- Home

- Todays Market

- Indian Stock Market News June 19, 2017

Sensex Remains Buoyant; Metal Stocks Lead Gains Mon, 19 Jun 01:30 pm

After opening the day on a positive note, share markets in India have continued the momentum are trading strong. Apart from stocks in the realty sector and stocks in the pharma sector, all sectoral indices are trading on a positive note. Stocks in the metal sector and stocks in the FMCG sector are leading the gains.

The BSE Sensex is trading up by 160 points (up 0.5%), and the NSE Nifty is trading up by 40 points (up 0.4%). Meanwhile, the BSE Mid Cap index is trading up by 0.1%, while the BSE Small Cap index is trading flat. The rupee is trading at 64.39 to the US$.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

In news from the banking sector. According to a leading financial daily, banks are meeting to finalise their next course of action on six of the 12 bad loan accounts for immediate referral to National Company Law Tribunal (NCLT) after the Reserve Bank of India's (RBI) named the largest defaulters to face bankruptcy proceedings.

This marks a small step in the long overdue process of recovery of loans choking the banking system.

The bank's action follows the RBI order to initiate insolvency and bankruptcy proceedings against the top 12 defaulters that account for a quarter of total bad loans in the banking system.

Last week, the RBI's internal advisory committee (IAC) had sent the list of 12 accounts to bankers for immediate reference under the Insolvency and Bankruptcy Code (IBC). These 12 accounts are led by SBI (six of them), PNB, ICICI Bank, Union Bank, IDBI Bank and Corporation Bank, according to bankers.

These 12 accounts referred by the RBI have an exposure of more than Rs 50 billion each, with 60% or more classified as bad loans by banks as of March 2016.

According to RBI, these 12 accounts owe Rs 2.5 trillion to the system, which constitutes around 25% of gross bad loans.

Since these are large accounts and involve multiple banks, the lenders will try to take a common view on all administrative requirements before referring these accounts to the NCLT.

Bad loan recovery has gathered momentum after years of hesitation since the government empowered RBI to direct banks to take big defaulters through the process prescribed under the Insolvency and Bankruptcy Code (IBC) that specifies timebound resolution.

Banks that have been hesitant to follow this route fearing huge writedowns of asset values have been forced get cracking following the Reserve Bank's directive.

While these are steps in the right direction for better accountability in the sector, the RBI has a lot to do if it plans to strengthen India's banking sector, which is reeling under large non-performing assets (NPAs).

India is going through a severe bad loan problem. Major banks have reported poor numbers in the recent earnings season.

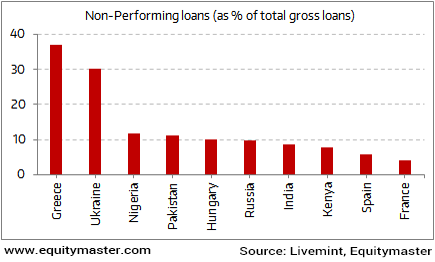

India is Near the Bottom of the Global NPA List

The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting.

Out of the ten major economies facing NPA problems, India is ranked seventh.

The overhang of bad debts has not only hit the bank's profitability, but has also restricted their loan book growth.

Moving on to news from stocks in the construction sector. Larsen & Toubro (L&T) share price is in focus today as the company's construction arm L&T Construction won orders worth Rs 22 billion across various business segments.

The company's building and factories business bagged a turnkey order worth Rs 13 billion from Andhra Pradesh Township Infrastructure Development Corporation Limited for the construction of residential buildings in the West Godavari District of Andhra Pradesh.

The project is part of the Pradhan Mantri Awas Yojana (PMAY) Scheme and consists of residential tenements for the economically weaker sections, it said, adding that the scope of work includes construction of around 22,000 residential units in first-track mode.

While its power and transmission & distribution business bagged major orders worth Rs 5.4 billion from

L&T also announced that it has got a mandate of Rs 3.6 billion from the Tamil Nadu Water Supply and Drainage Board to execute a dedicated water supply project.

At the time of writing, L&T share price was trading up by 0.8%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Buoyant; Metal Stocks Lead Gains". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!