- Home

- Todays Market

- Indian Stock Market News June 4, 2016

A Mixed Week for Global Markets Sat, 4 Jun RoundUp

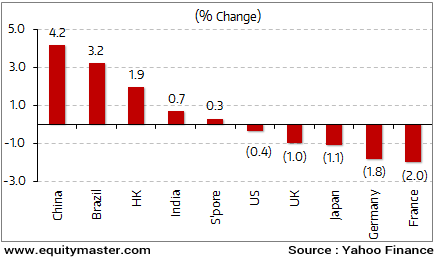

Global markets witnessed mixed trends this week. The US markets ended marginally lower on rising concerns that the US Fed may hike interest rates in this month's meeting. However, the Chinese markets bounced back this week and were the top gainer.

The Indian markets also closed the week in positive territory. Investor sentiment was buoyed by strong results posted by some index heavyweights. Markets have put the tightening of P-note norms behind them. The BSE-Sensex was up 0.7% for the week. Expectations of a good monsoon and signs of improvement for some companies in the March quarter results, have kept sentiment positive in recent weeks.

European markets ended in the red in the week gone by on concerns of a Brexit i.e. Britain leaving the Eurozone. The British FTSE, the German DAX and the French CAC indices ended the week lower by 1%, 1.8% and 2% respectively.

Meanwhile, crude oil prices fell 1.5% this week as OPEC members agreed to continue their policy of record production.

Talking about the positive sentiments, most of you ll would have read about Rahul Shah's prediction of a 70% upside in the Sensex. We did not pull that number out of a hat. It comes from constantly tracking the performance of hundreds of listed companies versus their long-term track record. Our research has revealed some key reasons the 70% earnings upside in stocks can be for real.

Very soon, we will release a report exclusively for our StockSelect subscribers called Sensex 40,000: 4 Stocks to Profit from the Coming Stock Market Wave. Keep an eye out for it.

Key World Markets During the Week

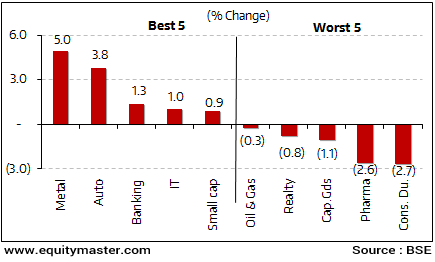

Among the sectoral indices, metal and auto stocks witnessed the maximum buying interest.

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

The Central Statistics Office (CSO) released the gross domestic product (GDP) numbers for the quarter ending March 2016. If the numbers are to be believed, India's economy grew at 7.9% during the quarter. While for the fiscal year 2016, the economy grew at 7.6% as estimated earlier.

The healthy growth was on the back of improved agriculture performance and growth in consumption. Reportedly, private consumption remained robust at 7.4% in the fiscal year 2016. Moreover, the implementation of the Seventh Pay Commission coupled with projections of good monsoon will further boost consumption.

However, on the negative side the private investment continues to remain subdued. Going forward though, increasing consumption trends could lead to higher capacity utilization, which could encourage private sector to revive its investment plans.

Further, the economic survey has projected the economy to grow within a wide band of 7-7.5% in the fiscal year 2017. Moreover, Mr. Arun Jaitley has even expressed hopes of the economy growing over 8%.

While India retains the tag of the fastest growing economy in the world, there is a wide gap between the Index of Industrial Production (IIP) figures and that of GDP. While, IIP registered a growth rate of just 2% in FY16, GDP grew at 7.6%. The wide gap only hints that there might be flaws in the computation of our GDP numbers.

In one the articles we have given a renowned economists view on how the GDP growth number is wrong. Don't miss to read this interesting piece. Click here to access it.

The World Bank has dropped the use of developing nation tag for India in its specialized reports. This comes as the World Bank recently changed the status of the country from 'developing' to 'lower-middle income' based on poor performance on parameters such as electricity generation, sanitation facilities and labour force participation rate.

This can be a clear wake-up call for India despite it being the fastest growing economy. Our recent edition of The 5 Minute WrapUp talks about what India needs to focus on if it has to sustain the growth momentum in future.

As per an article in Economic Times, more than 200 stocks in which the overseas holding is more than 5% have fallen as much as 30% since the Securities and Exchange Board (SEBI) tightened disclosure norms for participatory notes (P-Note) on May 19.

P-Notes are derivative instruments issued by registered foreign portfolio investors (FPIs). They are issued to overseas investors to enable them to trade in Indian stocks without having to register with the regulator themselves. That meant the identity of the real owners of the instruments wasn't known. However, as per the new regulations, SEBI has made it mandatory to update the complete transfer trail of P-Notes on a monthly basis.

