- Home

- Todays Market

- Indian Stock Market News August 31, 2017

Share Markets in India Open on a Cautious Note Ahead of GDP Numbers Thu, 31 Aug 09:30 am

Majority of Asian stock indices are lower today as Chinese and Hong Kong shares fall. The Shanghai Composite is off 0.43% while the Hang Seng is down 0.56%. The Nikkei 225 is trading higher by 0.7%. US stocks rose on Wednesday after stronger-than-expected US economic growth outweighed concerns about escalating tensions between the United States and North Korea.

Back home, share markets in India have opened the day on a flattish note. The BSE Sensex is trading lower by 11 points while the NSE Nifty is trading lower by 10 points. The BSE Mid Cap and BSE Small Cap index opened the day up by 0.1% & 0.2% respectively.

Barring bank stocks and FMCG stocks, all sectoral indices have opened the day in green with stocks from energy sector and capital goods sector leading the gains. The rupee is trading at 63.94 to the US$.

Pharma stocks opened the day on a mixed note with Orchid Pharma and Biocon Ltd witnessing maximum selling pressure. As per an article in a leading financial daily, Aurobindo Pharma Ltd is in talks with Shreya Life Sciences for a deal to buy the latter's Russian business. The potential deal is valued between US$80 million to US$100 million.

Shreya Life Sciences Pvt Ltd was established in 2001 and deals with a wide variety of pharmaceutical products. The company runs operations all over the world and had started its Russian operations just a year after its birth.

Apart from Russia, the company also has operations in Ukraine, Uzbekistan, Belarus and Kazakhstan in the region and globally in Africa, South America and South-east Asia.

Notably, Aurobindo Pharma has been on an acquisition drive for some time. The pharma company had recently acquired four biosimilar products from Swiss firm TL Biopharmaceutical AG.

It is also in the race to acquire a part of the European assets of Israeli generic drugmaker Teva Pharmaceutical Industries Ltd in what could be one of the biggest acquisition by an Indian pharmaceutical company.

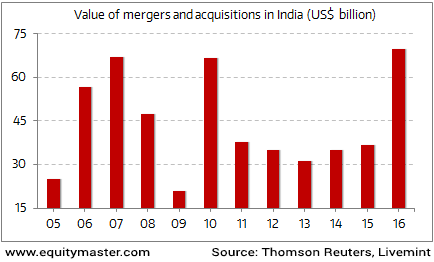

Interestingly, the Indian pharma majors have been on an acquisition spree over the past few years. The value of M&As that took place in 2016 were at US$ 69.75 billion. This even beats the previous record of US$ 66.96 billion set in 2007.

Indian M&A activity in the Past Few Years

Especially, the M&A activity in the Indian pharma space has been on the rise in recent times. At the end of the day, whether the company is able to derive value from the acquisitions and augment the overall performance will be the key thing to watch out for.

To know more about the company's financial performance, subscribers can access to Aurobindo Pharma's latest result analysis and Aurobindo Pharma stock analysis on our website.

Moving on to the news from the economy. As per an article in the Livemint, India's economic growth is likely to remain "soft" and the GDP is expected to grow by 6% in April-June, down from 6.1% in the preceding quarter.

As per the reports, repercussions of an early budget and the newly implemented Goods and Services Tax (GST) rates, receipts and rebates are likely to distort upcoming GDP readings.

However, GVA growth should be the number to watch from here on, the report stated. The GVA growth will accelerate to 6.2% for the April-June period on a year-on-year basis, up from the 5.6% in the preceding March quarter, which saw negative impact of demonetisation.

Explaining the lower GDP growth as against the GVA growth, it said a large subsidy outgo will likely depress the net indirect taxes (NIT) growth which will result in slower GDP.

One must note that, the government is expected to come out with its official growth estimates for the first quarter today. It will be interesting to see how GDP growth estimate pans out during the quarter. Watch this space.

For those investing based on macro clues, these are times to be a little skeptical. What you see could be too good to be true. And could be a very slippery premise for one's investment thesis. Ask superinvestors who have consistently beaten benchmark indices.

Our Research analyst, Kunal has been working on a project to answer this. They have travelled the length and breadth of the country to interview a bunch of value-oriented investors who've had tremendous success with investing.

Who are these super investors? And more importantly, how do they pick stocks? Which stocks are they picking?

To know more about these super investors, download a free copy of - The Super Investors Of India.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Share Markets in India Open on a Cautious Note Ahead of GDP Numbers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!