- Home

- Todays Market

- Indian Stock Market News June 20, 2017

Sensex Trades on a Dull Note; Tata Motors up by 3.6% Tue, 20 Jun 01:30 pm

After opening the day marginally higher, share markets in India had a tepid session of trading and are currently trading flat. Sectoral indices are trading on a mixed note with stocks in the consumer durables sector and stocks in the auto sector trading in green, while stocks in the realty sector are leading the losses.

The BSE Sensex is trading up by 11 points (up 0.1%), and the NSE Nifty is trading lower by 5 points (down 0.1%). Meanwhile, the BSE Mid Cap index is trading up by 0.1%, while the BSE Small Cap index is trading up by 0.2% The rupee is trading at 64.34 to the US$.

In news from stocks in the auto sector. Tata Motors share price is in focus today after the auto major denied rumors about plans of an Initial Public Offering (IPO) for its luxury brand - Jaguar Land Rover (JLR).

Earlier it was reported that Tata Group is considering an IPO of Jaguar Land Rover. It said that senior Tata Group officials have held preliminary internal discussions over the past few months about the potential listing of JLR on an international stock exchange.

However, Tata Motors denied the reports of listing the luxury-car maker the Indian conglomerate bought in 2008 for US$ 2.4 billion.

Tata Motors has turned around Jaguar Land Rover since buying the business from Ford Motor Co., helping boost revenue more than sevenfold between 2008 and 2015.

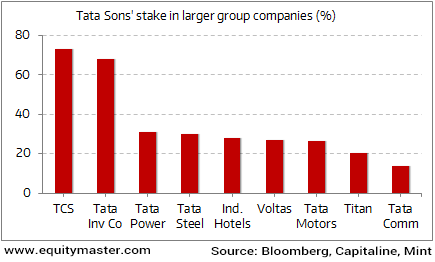

Tatas High on Control, Low on Equity Stake

The reports came after the Tata Group has reportedly decided to bring down cross-holdings in the group so that these companies can focus more on their core businesses as well as unlock shareholder value. The move will also help Tata Motors pare debt. Its consolidated debt (including that at UK subsidiary Jaguar Land Rover Automotive Plc) stood at Rs 793.2 billion at the end of fiscal 2016-17.

According to reports, various group companies own shares worth tens of thousands of crores in each other and this was one of the charges that the ousted chairman Cyrus Mistry had made against Tata Sons management.

At the time of writing, Tata Motors share price was trading up by 3.6%.

Moving on to news from stocks in the energy sector. According to an article in a leading financial daily, state run Bharat Petroleum (BPCL), is set to revisit its earlier plan to build a refinery in Allahabad to cater to the expanding demand for fuel in the country. The management said that it was reassessing the plan and that it has begun maintenance on the land already acquired for the proposed project.

The company plans to reinstate the old plan to meet the rising fuel demand in the country, as well as meet its own target of raising refining capacity to 50 million tonnes in the next five years. A greenfield project like this is necessary for the expansion.

India's fuel demand rose 5% in 2016-17, with consumption of diesel and petrol rising about 2% and 9% respectively. The expansion in fuel demand has spurred refiners to increase capacity, which the government expects to go up by 150 million tonnes in the next 7-8 years from 235 million tonnes today

To help achieve its fuel and energy goals, the government is mulling over consolidating all the major oil players into an integrated public sector 'oil major'. Our energy sector analyst Richa Agarwal, had written about her view of this development in one of the recent editions of the 5 Minute WrapUp Premium. Give it a read to form a better understanding of the development.

At the time of writing, BPCL share price was trading up by 1%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades on a Dull Note; Tata Motors up by 3.6%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!