- Home

- Todays Market

- Indian Stock Market News June 27, 2017

Indian Indices Trade Marginally Lower; Energy Stocks Witness Selling Tue, 27 Jun 11:30 am

Share markets in India are presently trading marginally lower. Sectoral indices are trading on a mixed note with stocks in the energy sector and capital goods sector witnessing maximum selling pressure.

The BSE Sensex is trading down 89 points (down 0.3%) and the NSE Nifty is trading down by 39 points (down 0.4%). The BSE Mid Cap index is trading down by 0.9%, while the BSE Small Cap index is trading down by 1.1%. The rupee is trading at 64.45 to the US$.

Shares of public sector banks are trading on a negative note today. Most of the brunt is seen after credit rating agency said banks will have to sacrifice nearly 60% of the value of the loans extended to the 12 indebted companies they have referred to the NCLT at the instance of the Reserve Bank of India (RBI).

Last week, the RBI's internal advisory committee sent the list of 12 accounts to bankers for immediate reference under the Insolvency and Bankruptcy Code (IBC).

These 12 accounts are led by SBI (six of them), PNB, ICICI Bank, Union Bank, IDBI Bank and Corporation Bank.

According to RBI, these 12 accounts owe Rs 2.5 trillion to the system, which constitutes around 25% of gross bad loans.

The above development marks a significant step in the long overdue process of recovery of loans choking the banking system.

Bad loan recovery has gathered momentum after years of hesitation since the government empowered RBI to direct banks to take big defaulters through the process prescribed under the Insolvency and Bankruptcy Code (IBC) that specifies timebound resolution.

While these are steps in the right direction for better accountability in the sector, the RBI has a lot to do if it plans to strengthen India's banking sector, which is reeling under large non-performing assets (NPAs).

India is going through a severe bad loan problem. Major banks have reported poor numbers in the recent earnings season.

India is Near the Bottom of the Global NPA List

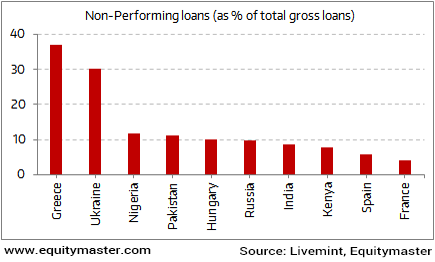

The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting.

Out of the ten major economies facing NPA problems, India is ranked seventh.

The overhang of bad debts has not only hit the bank's profitability, but has also restricted their loan book growth.

In other news, the government has deferred implementation of a provision that required ecommerce players to deduct tax on payments made to their vendors from July 1, under the new Goods and Service Tax (GST) regime. Also, the government notified that small businesses that sell through these ecommerce platforms don't have to register themselves immediately.

One shall note that the GST Council has stuck to the scheduled rollout of the new tax regime.

The panel has relaxed the time for filing initial invoice wise returns for the first two months. The hospitality industry has got a breather with five-star restaurants getting parity with other AC restaurants at 18% GST and the Rs 5,000 room rent limit moving up to Rs 7,500.

GST promises to transform India into a single common market, and many sectors will gain immensely from this transition.

If you would like to dig deeper into the practical implications of GST, download Vivek Kaul's free report, What the Mainstream Media DID NOT TELL YOU about GST.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Trade Marginally Lower; Energy Stocks Witness Selling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!