- Home

- Todays Market

- Indian Stock Market News August 31, 2017

Sensex Trades Marginally Lower; Telecom Stocks Witness Losses Thu, 31 Aug 11:30 am

Share markets in India are presently trading marginally lower. Sectoral indices are trading on a mixed note with stocks in the telecom sector and metal sector witnessing maximum selling pressure. Energy stocks are trading in the green.

The BSE Sensex is trading down 81 points (down 0.3%) and the NSE Nifty is trading down by 23 points (down 0.2%). The BSE Mid Cap index is trading flat, while the BSE Small Cap index is trading up by 0.3%. The rupee is trading at 64.00 to the US$.

The Reserve Bank of India (RBI) in its annual report stated that fiscal consolidation may come under threat at the central and state level due to the immediate effects of Goods and Services Tax (GST), loan waivers, and pay revisions. The apex bank stated that these factors are likely to weigh on the overall growth matrix this year.

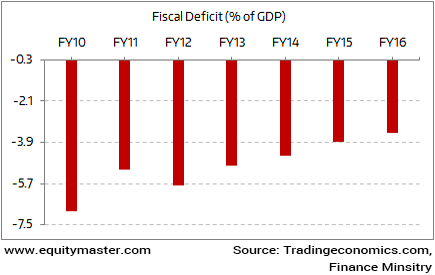

One must note that in the last one decade, India is making serious efforts to reduce the fiscal deficit level. Ever since the new government came in, it has been in favor of fiscal consolidation and wants to meet the long term fiscal deficit target of 3% by FY17-18. This will be the lowest target compared to the last couple of years, as can be seen from the chart below:

Fiscal Deficit target of 3% of GDP

That said, challenges remain. The demonetisation exercise has resulted in a slowdown. Further, government has announced a flurry of projects but execution is still pending.

This means, once again, the government needs to fight dual challenge. First, maintaining its stance on fiscal consolidation and sticking it fiscal deficit target of 3% of GDP for FY17-18. Second, it must relax the deficit target for reviving the economy from the shock of demonetisation.

It would be interesting to see how the government tackles these challenges ahead.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Apart from the above, the RBI report also gave some new insights on the notebandi exercise carried by the government last year. The RBI stated that coincident with the announcement of the withdrawal of Rs 500 and Rs 1,000 notes due to demonetisation, it launched a nationwide exercise to estimate the density of fake Indian currency notes (FICN) detected during the counting and verification of notes.

The result of the above exercise showed the rate of FICN detected per million pieces of notes processed at 7.1 pieces for Rs 500 denomination and 19.1 pieces for Rs 1,000 denomination. This meant that as many as 762,072 pieces of fake notes were detected in the banking system last fiscal, a 20.4% increase over the previous year.

Owing to the above developments, the RBI is working with the government to maintain a data on fake notes. It said the National Crime Records Bureau (NCRB) under the Ministry of Home Affairs has designed a uniform proforma for collection of Fake Indian Currency Note (FICN) data.

Also, a web-enabled software for uploading data on FICN detected by banks and law enforcement agencies has been developed. The RBI has confirmed it is facilitating implementation of the system in collaboration with NCRB.

The above steps by the RBI are a step in the right direction and will inevitably stop the circulation of fake currency in the system.

In other news, Wipro share price is in focus today. This comes as the company yesterday announced that it has got shareholders nod for its share buyback.

Wipro has announced an Rs 110 billion buyback, proposing to buy back 343,750,000 equity shares at Rs 320 per share.

Speaking of share buybacks, many buybacks are set to hit a new record this financial year. As per Prime Database, in the first five months of FY18, at least twenty companies have offered to buy back shares worth Rs 480 billion.

As per Rahul Shah, co-head of Research, investors should not assume buybacks are always good. Here's an excerpt of what he wrote in a recent edition of The 5 Minute Wrapup:

- The reason behind the buyback must be investigated. At the end of the day, an increase in earnings should be more a function of the inherent robustness of the business, as that's what will help it continue to grow at a healthy pace.

The topic also brings us to ask: Do buy-backs offer an arbitrage opportunity for retail investors? Ankit Shah has answered this question in a recent edition of Equitymaster Insider. You can access the issue here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Marginally Lower; Telecom Stocks Witness Losses". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!