- Home

- Todays Market

- Indian Stock Market News August 2, 2021

Sensex Ends 364 Points Higher; Titan and Shree Cement Among Top Nifty Gainers Mon, 2 Aug Closing

Indian share markets witnessed positive trading activity throughout the day today and ended higher.

Benchmark indices rallied today after tracking positive cues across global markets and helped by gains in realty and auto stocks.

At the closing bell, the BSE Sensex stood higher by 364 points (up 0.7%).

Meanwhile, the NSE Nifty closed higher by 122 points (up 0.8%).

Titan and Shree Cement were among the top gainers today.

UPL and Tata Steel, on the other hand, were among the top losers today.

The SGX Nifty was trading at 15,919, up by 145 points, at the time of writing.

Both, the BSE Mid Cap index and the BSE Small Cap index ended the day up by 1.1%.

Sectoral indices ended on a positive note with stocks in the realty sector, oil & gas sector and energy sector witnessing most of the buying interest.

Shares of Balkrishna Industries and Godrej Properties hit their respective 52-week highs today.

Asian stock markets ended on a positive note today as some of the concerns over Covid-19 reopening disruption and China's regulatory crackdown eased.

The Hang Seng and the Shanghai Composite ended the day up by 1.1% and 2%, respectively.

The Nikkei ended up by 1.8% in today's session.

US stock futures are trading on a positive note today with the Dow Futures trading up by 185 points.

The rupee is trading at 74.34 against the US$.

Gold prices for the latest contract on MCX are trading down by 0.2% at Rs 47,755 per 10 grams.

Speaking of the stock markets, Brijesh Bhatia, Research Analyst at Fast Profits Report, shares why he thinks the Nifty is making a short-term top in his latest video for Fast Profits Daily.

Tune in to the video below to find out more:

In news from the auto sector, Tata Motors was among the top buzzing stocks today.

Tata Motors said its total domestic sales increased by 92% to 51,981 units in July as compared to the same month last year. The company had sold 27,024 units in July 2020.

The auto major said its passenger vehicle sales in the domestic market stood at 30,185 units in July, compared to 15,012 units in the same month last year.

Commercial vehicle sales in the domestic market stood at 21,796 units, up 81% from 12,012 units in July 2020.

It exported 2,052 vehicles in July 2021, compared to 2,506 units during July 2020.

Total MHCVs sale in July 2021 including medium and heavy commercial vehicles (M&HCV) Truck, buses and international business stood at 6,314 units, compared to 2,150 units in July 2020.

Apart from that, Tata Motors will be increasing the price of its passenger vehicles in India from this week, and it is expected to be in the range of 2.5%.

Tata has, however, not yet announced the exact quantum of the hike, which will be the third one from the homegrown carmaker this year.

Earlier in May, Tata increased prices of its vehicles by up to 1.8%. Prior to that, in January, prices of cars were hiked by up to Rs 26,000.

Tata Motors share price ended the day up by 1% on the BSE.

Moving on to news from the telecom sector...

Kumar Mangalam Birla to Give Up Promoter Stake in Vodafone Idea

Kumar Mangalam Birla has told the government that he is willing to offer his stake in Vodafone Idea (VIL) to any state-owned or 'domestic financial entity' to keep the stressed telecom company afloat.

Birla, VIL's promoter and chairman of the Aditya Birla Group, made the suggestion in a letter to union cabinet secretary Rajiv Gauba on June 7.

The company has a debt of around Rs 1.8 tn, which includes deferred spectrum obligations and adjusted gross revenue liabilities.

Its board had last September announced a plan to raise Rs 250 bn but investors have not been forthcoming in the absence of government support.

Birla's letter highlighted the need for urgent measures from the government while offering to give up control of the company.

- 'It is with a sense of duty towards 270 m Indians connected by VIL, I am more than willing to hand over my stake in the company to any entity-public sector/government/domestic financial entity or any other that the government may consider worthy of keeping the company as a going concern,' Birla said in his letter.

Birla owns over 27% stake in VIL, while Vodafone Public limited company (Plc) holds over 44%.

The current market capitalisation of VIL is over Rs 240 bn.

The two promoters have decided against infusing fresh funds in the company. Vodafone Plc has already written off all its investment in VIL following continuous losses.

Vodafone Idea share price ended the day down by 0.7% on the BSE.

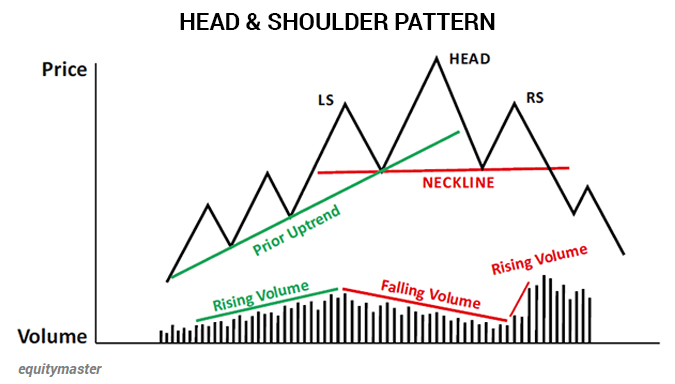

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the editions of Profit Hunter here: It's When You Sell that Counts

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 364 Points Higher; Titan and Shree Cement Among Top Nifty Gainers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!