- Home

- Todays Market

- Indian Stock Market News April 17, 2017

Sensex Trades Flat; Realty Stocks Outperform Mon, 17 Apr 01:30 pm

After opening the day on a flat note, share markets in India witnessed volatile trading activity and are trading on a flat note with a negative bias. Sectoral indices are trading on a mixed note with stocks in the realty sector and stocks in the consumer durables sector trading in green, while stocks in the metal sector are leading the losses.

The BSE Sensex is trading down by 27 points (down 0.1%), and the NSE Nifty is trading down by 10 points (down 0.1%). Meanwhile, the BSE Mid Cap index is trading up by 0.1%, while the BSE Small Cap index is trading up by 0.3% The rupee is trading at 64.40 to the US$.

Idea Cellular, in a joint venture with Aditya Birla Nuvo Ltd (ABNL) is set to launch the Aditya Birla Idea Payments Bank in June this year.

The telecom giant has set itself a June target to launch operations and is signing up retailers who sell its telecom services to also double up as banking touch points to allow customers to carry out transactions.

The company, that recently received the Reserve Bank of India's final approval to open its payments bank, is in the process of integrating its systems with those of the National Payments Corporation of India and the RBI. Joining the network will allow it to facilitate interbank electronic transactions.

The company plans to tap into its telecom customer base of over 200 million and plans to sign a majority of them initially for the services, giving it a large base to keep off competition from digital wallet players and others set to enter the segment.

The company plans to convert its 2 million strong retailer base across the country into banking touch points to take financial services to the rural areas.

The payments bank JV will also acquire customers online, leveraging on Aditya Birla Group's nearly 45 million digital customers.

Aditya Birla Idea Payments Bank is a 51:49 joint venture between ABNL and telecom major Idea Cellular, respectively.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

With the objective of deepening financial inclusion, RBI, in 2015 kicked off an era of differentiated banking by allowing SFBs (small finance banks) and PBs (payments banks) to start services. A total of 21 entities were given in-principle nod last year, including 11 for payments banks. Payments banks can accept deposits from individuals and small businesses up to a maximum of Rs 100,000 per account.

Payments banks aren't allowed to lend, but can take deposits, facilitate remittances and dispense payments to recipients. The RBI had devised payments banks and small finance banks as tools to take formal banking to the unbanked.

For telecom companies like Idea and Bharti Airtel, this offered a new business opportunity as they already have extensive networks across the country and a huge potential customer base for the banking services in their existing users.

Bharti Airtel, the telecom market leader, launched its payments bank in January.

India's major telecom operators are pushing ahead the government's broad agenda to move towards cashless economy, soon after notebandi which crippled cash payments due to inadequate cash in the system.

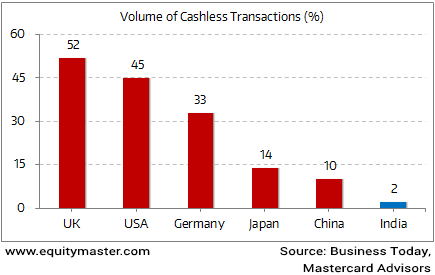

However, this push towards a cashless economy may not have the desired results in a country where nearly 98% of the transactions by volume are undertaken in cash.

Is India Ready to Go Digital?

To go cashless would mean a complete overhaul of how Indians spend their money. Banks and other financial institutions banks will have to be technologically competent to tackle the security issues associated with the shift towards a digital economy.

All these are major changes, and thus beg the question - Is India ready to go digital?

Moving on to news about the economy. According to data released by the Central Statistics Office, Wholesale price inflation (WPI) eased to 5.7% in March as compared to 6.6% in February this year.

However, WPI was in the negative zone, at -0.5% in March last year.

The fall in inflation can be attributed mostly to falling oil prices, with the inflation for fuel and power segment coming in at 18.2% in March as compared to 21% for the previous month.

The build up inflation rate in the financial year so far was 5.7% compared to a build up rate of -0.45% in the corresponding period of the previous year.

Since the start of financial year 2016-17, WPI has been rising consistently, so much so that in February it reached to a 4-year high due to rise in fuel inflation (21%) and lower base in the previous year's index.

Interestingly, core WPI, which has been increasing since July 2016, declined marginally to 2.4% in February 2017 - it was at 28-month high of 2.7% in previous month.

The decline was led by a marked fall in fuel and manufacturing products inflation. While this came as a welcome breather, the same is expected to rise as the cash crunch led by notebandi turns normal. So when consumer spending normalizes, we should all be on our guard for rising inflation.

However, the sharp correction in crude oil prices witnessed over the last week would aid in dousing minerals inflation in March 2017. Moreover, the continued appreciation of the Rupee relative to the US Dollar would dampen the landed cost of imports. In addition to this, the RBI has slowed down the pace of remonetisation in March, which will reduce spending over time.

Such trends are likely to keep the WPI below the 6% mark in the ongoing month.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Flat; Realty Stocks Outperform". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!