- Home

- Todays Market

- Indian Stock Market News September 13, 2017

Sensex Continues Uptrend; Metal Stocks Drag Wed, 13 Sep 01:30 pm

After opening the day on a positive note, the Indian share markets have continued the momentum and are currently trading comfortably in green. Sectoral indices are trading on a mixed note, with stocks in the pharma sector and the energy sector witnessing maximum buying interest. While, stocks in the metals sector are leading the losses.

The BSE Sensex is trading up 126 points (up 0.4%) and the NSE Nifty is trading up 28 points (up 0.3%). Meanwhile, the BSE Mid Cap index is trading up by 0.3%, while the BSE Small Cap index is trading up by 0.4%. The rupee is trading at 63.99 to the US$.

In news from stocks in the telecom sector, Bharti Airtel share price is in focus today after it announced a strategic partnership with South Korean telecom major STK Telecom.

SKT Telecom known for using latest technologies, will partner with Airtel to build the most advanced telecom network in India.

The two companies will also collaborate on an on-going basis to evolve standards for 5G and advanced technologies like network functions virtualisation (NFV), software-defined networking (SDN) and Internet of Things (IoT).

The companies will jointly work towards building an enabling ecosystem for the introduction of these technologies in the Indian context.

There has been a quest among Indian telecom operators for delivering high speed mobile broadband to consumers. As per data published by sector regulator TRAI, Reliance Jio has been offering about double the speed delivered by its closest rival at around 18 megabits per second.

SK Telecom has led the development of the global mobile telecommunications industry by launching CDMA (2G), WCDMA (3G) and LTE-A (4G) for the first time in the world. The company has been offering up to 500 Mbps 4G speed using carrier aggregation technology.

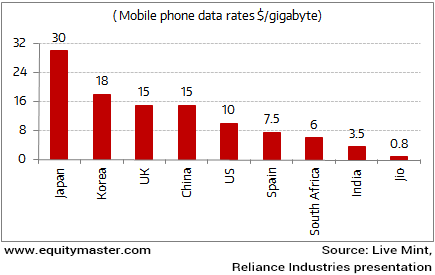

Jio's Data Pricing Disrupts the Telecom Apple Cart

The entry of Reliance Jio and the fierce tariff war it has triggered has set off brisk activity in the industry for fundraising and consolidation, as the incumbents look for ways and means to fend off the competition.

This effort by Airtel could be a way to differentiate itself from the competition.

At the time of writing, Airtel share price was trading down by 0.2%.

Moving on to news from stocks in the pharma sector. Aurobindo Pharma share price is surging on the markets today. The stock climbed amid reports that the US Food and Drug Administration (USFDA) has classified Unit IV of its Hyderabad plant as VAI (voluntary action indicated).

The classification suggested that the matter has not escalated to the extent of slapping warnings letter or import alert.

In May, the drug regulator issued a Form 483 to the company's Unit-IV citing seven observations relating to violation of current good manufacturing practices following an inspection that was held during April 20-28 this year.

As per USFDA, observations are made in Form 483 when investigators feel that conditions or practices in the facility are such that products may become adulterated or render injuries to health.

The Indian pharmaceutical industry has come under a lot of regulatory pressure in the past few years.

The sector has faced great volatility over the years.

We had written about the current predicament of Indian pharma companies in one of the premium editions of the 5 Minute WrapUp:

- Over the past few years, risk in the US markets has increased. The US Food and Drug Administration has become stricter on products entering US borders. Surprise inspections have increased and companies are being issued warning letters. This has impacted the business and earnings of Indian pharma players, causing major volatility for the sector.

The list of pharma sector woes is long. So, is there light at the end of the tunnel? Girish Shetty, our research analyst thinks there is.

As per him, it doesn't make sense to paint all pharma stocks with the same brush. The leaders of the industry will certainly survive this phase. There are interesting, niche pharma stocks that are worth your attention.

Facing pricing pressures in the domestic and export markets, currency fluctuations, as well as manufacturing issues related to their plant, there is a transformation happening in the overall sector as to how business is done and will be done in the future.

At the time of writing, Aurobindo pharma share price was trading up by 1.2%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Continues Uptrend; Metal Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!