- Home

- Todays Market

- Indian Stock Market News August 24, 2020

Sensex Opens Higher; Banking and Finance Stocks Lead Mon, 24 Aug 09:30 am

Asian stock markets are higher today as Chinese and Hong Kong shares show gains. The Shanghai Composite is up 0.3% while the Hang Seng is up 1.6%. The Nikkei 225 is trading up by 0.3%.

Among global indices, the S&P 500 and Nasdaq closed at record highs on Friday, as data pointed to some pockets of strength in the US economy.

Back home, Indian share markets have opened the day on a higher note tracking the positive trend in SGX Nifty.

The BSE Sensex is trading up by 205 points.

The NSE Nifty is trading higher by 69 points.

Meanwhile, the BSE Mid Cap index has opened up by 0.6%.

BSE Small Cap index is also trading higher by 0.7%.

Sectoral indices are trading mixed with BSE Telecom Index witnessing selling pressure.

BSE Bankex is trading in green with 1% gains.

Among the top gainers in the banking index include Kotak Mahindra Bank and City Union Bank.

Moving on, the rupee is currently trading at 74.92 against the US$.

Gold prices are currently trading down by 0.3% at Rs 52,016. To know more about gold, just visit our Youtube Playlist on gold investing.

Moving on to the stock specific news...

Punjab National Bank (PNB) is among the top buzzing stocks today after the bank reported standalone net profit of Rs 3.1 billion in the quarter ended June 2020 against Rs 10.2 billion in a year ago period.

The net interest income (NII) of the bank was at Rs 67.5 billion versus Rs 41.4 billion, YoY.

The gross NPA for the quarter ended June 2020 was at 14.1% versus 14.2% and net NPA was at 5.4% versus 5.8%, QoQ.

In absolute term, the gross NPA for the quarter ended June 2020 stood at Rs 1.1 trillion against Rs 734.8 billion in the quarter ended March 2020, while net NPA was at Rs 353 billion versus Rs 272.2 billion.

PNB share price opened the day up by 1.3%.

Moving on to the news from insurance sector. ICICI Lombard General Insurance Company and Bharti AXA General Insurance Co Ltd on Saturday said they will combine their insurance businesses through a share swap deal, paving the way for the creation of the country's third-largest general insurance entity.

The boards of both the companies approved entering into definitive agreements for demerger of Bharti AXA's non-life insurance business into ICICI Lombard through a Scheme of Arrangement.

ICICI Bank holds 51.9% stake in ICICI Lombard, while the rest is with the public. After the proposed deal, promoter stake will come down to 48.1%.

Reportedly, the combined entity shall have a market share of 8.7% on pro-forma basis. Through this proposed transaction, ICICI Lombard will be able to augment its distribution strength with Bharti AXA's existing distribution partnerships.

After obtaining all approvals, when the scheme becomes effective, the non-life insurance business will be demerged from Bharti AXA into ICICI Lombard.

ICICI Lombard share price opened the day up by 0.2%.

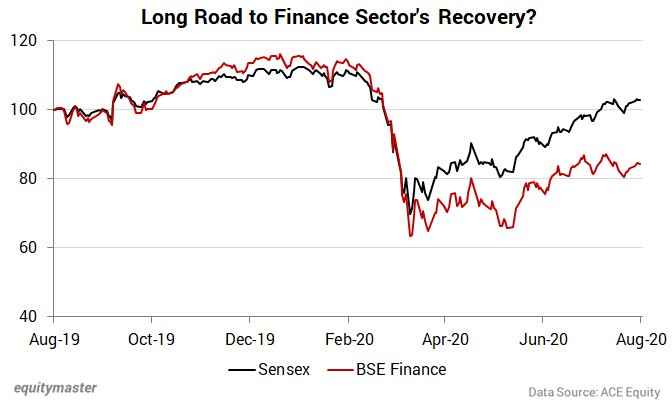

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex has made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in today's edition of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me.

However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums.

This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back.

I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Last week, Richa recommended one such stock - a high quality NBFC. Subscribers can read the report here.

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Higher; Banking and Finance Stocks Lead". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!