- Home

- Todays Market

- Indian Stock Market News June 11, 2016

Major Global Markets Close on a Weak Footing Sat, 11 Jun RoundUp

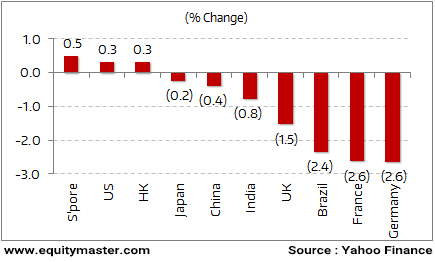

Barring US stock markets and few markets in Asia Pacific region, major global indices closed on a weak note. Concerns over hike in the interest rate by US Fed kept the global markets on the edge. Investors are looking ahead to next week's Fed meeting.

European stock markets also closed on a weak note. The outcome of Brexit seems to be weighing on the indices. The Brexit referendum will be held June 23, where voters will be asked whether Britain should remain part of the European Union.

Barring Singapore (up 0.5%) and Hong Kong (up 0.3%), the major Asian indices closed in the red. Uncertainty around global events in coming weeks have kept investors on the sidelines. Meanwhile, crude oil prices fell below US$ 50 per barrel, witnessing marginal rise during the week.

The Indian markets too closed the week in negative territory. The Reserve Bank of India, in its second bimonthly monetary policy review kept the key policy rates unchanged. The rising inflation since last two months has been the concern for the policymakers.

Key World Markets During the Week

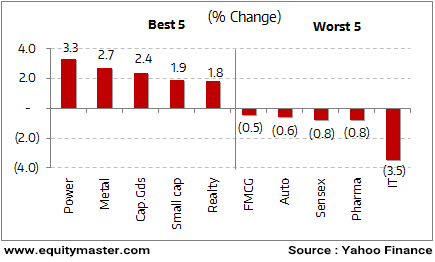

Among the sectoral indices, power and metal stocks witnessed the maximum buying interest. On the other hand stocks from <>IT and <>Pharma sectors were leading the losers.

BSE Indices During the Week

Now let us discuss some key economic and industry developments during the week gone by.

The Reserve Bank of India (RBI) maintained status quo at its third bi-monthly policy review today, all attention has now turned on whether Raghuram Rajan would keep his job as the RBI governor come September. When asked about this, Mr Rajan said that it would be cruel for him to spoil the fun the press is having. He added that the government and the RBI would collectively take the decision. The government had earlier stated that it will take a call on extending Raghuram Rajan's tenure as Reserve Bank of India (RBI) governor in August, a month before his three-year term ends. A senior official had said that the government acknowledges Rajan's role in heading a strong regulator and forcing banks to crack down on bad loans.

As per a leading financial daily, India is planning to introduce a 25% tax on sugar exports. This is in order to maintain local sugar supplies that are going to decline due to a drought in major growing regions. Food Minister Ram Vilas Paswan said the levy is aimed at curbing the county's exports and would help in keeping local prices under control in domestic markets. The above move is said to push up the sugar prices globally and boost shipments from Thailand. According to US Department of Agriculture (USDA) figures, India exported 2.9 million tonnes (MT) of sugar in 2015-16, accounting for 5.3% of world exports. Reports released early this financial year had stated that the output of sugar is projected to be the lowest in five years in FY17 due to two consecutive years of drought. One shall note that many parts of India are going through a water crisis on the back of below normal monsoons for two consecutive years.

As per an article in The Economic Times, the growth in Indian pharmaceuticals market dipped to its lowest in two years this May. This came on the back of a drop in sales of fixed dose combination drugs, fresh price cuts and a lower-than-expected uptake. During the last month, the pharmaceuticals market grew by 7.7% compared to 11.6% during the same month last year. It reached sales of Rs 994 billion over a 12-month period based on Moving Annual Total (MAT). According to pharmaceutical market research company PharmaTrack, the country's fixed dose combination (FDC) market dropped 14.6% and is now valued at Rs 1.9 billion. Further, anti-infectives, derma and respiratory were the worst-hit segments. FDC drugs are developed using two or more different active pharmaceutical ingredients (APIs) in a single pill. Sales of these drugs have witnessed a drop since March. This was seen as the Indian Health Ministry announced a ban on 344 fixed dosage combination (FDC) drugs. Over 100 combination drug makers have challenged the government's decision to ban such products at the Delhi High Court.

As per a leading financial daily, the Telecom Commission (TC) has lowered the annual spectrum usage fee for telecom operators to 3% of adjusted gross revenue for all bands in the upcoming auction that is going to be held in July. The commission has also kept the charge for using broadband wireless access (BWA), or 4G spectrum, bought in the 2010 auctions, at 1% of revenue. As per the new formula, weighted average will be calculated between broadband wireless access (BWA) spectrum, the current spectrum usage charge (SUC) rate and the spectrum that will be acquired in future by the company. Also, to prevent the revenue loss for the government, if new SUC computation leads to a lower payout, telecom operators will pay a minimum amount they are paying as per 2015-16 rates. The annual SUC collection as per present levels is at around Rs 70 billion. Department of Telecommunications (DoT) is going to move the Cabinet note on spectrum auction in a week for inter-ministerial consultations.

