- Home

- Todays Market

- Indian Stock Market News May 22, 2017

Sensex Opens 200 Points Higher; FMCG Stocks Lead Mon, 22 May 09:30 am

Asian equity markets opened higher today, following the continued recovery on Wall Street last week and as investors digest yet another missile test out of North Korea at the weekend. The Shanghai Composite is up 0.09%, while the Hang Seng is up 0.77%. The Nikkei 225 is trading up by 0.30%. The US stock market closed with a positive bias, after two new reports related to a federal investigation into possible coordination between Russia and Trump's election campaign.

Meanwhile, share markets in India have opened the day on a negative note. The BSE Sensex is trading higher by 208 points while the NSE Nifty is trading higher by 61 points. The BSE Mid Cap index opened up by 0.6% while BSE Small Cap index has opened the day up by 0.7%.

Barring healthcare stocks, all sectoral indices have opened the day in green with FMCG stocks and realty stocks leading the gains. The rupee is trading at 64.99 to the US$.

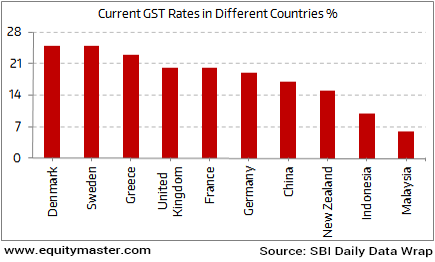

In the latest development, India moved towards multi-tiered tax structure with the Finance Minister Arun Jaitley headed Goods and Services Tax (GST) Council deciding to place services under four slabs - 5%, 12%, 18% and 28% compared to the current uniform 15% levy on all eligible services.

What would be India's GST Rate?

Thirteen services including travelling by road and by air in the economy class or to any airport covered under the government's regional connectivity scheme will attract a concessional 5% GST rate, while seven services including rail freight, business class air travel and construction services will be taxed at 12%.

The Council decided to continue tax exemption on services including health, education, select government services, budget hotels charging less than Rs1,000 a day and services given to international bodies like the UN.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Further, a new item to the exemption list was added including services provided by the GST Network (GSTN), the company that provides the IT infrastructure to union and state governments and union territories for the new indirect tax regime. That takes the total number of services out of GST to 83.

The council has deferred the decision on the tax rates for gold, and also on bidis and cigarettes, to its next meeting, which is scheduled for June 3. We believe that GST is one of the key reforms that has the potential to bring about a structural change in the Indian economy.

If you would like to dig deeper into the practical implications of GST, I strongly recommend you download Vivek Kaul's free report, What the Mainstream Media DID NOT TELL YOU about GST.

Moving on to the news from stocks in oil & gas sector. A leading financial daily reported that, Oil Ministry may block any attempt by state-owned GAIL, IOC, ONGC and BPCL to buy 10% stake in France's GDF International in Petronet LNG Ltd.

GDF, a unit of French energy giant Engie SA, has written to sell its entire stake in Petronet to the company's principal promoters GAIL India Ltd, Oil and Natural Gas Corp (ONGC) and refiners Indian Oil Corp (IOC) and Bharat Petroleum Corp Ltd (BPCL). At present, the four companies hold 49.99% stake of Petronet.

This comes on the back of oil ministry's aim to keep the liquefied natural gas importer a private limited company. If any of the promoters were to buy GDF's stake, the combined shareholding of state-owned firms will rise above 50% and will lead to conversion of Petronet into a public-sector company, something that oil ministry does not want.

The four promoter firms hold 12.5% stake each in Petronet. Going by this proportion, they are each entitled to buy 2.5% of GDF's stake. But now, it is unlikely that anyone of them will exercise that option given that Petronet has been structured as a private company, the reports noted.

Oil & gas stocks opened the day on a mixed note with Suzlon Energy and Petronet LNG leading the gains.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens 200 Points Higher; FMCG Stocks Lead". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!