- Home

- Todays Market

- Indian Stock Market News June 15, 2017

Indian Indices Trade Marginally Lower; Oil & Gas Stocks Witness Selling Thu, 15 Jun 11:30 am

Share markets in India are presently trading marginally lower. Sectoral indices are trading on a mixed note with stocks in the energy sector and IT sector witnessing maximum selling pressure. Realty stocks and healthcare stocks are trading in the green.

The BSE Sensex is trading down 11 points (down 0.1%) and the NSE Nifty is trading down by 20 points (down 0.2%). The BSE Mid Cap index is trading up by 0.1%, while the BSE Small Cap index is trading up by 0.6%. The rupee is trading at 64.28 to the US$.

In the news from telecom sector... As per an article in the Economic Times, bankers have told the government that telecom companies are on the verge of defaulting their loans.

This, they say, is because competitive pressures, especially after the launch of Reliance Jio in September last year, have created a severe financial stress on the business dynamics of the industry.

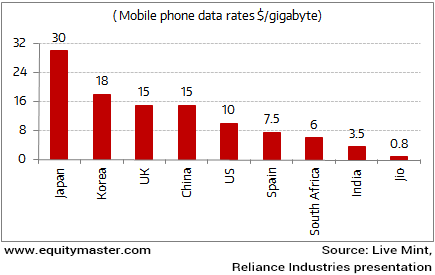

One shall note that Indian telecom players are facing the brunt on the back of Reliance Jio's aggressive pricing strategy, as can be seen in the chart below. To catch up with the competition, many players have started offering similar services. But the aggressive pricing has dented the overall health of these telecom companies.

Jio's Data Pricing to Disrupt the Telecom Apple Cart

Further, higher investments to upgrade infrastructure had stretched their balance sheets. Also, the regulatory costs for the telecom industry have shot the through the roof. After 122 licenses were cancelled by the Supreme Court, the new spectrum airwaves were auctioned off at exorbitantly high prices pushing telecom companies neck-deep in debt.

You can check the financial health of telecom companies by running a query in the Stock Screener section. This gives you the option to run a sector-wise query for top 10 stocks.

Also, Apurva Seth, at Profit Hunter, took a look at the telecom sector recently. And it doesn't look good. Here's Apurva's conclusion after studying the charts...

- Some stocks, like Idea, will fit perfectly into the model and move in a rhythmic fashion...from one phase to another. Keep these stocks on your radar. On the other hand, some stocks may never see the light of the day after going through a downtrend. Avoid these stocks.

If you want to know more about which stocks to keep on radar and which to avoid, it's worth reading Apurva's piece in its entirety.

In the news from global financial markets, the US Federal Reserve raised its interest rates for the second time in three months by 25 basis points to 1.25%.

The central bank also said it would begin cutting its holdings of bonds and other securities this year.

Most Fed policymakers now think that the central bank should take steps to trim its balance sheet later this year as long as the economic data holds up.

However, trimming the balance sheet would tighten financial conditions.

Normalising the balance sheet could also impact emerging markets.

Since 2008, the Fed's swelling balance sheet has propped up the US economy. And it has aided the rally in emerging markets all these years.

So any change to the Fed's balance sheet will have an immediate impact on emerging stock markets.

Only time will tell how this all pan out. Meanwhile, we'll keep you posted on the latest developments.

For domestic markets, the Fed's decision may bring some concerns for Indian share markets in the short run. However, a crash can be an ideal time to bet on solid Indian companies that are well-shielded from adverse developments in global markets. As these companies can turn into bargain buying opportunities.

In the news from commodity markets, crude oil is witnessing selling pressure and trading near its lowest levels in seven months today. Most of the losses are seen on the back of rising inventories and doubts over OPEC's ability to implement production cuts.

Apart from the above losses, crude oil has also been witnessing volatility recently over Donald Trump's proposal to sell half of the country's strategic oil reserves.

One shall note that crude oil prices have been remarkably silent over the last two years. Prices have remained within a tight range, rarely dropping below US$40 or rising above US$60. Volatility has crashed. And if you are trading crude oil, it's critical to understand why this has occurred.

One of the issues of Vivek Kaul's Inner Circle (requires subscription) explains what has triggered the above taming in crude oil prices.

To keep a tab on the movements in crude oil and other commodities, you can read the stock market commentary from the Daily Profit Hunter team. Their commentary tracks the developments in the global economy as well as stock, currency and commodity markets.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Trade Marginally Lower; Oil & Gas Stocks Witness Selling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!