- Home

- Todays Market

- Indian Stock Market News August 20, 2020

Sensex Opens Over 350 Points Down; Metal and Banking Stocks Under Pressure Thu, 20 Aug 09:30 am

Asian stock markets are lower today as Chinese and Hong Kong shares fall. The Shanghai Composite is off 1% while the Hang Seng is down 2%. The Nikkei 225 is trading down by 0.7%.

Among global indices, Wall Street finished lower on Wednesday after the Federal Reserve raised concerns that the US economic recovery from the devastating effects of the pandemic faced a highly uncertain path.

Back home, Indian share markets have opened the day lower today.

The BSE Sensex is trading down by 327 points.

The NSE Nifty is trading lower by 92 points.

Meanwhile, the BSE Mid Cap index has opened down by 0.6%.

BSE Small Cap index is also trading lower by 0.5%.

Sectoral indices are trading in red with BSE Metal Index witnessing maximum selling pressure.

Among the top gainers in the metals index include Vedanta Ltd.

Moving on, the rupee is currently trading at 74.85 against the US$.

Gold prices are currently trading down by 1.8% at Rs 52,622.

Gold and silver prices fell today in Indian markets after a strong surge in the previous two sessions.

In the previous two sessions, gold prices had jumped Rs 1,300 per 10 gram while silver had surged Rs 2,100 per kg.

In global markets, gold prices held above the key level of US$2,000 per ounce, supported by a softer US dollar. Spot gold was up 0.1% at US$2,002.1 per ounce.

So, is it time to book profits in gold and silver?

In this video below, India's no. 1 trader, Vijay Bhambwani tells what he thinks you should do with your bullion holdings.

Tune in here:

To know more about gold, just visit our Youtube Playlist on gold investing.

Moving on to the stock specific news...

Muthoot Finance is among the top buzzing stocks today after the company reported 59% jump in its net profit for the June quarter at Rs 8.4 billion.

Total revenue from operations increased 28% YoY.

The company said it has decided to seek shareholders' approval for an increase in the borrowing powers of the Board of Directors to Rs 750 billion.

In accordance with the concessional package announced by RBl, the company has offered an optional moratorium on repayment of loan instalments falling due between 1 March 2020 and 31 August 2020 and the asset classification for all accounts where moratorium is granted continues to remain stand-still during the aforesaid period as per such guidelines, the company stated.

Consolidated gross loan assets of the company increased 16% YoY.

The company has witnessed a significant increase in disbursements since June 2020 which has continued in July and August.

Muthoot Finance share price opened the day down by 4.9%.

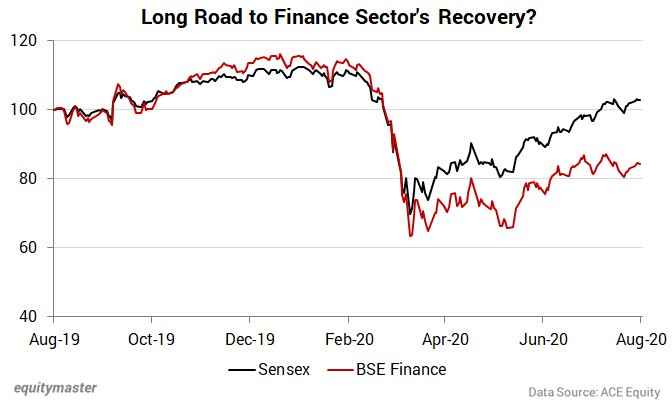

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex has made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in today's edition of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me.

However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums.

This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back.

I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Last week, Richa recommended one such stock - a high quality NBFC. Subscribers can read the report here.

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Over 350 Points Down; Metal and Banking Stocks Under Pressure". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!