According to the data put out by the Union environment ministry, projects worth Rs 5,037 billion were cleared across all states which together have a potential of creating 164,239 jobs. Also, the Environment Minister Prakash Javadekar said that average waiting period for approval of projects has been brought down to 190 days from 600 days earlier. He further added that Modi's government will bring a kind of revolution in this space ahead and the development will unlock the potential of creating millions of jobs which in turn will drive India's economic growth.

As per the data released, Maharashtra was leading among the states with 35 projects approved followed by Andhra Pradesh and Gujarat with 11 and 19 projects respectively. Projects of upto 40 hectares and linear projects will be taken up at 10 offices instead of one ministry. Also, the forest cover in India has been increased by 3,500 sq km in the last two years.

Movers and Shakers During the Week

| Company | 3-Jun-16 | 10-Jun-16 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top Gainers During the Week (BSE A Group) | ||||

| Jaypee Infratech | 6 | 7 | 29.2% | 18/5 |

| MMTC | 38 | 45 | 20.0% | 58/30 |

| Jaiprakash Power | 4 | 5 | 19.3% | 8/4 |

| Lanco Infratech | 4 | 5 | 18.6% | 8/2 |

| J&K Bank | 57 | 66 | 17.2% | 115/56 |

| Top Losers During the Week (BSE A Group) | ||||

| Piramal Enterprises | 1,446 | 1,342 | -7.2% | 1537/805 |

| Infosys Ltd | 1,266 | 1,181 | -6.8% | 1278/933 |

| Aurobindo Pharma | 789 | 745 | -5.6% | 892/582 |

| Glenmark Pharma | 810 | 774 | -4.4% | 1262/672 |

| HPCL | 932 | 893 | -4.2% | 991/636 |

Source: Equitymaster

Now let us move on to some of the key corporate developments in the week gone by.

National Thermal Power Corporation (NTPC) has laid out plans for Rs 10 billion investments in Karnataka. The company has signed an agreement with South Western Railway for doubling of the Hotgi-Kudgi section under the customer funding concession scheme. The section consists of 10 block stations, 8 major bridges and 2 important bridges. The company has agreed to finance the cost of doubling of the 134-km section and has already deposited Rs 9 billion with the South Western Railway. NTPC is an Indian Central Public Sector Undertaking (PSU) under the Ministry of Power. It is engaged in the business of generation of electricity and allied activities.

As per a leading financial daily, State Bank of India (SBI) chairperson Arundhati Bhattacharya said that the merger of SBI with its five subsidiaries will strengthen them and boost market share as the move will help in reducing several repetitive costs. She also stated that talks with bank unions will take place and their concerns related to the proposed merger will be addressed once the government gives its in-principle approval. The bank is going to merge its five associate banks, along with Bharatiya Mahila Bank, with itself. The five associate banks are State Bank of Travancore, State Bank of Hyderabad, State Bank of Mysore, State Bank of Bikaner and Jaipur, and State Bank of Patiala. Recently, Finance Minister Arun Jaitley announced that the government as of now was looking at SBI merging its subsidiaries and a decision on this will be taken soon. The above development comes as some state-run banks have evinced their interest to take on smaller entities. Finance Minister Arun Jaitley had said in March that the bankers' themselves have supported the proposal of consolidation of banks in order to have strong banks rather than having numerically large number of banks.

As per a leading financial daily, Gavis Pharmaceutical LLC, the US arm of Lupin Ltd has received a final nod from the US health regulator to launch Voriconazole tablets. The drug is used to treat infections in skin, abdomen, kidney, bladder wall and wounds. Vfend tablets and Vfend oral suspension had sales of US$ 92.8 million and US$ 15.9 million, respectively in the US as at the end of FY16. The company has stated that it shall commence marketing the drug in the US shortly. Many companies including the likes of Ajanta Pharma and Zydus Cadila Pharma have received US FDA approvals to sell this drug. Hence, the competition seems to be tough in this segment.

According to a leading financial daily, Grasim Industries has suspended production of Viscose Staple Fibre (VSF) at its Nagda plant in Madhya Pradesh (MP). The suspension comes on the back of water shortage caused by deficient rain last year. The company has suspended production from 5th June 2016 in a phased manner and said that it will be resumed on the arrival of monsoon and availability of adequate water. The company said that it has built up adequate VSF stock. The company will continue to cater to the requirements of all its customers from its available stock as well as supplies from other VSF Plants located at Kharach and Vilayat (Gujarat) and Harihar (Karnataka). Backed by this, VSF sales are not likely to be affected. Grasim Industries is the flagship company of the Aditya Birla Group. The company is engaged in two businesses viz. viscose staple fibre (VSF) and cement. In its results for the quarter ended March 2016, the company reported a sharp jump in its sales and net profit by 46.5% YoY and 573.5% YoY respectively. To know our view on Grasim Industries, you can read our result analysis (subscription required).

The Federal Reserve's interest-rate decision next Wednesday and Brexit issue will on global markets in the coming weeks. We would suggest investors to not should not to get distracted by such short-term events and focus on buying fundamentally strong businesses at attractive valuations instead.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Major Global Markets Close on a Weak Footing". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!