- Home

- Todays Market

- Indian Stock Market News June 23, 2017

Indian Indices Trade Marginally Lower; Realty Stocks Witness Selling Fri, 23 Jun 11:30 am

Share markets in India are presently trading marginally lower. Sectoral indices are trading on a mixed note with stocks in the realty sector and metal sector witnessing maximum selling pressure.

The BSE Sensex is trading down 95 points (down 0.3%) and the NSE Nifty is trading down by 38 points (down 0.4%). The BSE Mid Cap index is trading down by 1.3%, while the BSE Small Cap index is trading down by 1.7%. The rupee is trading at 64.52 to the US$.

As per an article in the Economic Times, State Bank of India (SBI) has been authorised to refer Essar Steel, Bhushan Steel and Electrosteel to the bankruptcy court raising the possibility that some of these companies could be merged in an effort to return them to health.

The above decision comes after the RBI's internal advisory committee sent the list of 12 accounts to bankers for immediate reference under the Insolvency and Bankruptcy Code (IBC).

These 12 accounts are led by SBI (six of them), PNB, ICICI Bank, Union Bank, IDBI Bank and Corporation Bank.

According to RBI, these 12 accounts owe Rs 2.5 trillion to the system, which constitutes around 25% of gross bad loans.

The above development marks a significant step in the long overdue process of recovery of loans choking the banking system.

Bad loan recovery has gathered momentum after years of hesitation since the government empowered RBI to direct banks to take big defaulters through the process prescribed under the Insolvency and Bankruptcy Code (IBC) that specifies timebound resolution.

While these are steps in the right direction for better accountability in the sector, the RBI has a lot to do if it plans to strengthen India's banking sector, which is reeling under large non-performing assets (NPAs).

India is going through a severe bad loan problem. Major banks have reported poor numbers in the recent earnings season.

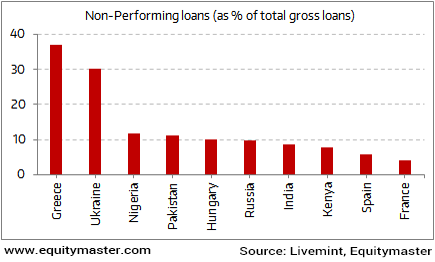

India is Near the Bottom of the Global NPA List

The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting.

Out of the ten major economies facing NPA problems, India is ranked seventh.

The overhang of bad debts has not only hit the bank's profitability, but has also restricted their loan book growth.

In the news from IPO markets, the initial public offer of GTPL Hathway received 41% subscription at the end of the second day yesterday.

The company has set a price band of Rs 167-170 per share for the IPO. The offer will see the firm raise Rs 2.4 billion through a fresh issue of shares and a secondary share sale of 14.4 million shares by the promoter group.

Should you consider participating in this IPO?

Here's our view on the GTPL Hathway IPO.

We, at Equitymaster, have always recommended IPOs cautiously. Here's Rahul Shah, co-head of research at Equitymaster, explaining our rationale behind the approach:

- 'We know what a dirty game the IPO business is. We've seen it over and over again: It's a game where the odds are stacked against investors. So for us, the equation is simple. We'd rather face criticism in the short run than see our subscribers lose money over the longer term. We weren't afraid to do this during the hot IPO days of 2007, and we're not afraid to do it today.'

The Bottomline: You need to evaluate each IPO on its merits by considering its fundamentals, and most importantly, the valuations. And this is particularly important when the hype surrounding IPOs is at its peak.

If you're new to the 'lovely' world of IPOs, we have something for you...

Our new and completely free report - How to Get Rich with IPOs - will tell you how to find those money spinning IPOs and avoid the disasters in the coming year and beyond.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Trade Marginally Lower; Realty Stocks Witness Selling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!