- Home

- Todays Market

- Indian Stock Market News May 24, 2022

Sensex Ends 236 Points Lower, Nifty Falls Below 16,150; IT & FMCG Stocks Witness Selling Tue, 24 May Closing

Indian share markets ended on a negative note today as global cues remained weak.

At the closing bell, the BSE Sensex ended 236 points or 0.4% lower.

Meanwhile, the NSE Nifty was down by 90 points, ending at 16,125.

Dr Reddy's Laboratories, HDFC, and Power Grid were among the top gainers today.

Tech Mahindra, HUL, and HCL Technologies were among the top losers today.

The primary markets witnessed some action amid two listings and one new IPO in the offering. The Rs 8.1 bn initial public offering (IPO) of Aether Industries opened for subscription today.

Meanwhile, Delhivery made its debut on the bourses today and rose 10% after making a muted listing.

The IPO's GMP was signaling a discount of Rs 5 in the unlisted market before it listed.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Looking to Buy Midcap Stocks?

If you're looking to buy some high-quality midcap stocks, then our co-head of research Rahul Shah has got some great recommendations.

You can get instant access to these stocks by subscribing to his popular stock research service, Midcap Value Alert.

The great news is... as part of Equitymaster's 28th anniversary celebrations... you have the chance to access this service at a huge 80% OFF

Get Full Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

The broader markets ended on a weak note as the BSE Mid Cap index slipped 0.9% while the BSE Small Cap index plunged 1.1%.

Barring banking stocks, all sectoral indices remained under pressure. Stocks in the IT sector, pharma sector, metal sector, and FMCG sector witnessed most of the selling.

Metal stocks have seen a massive correction in recent days. Tata Steel, SAIL, JSW Steel and other larger counterparts fell over 10% yesterday.

Among the smaller counterparts, Godawari Power & Ispat is down over 25% so far this week.

Shares of KSB and Adani Power hit their 52-week high today.

Outside the home ground, Asian share markets ended on a weaker note as as relief rally hopes on Wall Street quickly soured by a slide in US stock futures.

At the close in Tokyo, the Nikkei 225 slumped 0.9%, while the Hang Seng plunged 1.9%. The shanghai composite plummeted 2.4%.

The SGX Nifty was trading 0.5% lower at the time of writing.

The rupee is trading at 77.5 against the US$.

Gold prices are currently trading up by 0.2% at Rs 51,025 per 10 grams while silver is trading up at 0.3% at Rs 61,479 per kg.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Up For Grabs

Equitymaster's Small Cap Research At 60% Off

Claim Now

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Speaking of silver, India's #1 trader Vijay Bhambwani talks about silver and why the silver bull market will continue, in his latest video for Fast Profits Daily.

Meanwhile, also take a look at the video we recorded on undervalued stocks.

In the video, we highlight the 5 most undervalued smallcap stocks to add to your watchlist.

In latest developments from the sugar sector, the Indian government has planned to potentially cap this season's sugar exports by 10 m tonnes.

Shares of sugar companies took a sharp knock after a news report said that the Government of India is looking to limit exports of sugar.

The new move to curb sugar export is being seen as a new risk to global food prices. While according to sources the step comes to prevent a surge in domestic sugar prices.

To put things in perspective, India is the world's largest sugar producer and second largest exporter after Brazil.

Although analysts are of the opinion that 10 m tonnes is fairly large cap and that this will help mills to export maximum amount and keep a bare minimum in the country. Sugar production in the country last year was 35.5 m tonnes.

The India Sugar Traders Association reacted to the potential export limit and has termed it as a precautionary step.

This would be the first such restriction in six years while this step comes just days after the Centre had restricted the export of wheat.

Alongside the potential export restriction, here's why sugar stocks are taking a dive.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Up For Grabs:

Equitymaster's Small Cap Research At 60% Off

Claim Now

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Moving on to developments from the insurance space, the newly listed Life Insurance Corporation of India (LIC) might consider paying dividends while announcing Q4 results next week.

In an exchange filing, the company has informed that the board is scheduled to meet on 30 May to consider and approve the audited financial results for the quarter ended March 2022 and payment of dividends, if any.

As of December 2021, LIC had a market share of 61.6% in terms of gross written premiums.

The country's largest IPO to date had closed with nearly 3 times subscription. The shares of the insurance behemoth made its stock market debut on 17 May and listed at a discount of 8.6%.

Life Insurance Corporation share price ended 0.8% higher on the BSE today.

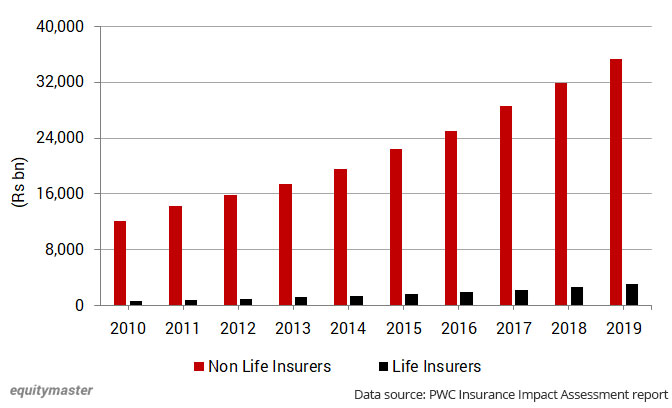

Speaking of the insurance sector, have a look at the chart below which shows the investment assets of non-life insurers and life insurers over the past 10 years:

Investment Assets of Non-Life Insurers 11x That of Life Insurers

As per Tanushree Banerjee, Co-Head of Research at Equitymaster, the above chart is enough proof of how big an earning opportunity is the zero-cost float to the non-life insurers. Their investment assets under management is nearly 11 times that of life insurers.

Moving on to news from the IPO space, the Rs 8.1 bn initial public offering (IPO) of Aether Industries opened for subscription today.

The specialty chemicals manufacturer will sell its shares in the range of Rs 610-642 apiece and the issue is open till 26 May.

Ahead of the public offer, Aether has garnered over Rs 2.4 bn from anchor investors from about 25 investors including Goldman Sachs, Nomura, and SBI Mutual Fund among others.

At the end of Day 1, the overall issue was subscribed 0.28 times led by qualified institutional buyers and retail investors who respectively subscribed 36% and 34% of their portion.

While the employee and the non-institutional investor quote received less traction.

Looking to bid for the IPO? Here are 5 things to know about Aether Industries IPO.

Moving on to another development from the IPO space, shares of logistics and supply chain startup Delhivery got listed at a 2% premium.

Delhivery share price ended 10.5% higher on their maiden day of trading on the BSE today.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 236 Points Lower, Nifty Falls Below 16,150; IT & FMCG Stocks Witness Selling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!