- Home

- Todays Market

- Indian Stock Market News July 20, 2017

Sensex Opens on a Positive Note; ONGC Gains Post Merger Nod Thu, 20 Jul 09:30 am

Asian equity markets are higher today as Japanese and Hong Kong shares show gains. The Nikkei 225 is up 0.36%, while the Hang Seng is up 0.26%. The Shanghai Composite is trading up by 0.17%. US stocks closed at record highs on Wednesday as investors digested key quarterly earnings.

Back home, share markets in India have opened the day in the green. The BSE Sensex is trading higher by 93 points, while the NSE Nifty is trading higher by 21 points. The BSE Mid Cap Index opened flat while BSE Small Cap index opened the day up by 0.3%.

Sectoral indices have opened the day on a mixed note with automobile stocks and FMCG stocks leading the gainers. While metal stocks and information technology stocks have opened in the red. The rupee is trading at 64.32 to the US$.

Oil & gas stocks opened the day on a mixed note with Hindustan Oil Exploration Ltd and Gulf Oil Lubricants Ltd leading the gains. In the latest development, the government has approved explorer Oil and Natural Gas Corp's (ONGC) plan to buy its 51.1% stake in state-refiner Hindustan Petroleum Corp Ltd (HPCL).

As per The Economic Times, ONGC will be exempted from making an open offer to other shareholders of HPCL in the transaction, which is expected to be completed in a year. More such integration of oil companies is in the offing.

One must note that the proceeds from the deal will cover about 40% of the government's divestment target of Rs 725 billion for 2017-18.

The combined market value of ONGC and HPCL would be US$42 billion, comparable with Russian energy giant Rosneft's US$56 billion, but much smaller than global giants such as ExxonMobil (US$340 billion), Shell (US$220 billion), Total (US$128 billion) or BP (US$114 billion).

Integration with a downstream company such as HPCL helps players like ONGC to de-risk their business to a large extent.

The government has planned a number of mergers and acquisitions in the PSU space this fiscal year.

ONGC share price opened up by 1.9%, while HPCL share price opened down by 4.5%.

Moving on to the news from Tata stocks. As per an article in a leading financial daily, Tata Group is considering a plan to streamline its technology and infrastructure businesses.

Reportedly, the restructuring plan would involve moving several of its technology businesses under Tata Consultancy Services Ltd (TCS).

Tata group is also considering a plan to merge several infrastructure businesses into a single company. Its Voltas Ltd. affiliate, which makes most of its money providing air conditioning systems, also offers engineering services and develops turnkey water treatment projects.

Further, Tata Realty & Infrastructure Ltd. has a business that builds bridges and airports, while Tata Projects Ltd. works on roads, railways and power transmission networks.

Since joining earlier this year, new Tata group chairman Natarajan Chandrasekaran has been seeking to revamp the US$100 billion conglomerate, which makes everything from table salt to luxury cars. Notably, reducing cross-holdings among the Tata group companies has been one of the top priorities for N Chandrasekaran since he took charge as chairman on 21 February. As Rohan Pinto, our research analyst writes in The 5 Minute WrapUp:

- "The Tata Group too has some legacy business operations that are struggling. These businesses operate in a hyper-competitive environment and have generated sub-par returns for all stakeholders. Mr Chandrasekaran clearly has some tough calls to take on these operations."

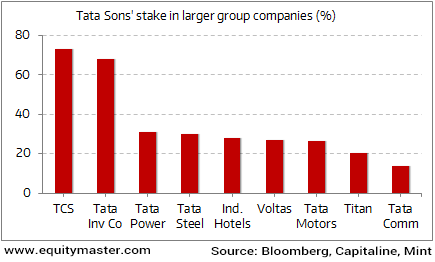

One must note that, apart from Tata Consultancy Services and Tata Investment Corp., Tata Sons seems to be very low on direct equity stake holdings. Its stake in most seems to be in the 20% range, which is quite a low number.

Tatas High on Control, Low on Equity Stake

Through its low holdings and large cross holdings, the group has for long relied on being high on control but low on actual equity stake.

However, the Tata Group too has some legacy business operations that are struggling. These businesses operate in a hyper-competitive environment and have generated sub-par returns for all stakeholders.

This is exactly what India's super investors look for. And that's when smart money slowly and steadily starts flowing in.

How does one track those superinvestors who patiently wait on the sidelines for such an opportunity? I think, our research analysts Kunal and Rohan might be able to help you out.

Right from promoter activity to bulk and block deals, they'll be tracking the well-known and successful names in the Indian stock markets. To know more about these super investors, download a free copy of - The Super Investors Of India.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens on a Positive Note; ONGC Gains Post Merger Nod". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!