- Home

- Todays Market

- Indian Stock Market News May 25, 2017

Sensex Trades Firmly in Green; IT Stocks Lead Gains Thu, 25 May 01:30 pm

After opening the day on a positive note, the Indian share markets have continued the momentum and are trading firmly above the dotted line. Sectoral indices are trading mixed, with stocks in the capital goods sector and stocks in the IT sector leading the gains, while stocks in the pharma sector are trading in red.

The BSE Sensex is trading up by 212 points (up 0.7%) and the NSE Nifty is trading up by 66 points (up 0.7%). Meanwhile, the BSE Mid Cap index is trading up by 0.8%, while the BSE Small Cap index is trading up by 1.1%. The rupee is trading at 64.53 to the US$.

In news from stocks in the auto sector. Tata Motors share price is in focus today after the company reduced its managerial workforce by up to 1,500 people domestically as a part of a restructuring exercise.

Tata Motors also declared its fourth quarter results. The auto maker reported a lower consolidated net profit of Rs 43.4 billion, down by 17% as compared to Rs 52.11 billion reported in the previous fiscal. For the year ended March 31, 2017, the Consolidated revenue (net of excise) was Rs 2,698.5 billion against Rs 2,731.1 billion for the last year. The manufacturer reported a net profit of Rs 75.6 billion, a drop of 35% of the previous year.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The company clarified that the affected employees were given the option of voluntary retirement, while some retired or resigned. The total reduction in jobs amounts to over 10-12% of the company's workforce.

The company joins a growing number of organisations adopting such strategies for a variety of reasons, ranging from cutting the flab to automation. These job cuts, which have led to concerns on 'jobless economic growth' in various quarters, have been across multiple sectors, including capital goods, banking & finance, and information technology.

India's Job Crisis is Getting Worse

Regular readers are aware that we have been warning about the consequences of India's worsening demographic problem. We have been researching extensively on this impending crisis, and now believe that the crisis is much worse than what our big-picture editor Vivek Kaul had earlier anticipated.

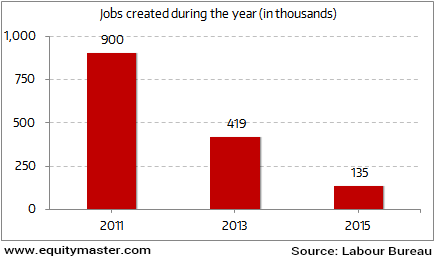

A look at the above chart reveals that job creation in India has been shrinking at an alarming rate.

In the last four years, India has lost an average of 550 jobs every single day!

But this crisis is not limited to the marginalised sections of our economy. It is way bigger and endemic than you could have imagine. And it's also taking a toll on white collar jobs. In case of Tata Motors' case, the company clarified that only the white collared personnel were affected by the VRS, and the blue collared workers have not been impacted by the exercise.

This trend certainly has a potential to impact the economy and consequently the stock prices.

So how can one make the most of the situation?

We believe a few super investors could provide the clue. These are the guys who've beaten the markets black and blue and have an eye for multi bagger stocks irrespective of the macro environment.

With respect to which super investors to follow, our Research analysts Kunal and Rohan could be of great help courtesy their project, The Super Investors of India.

To know more about these super investors and their stock picking approach, download a free copy of -The Super Investors Of India

Moving on to news from the oil and gas sector. According to an article in The Economic Times, state oil companies have planned a capital expenditure of over Rs 870 billion over the next fiscal.

The capital expenditure will be towards expansion of refining capacities, develop oil and gas fields and build pipelines.

Oil and Natural Gas Corp (ONGC) plans to invest Rs 300 billion, the maximum among all state oil firms. This is slightly higher than the company's spending of about Rs 280 billion in 2016-17.

The second-biggest investment has been planned by Indian Oil Corp. It aims to spend about Rs 200 billion this year, lower than Rs 220 billion last year. Oil India will be the third-highest spender with Rs 90 billion marked for the year.

GAIL and HPCL have also planned to spend more on capital expenditure than they did last year. However, the total capital expenditure for the fiscal will be nearly a fifth lower than last year's capex of Rs 1,060 billion by the state run oil firms.

In April, state firms had already spent a combined Rs 36 billion. State refiners are spending heavily to upgrade facilities to produce fuel with higher emission norms. All petrol and diesel sold must meet BS-VI emission norms from April 2020, according to the government mandate.

India needs big investment in exploration and production to raise domestic crude output that fell for the fifth straight year in 2016-17. Lower output pushed up India's import dependence to 82% of its requirement in 2016-17 from 81% in the previous year. The government is aiming to bring down import dependence to 67% by 2022.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Firmly in Green; IT Stocks Lead Gains". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!