The regulator has also made it compulsory or issuers to carry out reconfirmation of the P-Note position on a semi-annual basis and carry out KYC (know your client) reviews every year. These stringent rules for P-notes are initiated to check the flow of black money into stock markets.

Black money forms a major part of the Indian economy. The finance ministry recently stated that the government has taken sustained steps for curbing black money which includes enactment of a new Black Money Act with strict penalty provisions and new income disclosure scheme formulated for domestic black money.

Black money is money which has been earned, but on which tax has not been paid. Vivek Kaul, editor of Vivek Kaul's Diary, has offered some interesting data that shows India's love for black money. In his latest article on the topic he has shared some insights on what do the car sales tell us about black money.

Indian Meteorological Department (IMD) has recently given second forecast, stating above normal rains. Reportedly, the odds are overwhelmingly favouring an above normal monsoon-106% of the long period average (LPA).

Further, monsoon is expected to be well distributed across the country, with IMD projecting 108% rainfall in the northwest region and 113% in central and peninsular India.

The monsoon is considered normal when the rainfall is 96-104% of the LPA and is considered above normal when it is 105-110% of the LPA.

The news comes as a relief considering that the country has faced a deficit rainfall in the preceding two years. Eleven states declared a drought in the country after last year's failed rains which have also led to depleting water levels in reservoirs.

A normal monsoon will lead to higher disposable income in the hands of farmers, which in-turn will boost the rural consumption. To add to this, a normal monsoon will also help to keep the inflation at low levels. The possibility of a good monsoon would also increase the chances of the country's central bank retaining its easy money policy. However, there have been many instances in the past wherein the forecasts have gone wrong. Provided, they are accurate it will help to revive the rural sentiments.

In another news update, Nikkei Purchasing Managers Index (PMI) for the month of May indicated subdued growth in the manufacturing activities. PMI is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Reportedly, the PMI for manufacturing rose marginally to 50.7 points, from 50.5 in the month of April. A reading above 50 represents expansion, while one below this level means contraction. Despite, robust gross domestic product (GDP) numbers for the March quarter, the manufacturing activities continues to remain subdued.

The government's 'Make in India' drive is a big long term positive, but there are still near term challenges. Approvals have more or less have come through, the sector is groaning under a huge pile of debt. However, as long as the government sticks to its reform agenda, the future is bright for the manufacturing sector.

Service tax will be charged at 15% as the Krishi Kalyan cess of 0.5% comes into force from this week. Similarly, a luxury tax of 1% will be imposed on cars priced above Rs 10 lakh and services valued at above Rs 2 lakh.

This will push up retail prices of almost all everyday products, and services, including air travel, restaurant meals, movie tickets, telecom, credit card, electricity and mobile bills.

In Budget 2015-16, finance minister Arun Jaitley raised the service tax rate from 12.36% to 14%. The Swachh Bharat cess of 0.5% came into effect in November. Add the Krishi Kalyan cess to this and the service tax has increased to 15%. The revenues collected through the Krishi cess would be used for financing initiatives relating to the improvement of agriculture and welfare of farmers.

Further, the luxury tax is a part of the government's strategy to clamp down on cash transactions. Arun Jaitley had stated in the in the Budget that the aim of the tax is to reduce the quantum of cash transaction in sale of any goods and services, and for curbing the flow of unaccounted money in the trading system. Do read this interesting article by Vivek Kaul, editor of Vivek Kaul's Diary, where he explains correlation of car sales to black money.

The above increase in service tax rate could push up inflation. A high inflation rate will mean lower chances of an interest rate cut by the Reserve Bank of India (RBI).

Movers and Shakers During the Week

| Company | 27-May-16 | 3-Jun-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top Gainers During the Week (BSE A Group) | ||||

| https://www.equitymaster.com/result.asp?symbol=CRGR&name=CROMPTON-GREAVES-Stock-Quote-Chart&utm_source=top-menu&utm_medium=website&utm_campaign=performance&utm_content=get-quote | 60 | 72 | 19.4% | 204/41 |

| https://www.equitymaster.com/result.asp?symbol=MTFL&name=MUTHOOT-FINANCE-LTD-Stock-Quote-Chart&utm_source=top-menu&utm_medium=website&utm_campaign=performance&utm_content=get-quote | 215 | 254 | 17.8% | 274/152 |

