- Home

- Todays Market

- Indian Stock Market News August 18, 2017

Sensex Trades on a Negative Note; IT Sector Down 2.4% Fri, 18 Aug 11:30 am

After opening the day on a negative note, share markets in India continued to witness losses. Sectoral indices are trading on a mixed note with stocks in the IT sector and healthcare sector witnessing maximum selling pressure. Telecom stocks are trading in the green.

The BSE Sensex is trading down 237 points (down 0.8%) and the NSE Nifty is trading down by 58 points (down 0.6%). The BSE Mid Cap index is trading flat, while the BSE Small Cap index is trading down by 0.4%. The rupee is trading at 64.09 to the US$.

Infosys share price is witnessing selling pressure today as the company's CEO and MD Vishal Sikka announced his resignation with immediate effect.

With the above development, U B Pravin Rao has been appointed Interim Chief Executive Officer and Managing Director reporting to Sikka under the overall supervision and control of the company's board.

The board of directors of Infosys have accepted the resignation and said that Sikka would continue as Executive Vice-chairman.

Has Vishal Sikka's Leadership Transformed Infy's Fate?

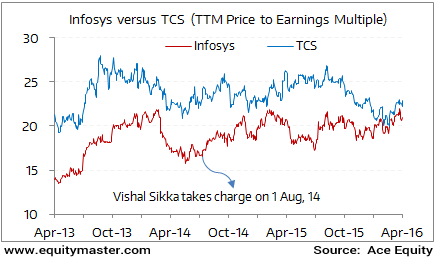

One shall note that Infy's fate has gone through a transformation after Vishal Sikka took over as CEO and Managing Director in August 2014.

As we wrote in one of our editions of The 5 Minute WrapUp...

- When Sikka took over on 1st August 2014, there was a lot of uncertainty around the business. Many people in senior management roles did not know what the long-term strategy was. Many project managers felt stuck in their jobs. The company had lost the vibrant culture of its past. This was reflected in the deal momentum to an extent. There was a very real concern that Infosys was not able to communicate the value that it could deliver to its clients.

Things have changed significantly since then. The company has a clear (but ambitious) plan for 2020. The rough targets are: Revenues of US$ 20 billion, operating (i.e. EBIT) margin of 30% and revenue/employee of US$ 80,000.

To make this a reality, Sikka has appointed the right people in the right positions. He himself decided to reside in Palo Alto instead of Bengaluru, to be closer to Silicon Valley clients. He also decided to be personally involved in all deals of value US$ 50 million and above, as well as in all acquisitions.

At the time of writing, the stock of Infosys was trading down by 7%. Market participants are keeping tabs on the company's board meeting scheduled tomorrow to consider a share buyback.

In the news from global financial markets, the International Monetary Fund (IMF) again warned China over its ballooning debt crisis. The IMF said that China's massive debt is on a dangerous path, raising the risk of a sharp slowdown in growth.

The report by IMF stated that while China's near-term growth outlook has firmed up, it is at the cost of further large and continuous increases in private and public debt, and thus increasing downside risks in the medium term. It also warned that the country's debt load could soar from around 235% of gross domestic product (GDP) last year to more than 290% in 2022.

Note that, while the Fed's balance sheet expanded rapidly during the financial crisis, from less than US$900 billion before 2007 to US$4.5 trillion in 2014, the PBOC's balance sheet less than doubled in size during that period.

China is staring at rapid domestic credit growth. Also, as per ratings agency Moody's, China's structural reforms are not enough to arrest its rising debt.

Moody's Investors Service has downgraded China's sovereign ratings by one notch to A1. The agency expects the financial strength of the world's second-largest economy to erode in coming years as growth falters and debt continues to rise.

Many economists are also of the view that central bank stimulus measures are masking the deeper problems of industrial overcapacity and high levels of corporate debt in China.

So there remain many concerns for China.

A recent issue of Vivek Kaul's Inner Circle (requires subscription) takes a closer look at the Chinese economy and explores how America and China are on the verge of swapping their economic ideologies.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades on a Negative Note; IT Sector Down 2.4%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!