- Home

- Todays Market

- Indian Stock Market News June 22, 2017

Indian Indices Trade Near All-time Highs; Banking Stocks in Focus Thu, 22 Jun 01:30 pm

After opening the day on a positive note, Indian share markets have continued the momentum and are trading near all-time high levels. Sectoral indices are trading on a mixed note, with stocks in the banking sector and the stocks in the IT sector witnessing maximum buying interest. Stocks in the oil & gas sector and stocks in the PSU sector are leading the losses.

The BSE Sensex is trading up by 172 points (up 0.6%) and the NSE Nifty is trading up by 45 points (up 0.5%). Meanwhile, the BSE Mid Cap index is trading up by 0.3%, while the BSE Small Cap index is trading up by 0.5%. The rupee is trading at 64.51 to the US$.

In news from the banking sector. The banking sector is in focus today as banks, led by the State Bank of India are set to decide the fate of three large defaulters - Essar Steel, Bhushan Steel and Electrosteel Steels - which constitute nearly half the loans of the top 12 defaulters identified by the Reserve Bank of India (RBI).

The bank's action follows the RBI order to initiate insolvency and bankruptcy proceedings against the top 12 defaulters that account for a quarter of total bad loans in the banking system.

Last week, the RBI's internal advisory committee had sent the list of 12 accounts to bankers for immediate reference under the Insolvency and Bankruptcy Code (IBC). These 12 accounts are led by SBI (six of them), PNB, ICICI Bank, Union Bank, IDBI Bank and Corporation Bank.

According to RBI, these 12 accounts owe Rs 2.5 trillion to the system, which constitutes around 25% of gross bad loans.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Of these, the three defaulters owe Rs 1 trillion combined. Banks have outstanding loans worth Rs 450 billion to Essar Steel, Rs 470 crore to Bhushan Steel, and Rs 110 crore to Electrosteel Steels.

The lenders and borrowers are set to meet today to discuss the possibility of the losses that banks would have to incur in reorganizing these loans, and the amount of equity that promoters will have to bring in.

This marks a significant step in the long overdue process of recovery of loans choking the banking system.

Bad loan recovery has gathered momentum after years of hesitation since the government empowered RBI to direct banks to take big defaulters through the process prescribed under the Insolvency and Bankruptcy Code (IBC) that specifies timebound resolution.

Banks that have been hesitant to follow this route fearing huge writedowns of asset values have been forced get cracking following the Reserve Bank's directive.

While these are steps in the right direction for better accountability in the sector, the RBI has a lot to do if it plans to strengthen India's banking sector, which is reeling under large non-performing assets (NPAs).

India is going through a severe bad loan problem. Major banks have reported poor numbers in the recent earnings season.

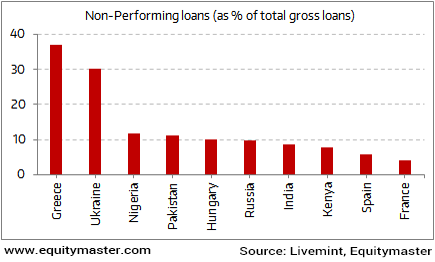

India is Near the Bottom of the Global NPA List

The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting.

Out of the ten major economies facing NPA problems, India is ranked seventh.

The overhang of bad debts has not only hit the bank's profitability, but has also restricted their loan book growth.

Moving on to news from stocks in the pharma sector. Glenmark Pharma share price is in focus today.

Glenmark Pharma announced that it had received tentative approval form the US Food and Drug Administration (USFDA) approval for its Solifenacin Succinate tablets.

Saxagliptin tablets, a generic version of Vesicare tablets of Astellas Pharma, is used for treatment of overactive bladder.

Citing IMS Health sales data for the 12 months to April 2017, the company said Vesicare tablets achieved annual sales of approximately US$ 1.1 billion.The company's current portfolio consists of 117 products authorised for distribution in the US marketplace and 68 Abbreviated New Drug Applications (ANDA) pending approval with the USFDA.

Glenmark Pharma share price had plunged by over 30% in the previous month over tepid results and subdued growth.

The Indian pharmaceutical industry has come under a lot of regulatory pressure in the past few years.

The sector has faced great volatility over the years.

We had written about the current predicament of Indian pharma companies in one of the premium editions of the 5 Minute WrapUp:

- Over the past few years, risk in the US markets has increased. The US Food and Drug Administration has become stricter on products entering US borders. Surprise inspections have increased and companies are being issued warning letters. This has impacted the business and earnings of Indian pharma players, causing major volatility for the sector.

The list of pharma sector woes is long. So, is there light at the end of the tunnel? Girish Shetty, our research analyst thinks there is.

As per him, it doesn't make sense to paint all pharma stocks with the same brush. The leaders of the industry will certainly survive this phase. There are interesting, niche pharma stocks that are worth your attention.

Facing pricing pressures in the domestic and export markets, currency fluctuations, as well as manufacturing issues related to their plant, there is a transformation happening in the overall sector as to how business is done and will be done in the future.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Trade Near All-time Highs; Banking Stocks in Focus". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!