- Home

- Todays Market

- Indian Stock Market News September 14, 2017

Indian Indices Pare Gains; BHEL Surges 7% Thu, 14 Sep 01:30 pm

After opening the day in green, share markets in India have pared early gains and are currently trading marginally above the dotted line. Sectoral indices are trading on a mixed note with stocks in the pharma sector and stocks in the PSU sector leading the gains. While, stocks in the metal sector and stocks in the energy sector are trading in red.

The BSE Sensex is trading up by 20 points (up 0.1%), and the NSE Nifty is trading flat. Meanwhile, the BSE Mid Cap index is trading up by 0.4%, while the BSE Small Cap index is trading up by 0.6% The rupee is trading at 64.07 to the US$.

In news from stocks in the capital goods sector. BHEL share price is among the top gainers in the market today. The surge comes after it was reported that the company will make rolling stock for bullet trains.

Prime Minister Narendra Modi and his Japanese counterpart Shinzo Abe laid the foundation stone of India's first bullet train project, a high-speed rail link to Mumbai, in Ahmedabad earlier today.

Various media reports said that BHEL and Kawasaki Heavy Industries will collaborate for making rolling stock for bullet train project.

Order will be big boost for BHEL which has been struggling recently.

At the time of writing, BHEL share price was trading up by 6.4%.

Moving on to news about the economy. According to data released by the Central Statistics Office (CSO), retail inflation as measured by the Wholesale Price Index (WPI) rose sharply to 3.2% in August, as compared to steady rise from 1.8% in July 2017.

Wholesale inflation rate, measured by the wholesale price index (WPI), is a marker for price movements in bulk buys for traders and broadly mirrors trends in shop-end prices.

The index portrays new series of WPI data released by the government earlier this fiscal, with 2011-12 as the base year, replacing existing the base year of 2004-05.

Food articles turned out to be major drivers as the data showed that prices of food articles rose by 4.4% in August on a yearly basis. Vegetable inflation stood at 44.9%.

Fuel and power segment, too rose by 9.9%, from 4.4% in July.

The Reserve Bank of India (RBI) in its monetary policy review meeting last month, announced a cut its policy rate by a quarter of a percentage point.

The decision to cut rates is in line with the RBI's neutral monetary policy stance, tracking the rate of inflation.

The RBI's monetary statement in June had projected quarterly average inflation in the range of 2-3.5% in the first half of fiscal 2018, and 3.5-4.5% in the second half. Now it expects inflation to be about 4% by the year end. As long as inflation follows this track, the possibilities of rate cuts during this fiscal year remain slim.

Moving on to news from stocks in the chemicals sector. Tata Chemicals share price is in focus today amid reports of potential sale of its phosphatic fertilizer business.

The company in a regulatory filing reported that it is in advanced stages of discussions and negotiations with Indorama Holdings BV, Netherlands (subsidiary of Indorama Corporation, Singapore), for the potential sale of its phosphatic fertiliser business located at Haldia and the trading business comprising of bulk and non-bulk fertilisers.

The transaction, if materialised, would involve the transfer of Haldia plant, trading Business along with immovable, movable properties, working capital and product brands but excluding outstanding subsidy amounts. The company is expected to receive consideration in the range of Rs 4 billion to Rs 5 billion.

However, Tata Chemicals also clarified that its exclusivity agreement with Indorama Holdings BV for the sale expires on 31 October and that there is no certainty of the transaction being completed. The potential transaction would be subject to due diligence, agreement on the definitive documents and approvals from the board, shareholders and regulatory authorities, it added

The development comes a year after Tata Chemicals sold its urea business to a local unit of Norwegian firm Yara International ASA for Rs 26.7 crore.

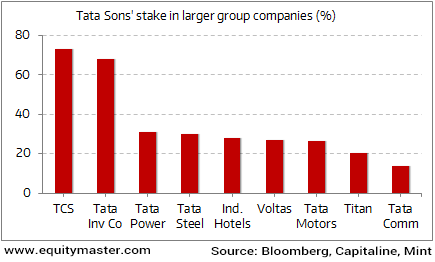

Tatas High on Control, Low on Equity Stake

In related news, it was earlier reported that Tata Sons, the holding company of the Tata conglomerate, is buying out Tata Global Beverages' stake in Tata Chemicals and vice versa.

The deal is estimated around Rs 14.5 billion. According to reports, the move by Chairman N Chandrasekaran is to unwind the cross-holding structure for a leaner organisation.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Pare Gains; BHEL Surges 7%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!