| https://www.equitymaster.com/result.asp?symbol=HALC&name=HINDALCO-Stock-Quote-Chart&utm_source=top-menu&utm_medium=website&utm_campaign=performance&utm_content=get-quote | 92 | 105 | 14.8% | 124/59 |

| https://www.equitymaster.com/result.asp?symbol=BFL&name=MPHASIS-LTD-Stock-Quote-Chart&utm_source=top-menu&utm_medium=website&utm_campaign=performance&utm_content=get-quote | 492 | 558 | 13.3% | 583/368 |

| https://www.equitymaster.com/result.asp?symbol=TELCO&name=TATA-MOTORS-Stock-Quote-Chart&utm_source=top-menu&utm_medium=website&utm_campaign=performance&utm_content=get-quote | 404 | 454 | 12.5% | 464/266 |

| Top Losers During the Week (BSE A Group) | ||||

| https://www.equitymaster.com/result.asp?symbol=LITL&name=LANCO-INFRATECH-Stock-Quote-Chart&utm_source=top-menu&utm_medium=website&utm_campaign=performance&utm_content=get-quote | 5 | 4 | -11.9% | 8/2 |

| https://www.equitymaster.com/result.asp?symbol=SUNP&name=SUN-PHARMA-Stock-Quote-Chart&utm_source=top-menu&utm_medium=website&utm_campaign=performance&utm_content=get-quote | 826 | 738 | -10.6% | 965/706 |

| https://www.equitymaster.com/result.asp?symbol=JFWL&name=JUBILANT-FOODWORKS-Stock-Quote-Chart&utm_source=top-menu&utm_medium=website&utm_campaign=performance&utm_content=get-quote | 1,112 | 1,000 | -10.1% | 1,984/897 |

| https://www.equitymaster.com/result.asp?symbol=JPHY&name=JAIPRAKASH-POWER-Stock-Quote-Chart&utm_source=top-menu&utm_medium=website&utm_campaign=performance&utm_content=get-quote | 4 | 4 | -9.1% | 8/4 |

| https://www.equitymaster.com/result.asp?symbol=BHEL&name=BHEL-Stock-Quote-Chart&utm_source=top-menu&utm_medium=website&utm_campaign=performance&utm_content=get-quote | 128 | 118 | -8.0% | 290/90 |

Source: Equitymaster

Let's have a look at some quarterly results announced by companies this week

Tata Motor's reported its results for the quarter ended March 2016. The consolidated revenues grew by 18.8% YoY to Rs 799.2 billion during the quarter. The healthy growth was on the back of the strong performance of its Jaguar Land Rover (JLR) unit.

The sales volumes of JLR grew by 28% YoY to 158,213 units during the quarter. The traction for JLR was across geographies and the volumes grew by 28% in the UK, 23% in North America, 19% in China and 54% in Europe as a whole during the quarter. Reportedly, net profit at JLR rose 56.29% YoY to Euro 472 million, while net sales increased 13.18% to €6,594 million during the quarter.

Moreover, the Indian operations too reported a profit of Rs 4.6 billion as compared to a net loss of Rs 11.6 billion a year ago. The Indian operations improved on the back of strong performance from the medium and heavy duty trucks.

The consolidated net profits of the company grew by 201% to Rs 51.7 billion during the quarter. However, the profits included a one-time gain of Rs 5.5 billion on account of an insurance claim.

The profitability margins may come under pressure going forward on the account of growing contribution of cheaper models. Reportedly, JLR is moving from being a premium, high-margin company to a high-volume, low-margin firm.

Going forward, the traction from the newly launched model in passenger vehicle space such as 'Tiago' and a pick -up in the economic activity to boost the demand for commercial vehicles will be the key thing to watch out for pertaining to Indian operations. As far as the JLR unit is concerned, the demand from key geographies such as China and Europe will need to be closely tracked to assess its impact on its financial performance going forward.

NTPC too reported its results for the quarter ended March 2016. The standalone total income declined by 6.6% YoY to Rs 185.6 billion during the quarter. Further, the company's net sales from electricity too declined by 6.4% YoY to Rs 179.9 billion during the quarter.

The sales from electricity declined on the back of low demand from the state electricity board (SEB). Partially the fall in the revenues was also on account of lower fuel cost which declined by 19% YoY during the quarter. Fuel cost is a pass-through for NTPC's regulated business model. As the benefit was passed on to the customers, average tariff fell, resulting in a 6% drop in revenue.

Further, the company's plant load factor or utilization levels dropped marginally to 62.28% in fiscal year 2016 as compared to 64.25% in the year ago period.

