- Home

- Todays Market

- Indian Stock Market News June 6, 2017

Sensex Finishes Lower Ahead of RBI Policy Meet Tue, 6 Jun Closing

Share markets in India edged lower in the afternoon session ahead of a central bank policy meeting tomorrow. At the closing bell, the BSE Sensex closed lower by 119 points. While, the NSE Nifty finished lower by 38 points. Meanwhile, the S&P BSE Midcap and the S&P BSE Small Cap Index both ended down by 0.7%.

Barring information technology stocks, all the sectoral indices finished the day in red with consumer durables sector and power sector witnessing maximum brunt.

Asian equity markets finished mixed as of the most recent closing prices. The Hang Seng gained 0.52% and the Shanghai Composite rose 0.34%. The Nikkei 225 lost 0.95%. European markets are lower today with shares in France off the most. The CAC 40 is down 0.44% while Germany's DAX is off 0.36% and London's FTSE 100 is lower by 0.23%.

The rupee was trading at Rs 64.35 against the US$ in the afternoon session. Oil prices were trading at US$ 47.25 at the time of writing.

TCS share price ended up sharply by 3.6% after the reports that the company is looking to run massive open online courses appears to have triggered some strong buying.

The IT major is reportedly looking to administer the written component of the tests on its iON cloud platform, a facility that was initially intended to cater to small businesses in the country.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Meanwhile, as per a Bank of America Merrill Lynch report, farm loan waivers will amount to 2% of Gross Domestic Product by 2019 polls as other states may follow BJP's Maharashtra and UP governments.

This covers bank loans to farmers with up to 5 acres of land. Recently, the Maharashtra government also waived loans of Rs 300 billion/0.2% of GDP owed by farmers with up to 5 acres of land by October.

Further, it also warned that, such moves will also be counter-productive to the Reserve Bank of India's efforts at cleaning up the NPA-saddled bank balance sheets.

Recently, RBI Governor Urjit Patel had expressed his displeasure at the spate of loan waiver announcements in different states. It would impact credit discipline and incentives for future borrowers to repay. In other words, waivers would engender a moral hazard.

However, Vivek Kaul pointed out that if there is a moral hazard for the farmer, there is also one for corporates. And if the RBI governor has pointed out one, he should have pointed out the other as well. Here's a snippet of what he wrote in his Diary titled: Dear Mr Urjit Patel, Have You Ever Heard of Wasim Barelvi?

- "Corporate loan write-offs have led to the situation of diminishing bank capital. This has led to the central government having to recapitalise the PSBs over the years. This money is ultimately borrowed by the government and leads to crowding out, higher interest rates and a weaker national balance sheet. All these issues pointed out by Patel in case of farm loan waive-offs apply to corporate write-offs as well."

Even as the national debate on subsidies has little support from the nation's intellectuals, it is unthinkable to question the subsidies offered to farmers. They seem to deserve all the help they can get.

The other side of the picture consists of millionaires and billionaires - rich landowners, masquerading as the poor old Indian farmer. The two sides are difficult to reconcile...the only commonality between them being subsidies- fertilizer subsidy, power subsidy, minimum support price, loan waivers, and tax relief. And even here, the rich enjoy the lion's share.

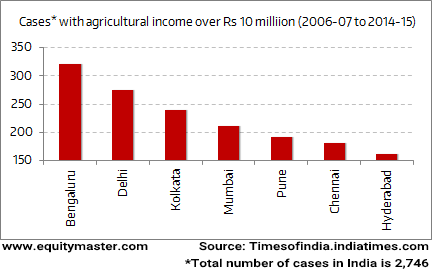

The road to riches passes through barren land. People have been buying cheap uncultivable land, claiming it to be agricultural land to get the status of farmer and enjoy the tax exemption on 'income from farming'.

Agricultural Income - A Channel for Money Laundering?

Agricultural income, being tax exempt, has become a channel for money laundering. The country is losing billions in revenues.

Moving on to news from the stocks in automobile sector. Tata Motors share price declined over 3% after its UK subsidiary Jaguar Land Rover (JLR) reported subdued UK sales growth.

JLR sold 8,813 units in May, down 7.8% compared with 8,880 units sold in same month last year, dented by both brands.

Jaguar's UK sales declined 1% to 2,564 units while Land Rover sales fell sharply by 10.7% to 5,619 units compared with year-ago month.

Meanwhile, in 2016-17, Tata Motors' share of the medium and heavy duty commercial vehicles (MHCV) segment, including buses, fell to 49.2% from 51.9% a year ago.

In May, Tata Motors MHCV truck sales fell 40%, while overall commercial vehicles sales dropped 13% to 23,606 units from a year ago.

According to the company, the decline was a result of several external factors such as the November note ban and the ban on selling BS-III vehicles from 1 April.

Moreover, Ravindra Pisharody, who was also head of the commercial vehicle (CV) business at Tata Motors, stepped down after a decade with the company, citing personal reasons. Pisharody also quit as director of the company and associated companies.

The company has appointed Satish Borwankar as chief operating officer with immediate effect and his tenure of executive directorship would be extended for a period of 2 years from July 2017.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Finishes Lower Ahead of RBI Policy Meet". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!