- Home

- Todays Market

- Indian Stock Market News June 22, 2017

Sensex Opens Over 100 Points Up Tracking Positive Global Cues Thu, 22 Jun 09:30 am

Asian equity markets are higher today as Chinese and Hong Kong shares show gains. The Shanghai Composite is up 0.71%, while the Hang Seng is up 0.17%. The Nikkei 225 is trading up by 0.16%. US stocks closed mostly lower on Wednesday as oil prices failed to rebound from a sharp fall during the previous session.

Meanwhile, share markets in India have opened the day on a firm note. The BSE Sensex is trading higher by 119 points, while the NSE Nifty is trading higher by 33 points. The BSE Mid Cap Index and BSE Small Cap index opened the day up by 0.3% & 0.5% respectively.

All sectoral indices have opened the day in the green with power stocks and metal stocks leading the pack gainers. The rupee is trading at 64.60 to the US$.

Engineering stocks opened the day on a mixed note with Punj Lloyd & Emco Ltd leading the gains. As per an article in a leading financial daily, The Centre has sold a 2.5% stake in Larsen and Toubro Ltd (L&T) for about Rs 40 billion through six block deals.

The stake sold by the Specified Undertaking of the Unit Trust of India (SUUTI) brings down the Centre's stake in L&T to about 4.2% from 6.7%.

The State Bank of India (SBI) and Life Insurance Corporation (LIC), New India Assurance and General Insurance Corporation bought over 23.7 million shares in L&T at an average price of Rs 1,764.2 a piece, fetching about Rs 42 billion to the exchequer.

With this transaction, the government has garnered nearly Rs 64 billion from disinvestment so far in the current financial year. The Budget has estimated to collect Rs 725 billion through minority sale and the strategic stake sale of CPSEs.

How Much Will the Government Raise?

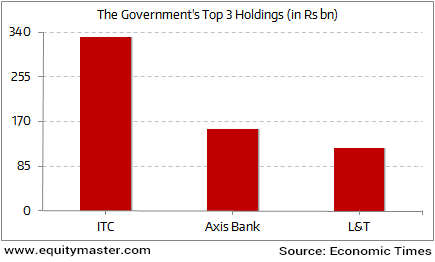

SUUTI holds equity stakes in nearly 50 companies. In February, SUUTI sold 2% of the 11.7% equity stake it held in ITC Ltd for about Rs 67 billion. It had also sold 9% equity stake in Axis Bank, raising Rs 55 billion.

The Indian government has undertaken the strategic sale of a stake in profitable PSUs to help boost up state revenue and bridge the fiscal deficit. In the last financial year 2016-17, the government raised Rs 462.5 billion through disinvestment, the highest ever amount earned by the sale of an equity stake in PSUs.

Further, the government is also reportedly looking at selling 10% equity stake each in <>Bharat Heavy Electricals Ltd and <>Oil India Ltd.

L&T share price opened up by 0.3%.

Moving on the news from Tata stocks. As per an article in a leading financial daily, the Tata Sons is considering buying Air India from the government in partnership with Singapore Airlines.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

According to reports, Tata Group chairman N Chandrasekaran has held informal talks with the Narendra Modi government over buying a controlling stake in Air India, the country's national carrier, with 51% equity.

Notably, Air India was launched in 1932 by JRD Tata as Tata Airlines. Its name was changed to the current one in 1946. The government decided to take it over in 1953.

The new owner of Air India will have a fleet of 118 aircraft; boast of flying the highest number of passengers to and fro from India. Air India's domestic market share is 14% and nearly 75% of its capacity is used for international flights.

On the flip side, the mounting debt is the precise reason for the government wanting to exit Air India. The Modi government alone has infused nearly Rs 160 billion since coming to office, and the central exchequer is no longer keen to keep the airline afloat.

However, while Air India's mammoth debt of Rs 550-600 billion is a big worry for the Tata Group, it also realizes that Air India could be its ticket to be top of the aviation game, the reports noted.

Tata Stocks opened mixed with Tata Teleservices and The Indian Hotels Co witnessing maximum buying interest.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Over 100 Points Up Tracking Positive Global Cues". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!