- Home

- Todays Market

- Indian Stock Market News September 26, 2017

Sensex Trades in Red; Metal Stocks Rally Tue, 26 Sep 01:30 pm

After opening the day flat, share markets in India witnessed volatile trading activity and are currently trading in red. Sectoral indices are trading on a mixed note with stocks in the metal sector and stocks in the realty sector trading in green, while stocks in the FMCG sector and stocks in the telecom sector are leading the losses.

The BSE Sensex is trading lower by 90 points (down 0.3%), and the NSE Nifty is trading down by 25 points (down 0.3%). Meanwhile, the BSE Mid Cap index is trading up by 0.4%, while the BSE Small Cap index is trading up by 0.7%. The rupee is trading at 65.36 to the US$.

In news from stocks in the automobile sector. Tata Motors share price is in focus today. The increased activity comes amid various reports suggesting that the company's luxury arm - Jaguar Land Rover (JLR) is scouting for acquisitions of international automakers amid rising competition in the industry.

Leading financial dailies report that the company has been holding internal discussions on buying other brands to diversify the range of vehicles it sells. JLR is considering purchasing luxury marques that fit with its current portfolio. The company is also weighing purchases of technology companies that would boost the company's efforts to roll out electric vehicles and autonomous driving systems.

Tata Motors has amassed a whopping Rs 398 billion in cash at the end of June this year, up by over 87% year on year. This is the second biggest among listed companies in the country.

The company certainly plans to utilize its cash kitty to make meaningful acquisitions. Once complete, the acquisition will be the luxury car maker's first since the takeover from Tata Motors in 2008.

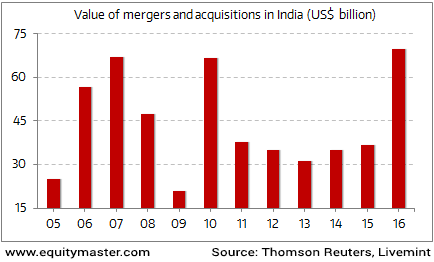

Indian M&A activity at an All Time High

Merger and acquisition activity in India is on a high. The value of M&As that have taken place last year - at US$ 69.8 billion - are the highest on record for the country. This even beats the previous record of US$ 66.9 billion set in 2007.

It will be interesting to see how the data stacks up this year.

At the time of writing, Tata Motors share price was trading up by 0.5%.

In news from stocks in the IPO space. Prataap Snacks' IPO is making waves in the market with its initial share sale offer. The initial public offerings of the general insurer will be open for subscription during 22nd-26th September.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Prataap Snacks Ltd is an Indore based snack food company and operates under the Yellow Diamond brand name. The company is currently present in three major savoury snack food categories in India and all of its products are sold under the Yellow Diamond brand. Over the years, the company has leveraged on its understanding of target markets and consumer segments, product innovation capabilities, extensive distribution network and strategically located manufacturing facilities.

The company has fixed a price band of Rs 930-938 per share for its IPO, through which it aims to raise about Rs 4.2 billion. Its public issue was subscribed 3 times at the time of writing.

Today is the final day for the IPO.

We have analysed and reviewed the offering and have released a recommendation note. You can check the same on the IPO page.

With multiple offerings lined up, it becomes difficult to evaluate and pick out the best opportunity, if any exists. Not all IPOs will have fortunes like the D-Mart IPO, as the IPO game is inherently rigged against the retail investor.

We don't need to back all the IPOs to get rich. But a few good IPOs could certainly become the multibagger in your portfolio in a few years.

We have come out with a special report titled, How to Get Rich with IPOs. It is a comprehensive report that aims to cut through all the hoopla surrounding IPOs. This guide will show you how to safely profit from the 2017 IPO rush.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades in Red; Metal Stocks Rally". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!