- Home

- Todays Market

- Indian Stock Market News June 16, 2017

Sensex Opens Marginally Up; Tata Motors Gains the Most Fri, 16 Jun 09:30 am

Asian equity markets are higher today as Japanese and Hong Kong shares show gains. The Nikkei 225 is up 0.53% while the Hang Seng is up 0.32%. The Shanghai Composite is trading down by 0.16%. US stocks ended lower as recent slump in technology stocks worsened on Thursday.

Meanwhile, share markets in India have opened the day marginally higher. The BSE Sensex is trading higher by 73 points while the NSE Nifty is trading higher by 17 points. The BSE Mid Cap Index and BSE Small Cap index both opened the day up by 0.4%.

All sectoral indices have opened the day in green with consumer durables stocks and automobile stocks leading the pack of gainers. The rupee is trading at 64.28 to the US$.

Tata stocks opened the day on a mixed note with Titan Company and Tata Motors leading the gains. As per an article in the Livemint, Tata Motors Ltd and two other group entities will sell a 43% stake in Tata Technologies Ltd to an affiliate of US-based private equity firm Warburg Pincus Llc for US$360 million, seeking to raise funds to reduce debt.

The deal will also see Tata Capital fully exiting the company by divesting its 13% stake held through Tata Growth Fund and Alpha TC Holdings. While Tata Motors will sell 30% to get its holding down to 43%, the same as the new investor.

Warburg will purchase a 30% stake from Tata Motors and its subsidiary Sheba Properties Ltd as well as the entire 13% stake held by Tata Capital Ltd.

Tata Technologies provides outsourced design, research and development services to the automotive, aerospace and industrial machinery industries. Tata Motors owns 70.4% of the Singapore-based firm.

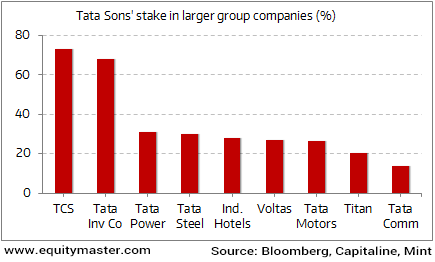

Tatas High on Control, Low on Equity Stake

The deal comes after the Tata Group has reportedly decided to bring down cross-holdings in the group so that these companies can focus more on their core businesses as well as unlock shareholder value. The move will also help Tata Motors pare debt. Its consolidated debt (including that at UK subsidiary Jaguar Land Rover Automotive Plc) stood at Rs 793.23 billion at the end of fiscal 2016-17.

According to reports, various group companies own shares worth tens of thousands of crores in each other and this was one of the charges that the ousted chairman Cyrus Mistry had made against Tata Sons management.

Moving on to the news from stocks in pharma sector. As per an article in a leading financial daily, Lupin Limited has launched the generic Wellbutrin XL tablets in the United States. The tablets are used for treatment of major depressive disorder.

The company has launched its generic tablets in the strengths of 150 mg and 300 mg after having received approval from the United States Food and Drug Administration (USFDA).

The company's tablets are generic versions of Valeant Pharmaceuticals North America LLC's Wellbutrin XL Tablets in the same strengths.

Further, Wellbutrin XL tablets had sales of US$ 758 million, as per IMS MAT May 2017.

In another development, Cadila Healthcare's subsidiary Zydus Cadila announced that the US health regulator has given its nod to market Acylovir drug for injection used as an anti-viral.

The company will produce the drug at the group's formulations manufacturing facility at Moraiya, Ahmedabad.

The group, so far, has received approvals for four drugs that have been filed from its Moraiya facility. With this, the group now has more than 120 approvals and has so far filed over 300 ANDAs since FY04.

Speaking of pharma space in India, according to a report by The Hindu Business Line, in spite of the prevailing challenges, the Indian pharma sector is expected to grow up to 45% by 2025 and 58,000 additional employment opportunities are likely to be created in the industry amid the job crisis in India.

Despite the capping of prices, notebandi and GST implementation, all of which are perceived to impact the pharma sector adversely, the industry will continue to grow. In fact, by 2020, the pharma market will be touching US$ 55 billion, with a CAGR of about 15.9%.

So how can one make money in a rising market?

We believe a few super investors could provide the clue. These are the guys who've beaten the markets black and blue and have an eye for multi bagger stocks irrespective of the macro environment.

If one could learn and implement the stock picking methods of these super investors, then one could theoretically replicate their success as well.

The project culminated in a special report, The Super Investors of India. The report has it all. Answers to your toughest questions about value investing and the rules and principles these super investors follow. These are the investing gurus whose ideas one would do well to learn and implement. Click Here to know more.

Lupin share price and Cadila Healthcare share price opened the day up by 0.2% & 0.3% reapectively.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Marginally Up; Tata Motors Gains the Most". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!