The standalone net profits too declined by 8% YoY to Rs 27.1 billion during the quarter. Increase in the generation and utilisation levels will be the key things to watch out for going forward.

Bharat Heavy Electricals Ltd (BHEL) reported its results for the quarter ended March, 2016. The company's net profit declined 59% YoY to Rs 3.6 billion during the quarter. Revenue declined 21% YoY to Rs 97 billion. Further, EBITDA (earnings before interest, taxes, depreciation and amortization) margin came in at 3.6%. This was much lower than estimates of 7% and was impacted by provisions of Rs 9.5 billion, which includes Rs 3.5 billion towards doubtful debts.

The company received orders worth Rs 156 billion in the fourth quarter. As such, the outstanding order book stood at Rs 1,100 billion as of March 31, 2016. However, the company has stated that projects worth about Rs 500 billion are relatively stressed and hence are likely to move at a slower pace.

BHEL is an integrated power plant equipment manufacturer and one of the largest engineering and manufacturing company of its kind in India. It produces a wide variety of industrial goods. The company recently commissioned 250 megawatt (MW) thermal power plant in Maharashtra. The company has been a major partner in the power development programme of the state and has contributed to more than 16,000 MW of power generation capacity in Maharashtra. This is recorded as its highest power generation capacity in any single state.

Now let us move on to some of the key corporate developments in the week gone by.

Sun Pharma's US subsidiary Sun Pharmaceutical Industries Inc (SPII), has received a grand jury subpoena from the anti-trust division of the US Department of Justice seeking documents from the company and its affiliates.

The subpoena was pertaining to corporate and employee records, generic products and pricing, communications with competitors and others regarding the sale of generic pharmaceutical products. The company is responding to the Justice Department's subpoena, and reportedly the outcome of the inquiry is unlikely to have any adverse material impact on operations or financial results (Subscription Required).

Also, the company reportedly recently terminated the umbrella agreement as well as the transaction agreement with Japanese drug maker Daiichi Sankyo as the latter has divested its stake from Ranbaxy. Daiichi, which owned Sun Pharma shares worth $3.6 billion as part of the Ranbaxy transaction, had sold its stake in April 2015, ending its run in the Indian pharma market.

Mahindra & Mahindra (M&M) has entered into a Brand License Agreement with Pininfarina. The agreement is entered for use of trademarks owned by the Pininfarina group including licensing of brand 'Pininfarina' for automotive products of the company.

The company has taken this step pursuant to acquisition of 76.06% stake in Pininfarina through a Special Purpose Vehicle (SPV). Last year in December, M&M announced acquisition of 76.06% stake in Pininfarina through SPV. Tech Mahindra would hold 60% in the said SPV while M&M will hold the remaining 40% stake in SPV.

Tata Steel's UK operation - Tata Steel UK has completed the sale of its Long Products Europe business to investment firm Greybull Capital LLP.

Under the agreement signed in April, Greybull Capital paid a nominal fee for the entire long-products business and takeover of Tata Steel UK's assets and liabilities. The deal includes a £400 million investment and financing package for the business, as well as agreements with suppliers and unions on cutting costs.

The sale follows an accelerated process of negotiations between Tata Steel UK and Greybull Capital to achieve this outcome.

On 29 March, Tata Steel decided to sell its UK operations, called Tata Steel Europe Ltd. This came as the company failed to turn around the business it bought as part of the takeover of Corus at the height of the commodity boom in 2007 for US$12.1 billion. The business suffered almost a decade of losses amid poor demand and cheap Chinese imports.

Radhika Pandit, Managing Editor, ValuePro had written an interesting piece on this matter in one of the editions of The 5 Minute WrapUp titled 'The Perils of Big Acquisitions Spare No One...Not Even the Tatas'.

Going ahead, with the results season behind us, Indian markets are expected to remain volatile on uncertainty over rate hike by the US Fed and the possibility of Brittan leaving the Eurozone. We recommend investors not to get distracted away by any short-term triggers. Instead we recommend they should buy fundamentally strong businesses when they are selling at attractive valuations.

And here's an update from our friends at Daily Profit Hunter...

The index ended this week on a flattish note after a sharp 400-point rally in the previous week. Although it has managed to cross the 8,200 mark, but it seems like the momentum is slowing. Intraday charts suggest exhaustion. 8,150 remains a support to watch out for on an immediate basis and breach below it could setback the bulls. You can read the detailed market update here...

Is the Momentum in Indian Indices Slowing Down?

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "A Mixed Week for Global Markets". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!