly, OIL had taken bridge loan to pay for its share of the acquisition of stake in Taas-Yuryakh Neftegazodobycha LLC.

Meanwhile, oil companies have announced that the prices for petrol and diesel will be changing every day from 1 May 2017 in accordance with that of the international prices. The plan will be carried out in five cities initially before its applied in the rest of the country.

The decision was collectively taken by state-owned fuel retailers Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL), which own over 95% of nearly 58,000 filling stations in the country.

The five cities in question are Puducherry, Vizag, Udaipur, Jamshedpur and Chandigarh. Introduction of dynamic pricing in these five cities will reveal the problems faced by this system before it is implemented across the country.

The current policy on revision of fuel prices requires prices to be changed every fortnight after considering volatility in the currency and global oil markets. Daily change in fuel prices would eradicate big leaps in prices that currently happen every fortnight, and also keep the consumer more aligned to market dynamics. The move will make fuel pricing in India more capable of competing with global fuel prices, the reports noted.

Oil & gas stocks opened the day on a mixed note with Petronet LNG and MRPL leading the gainers.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Marginally Lower; Infosys Slips on Outlook Letdown". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!