- Home

- Todays Market

- Indian Stock Market News September 30, 2020

Indian Indices Trade on a Volatile Note; Tata Steel & ONGC Top Losers Wed, 30 Sep 12:30 pm

Share markets in India are fluctuating between gains and losses in today's volatile session, tracking a mixed trend in global equities as the US began its presidential debate.

The BSE Sensex is trading down by 37 points, down 0.1%, at 37,950 levels.

Meanwhile, the NSE Nifty is trading down by 14 points.

HUL is among the top gainers today. Tata Steel and ONGC are among the top losers today.

The BSE Mid Cap index is trading up by 0.1%.

The BSE Small Cap index is trading down by 0.2%.

On the sectoral front, stocks in the metal sector and oil & gas sector are witnessing selling pressure.

FMCG stocks, on the other hand, are trading in green.

US stock futures are trading lower today. Nasdaq Futures are trading down by 123 points (down 1.1%), while Dow Futures are trading down by 293 points (down 1%).

The rupee is trading at 73.78 against the US$.

Gold prices are trading down by 0.8% at Rs 50,282 per 10 grams.

To know more about gold, just visit our HYPERLINK "https://www.youtube.com/playlist?list=PLouEzv5yQrJydv1WkG9aWMkjP6cJ3chTq&utm_source=TM&utm_medium=website&utm_campaign=MCOM&utm_content=market-commentary" \t "_blank" Youtube Playlist on gold investing.

Speaking of stock markets, in our latest episode of Investor Hour Podcast, India's #1 trader Vijay Bhambwani joins Rahul Goel to talk about his views on stock market, currencies, his trading strategy, and more...

In the podcast, Vijay talks about the volatility in the benchmark indices. Instead of trading for short-term profits of 5-10%, he thinks it's a far better idea to wait for the big profit trades. These are longer-term trades which can pay out anywhere between 50-80%.

Tune in here:

In news from the finance sector, Indiabulls Housing Finance is among the top buzzing stocks today.

The company on Tuesday said it has further sold a portion of its stake in OakNorth Holding to TEMF, a fund managed by Toscafund Asset Management for around Rs 6.3 billion.

OakNorth Holding is the parent company of the UK bank OakNorth Bank. OakNorth Bank was launched in September 2015 and Indiabulls had invested Rs 6.6 billion in November 2015 for a 40% stake in the bank.

In November 2017, the company recouped its investment by selling about 10% stake to the Government of Singapore's investment arm GIC for Rs 7.7 billion.

The housing finance company said sale proceeds will be accretive to the regulatory net worth and the capital adequacy ratio of the company.

With this stake sale, the company has raised a total of Rs 18.3 billion as fresh equity in September. It raised Rs 6.8 billion through qualified institutional placement (QIP) and Rs 11.5 billion through sale of stake in OakNorth.

Indiabulls Housing Finance share price is presently trading up by 1.2%.

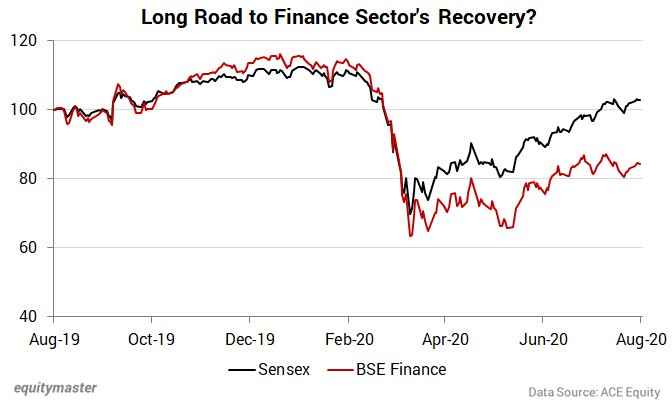

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

Moving on to news from the IPO space, as per a leading financial daily, Canadian investment giant Brookfield Asset Management has filed a draft offer document with markets regulator to monetise it's Indian rental assets via a REIT IPO.

This is the third REIT offering in India after the Embassy Office Parks REIT backed by Blackstone and the Mindspace REIT also backed by Blackstone and developer K Raheja Corp.

Reportedly, the IPO will be launched by 2020 end or early 2021. It will be a combination of fresh issue and offer for sale.

In other news, the initial public offering of ship builder Mazagon Dock Shipbuilders saw a strong demand from retail investors, with the issue getting oversubscribed on the first day itself.

The issue received bids for 63.9 million shares on Tuesday, 29 September 2020, as against 30.5 million shares on offer, as per the National Stock Exchange of India (NSE) website data.

The issue will close on October 1, 2020.

The company will raise nearly Rs 4.4 billion via public issue and all the money will go to the government as it is a part of government's divestment programme.

Mazagon Dock Shipbuilders is a defence public sector undertaking (PSU) shipyard under the department of defence production, Ministry of Defence (MoD) with a maximum shipbuilding and submarine capacity of 40,000 dead weight tonnage (DWT).

It is the only public sector defence shipyard to build destroyers and conventional submarines for the Indian Navy.

The company has a strong order book worth Rs 541 billion, which is to be executed in the next six to seven years. Furthermore, the company also expects the Indian government's 'Atmanirbhar Bharat' plan to positively impact private and public shipyards in coming years as domestic manufacturing picks up.

Mazagon Dock IPO was supposed to launch in September 2019, but the plan was shelved due to low demand.

To know more about the company, you can read our note on the IPO here: Mazagon Dock Shipbuilders IPO: Should You Apply? (requires subscription).

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Trade on a Volatile Note; Tata Steel & ONGC Top Losers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!