- Home

- Todays Market

- Indian Stock Market News October 10, 2015

Global markets close on a firm note Sat, 10 Oct RoundUp

The week gone by was quite strong for most of the global equity markets. US markets posted their biggest weekly gains since December 2014. The recent US Federal Reserve meeting indicated a lower probability of a rate hike in the near future. This too spurred the rally across the indices.

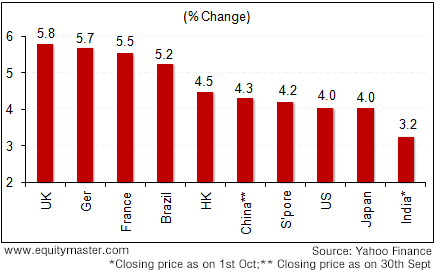

European stocks saw strong gains for the week. The stock markets in the UK (up 5.8%) and Germany (up 5.7%) were the top gainers in the weak gone by.

The dovish signals from the US Fed fuelled a rally in the Asian markets too. After a long holiday break, the China stock markets closed the week on a firm footing.

Back home, the Indian markets too closed on a positive note, posting the highest weekly gains since June 2015. The BSE Sensex was up 3.2% for the week. After the sharp outflows during August and September, the FIIs have infused around Rs 20 billion so far this month.

Key world markets during the week

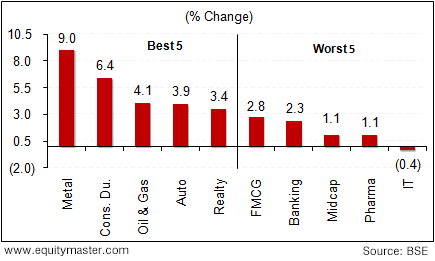

Among the sectoral indices, stocks from the consumer durables and metals were the top gainers. Stocks from the software sector closed marginally down for the week.

BSE indices during the week

Now let us discuss some of the key economic and industry developments in the week gone by.

The RBI has recently initiated a Prompt Corrective Action (PCA) on IOB which will be triggered if the bad loans rise above 10%. The PCA also comes into action if the capital adequacy ratio of the bank slips below 9% and when the return on assets falls below 0.25%. Under the PAC, IOB will be restricted to open new branches, declare dividend and recruit new employees without RBI's approval. The move to impose this was taken after RBI inspected the bank and found several irregularities.

As per a leading financial daily, National Commodity & Derivatives Exchange Ltd (NCDEX) has announced its tie-up with Kotak Mahindra Bank to promote financial inclusion through electronic pledge facility. The tie-up aims to provide financing to the depositors of goods in warehouses which will be approved by the exchange. As per the agreement, farmers and traders can use their commodities stored in approved warehouses as collateral for availing financial assistance from Kotak Mahindra Bank. In addition to Kotak Mahindra Bank, HDFC Bank, Axis Bank and IndusInd Bank are also associated with the exchange to provide this facility. Apart from these banks, 10 non-banking financial companies too have tied up with NCDEX in order to extend pledge finance. This initiative over a period of time could become an important tool to improve the credit access to agricultural producers. Productive reforms like this can push Indian agriculture to the next level.

Movers and shakers during the week

| Company | 1-Oct-15 | 9-Oct-15 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top gainers during the week (BSE-A Group) | ||||

| Vedanta | 84 | 104 | 24.0% | 264/77 |

| Tata Motors | 297 | 356 | 19.7% | 606/279 |

| Hindalco | 71 | 84 | 18.3% | 176/68 |

| Tata Steel | 212 | 251 | 18.2% | 495/200 |

| Unitech | 6 | 7 | 17.1% | 24/5 |

| Top losers during the week (BSE-A Group) | ||||

| Lanco Infratech | 5 | 5 | -7.0% | |

| Maruti Suzuki | 4,580 | 4,269 | -6.8% | 8/2 |

| Jubilant Foodworks | 1,641 | 1,550 | -5.6% | 4762/2903 |

| Sun TV | 366 | 352 | -3.9% | 1987/1177 |

| Rural Elect. | 273 | 263 | -3.6% | 460/256 |

Now let us move on to some of the key corporate developments of the week gone by.

According to a leading financial daily, Tata Motors' subsidiary Jaguar Land Rover (JLR) plans to invest about US$2 billion in the first phase to set up a manufacturing base in the Republic of Slovakia. Tata Motors was exploring plans to set up a factory with an installed capacity of up to 300,000 vehicles over the next decade. The company is planning to generate 400 jobs in the plant and 50,000 supplementary jobs in the allied sectors and is hoping to start production by 2018.

Reportedly, JLR derives around 40% of Tata motor's sales from diesel variants of which Europe accounts for 90%. However, in recent months, things have not been too hunky dory and there has been pressure on JLR volumes in China. Tata Motors has been among the top gainers in the pack.

According to a leading financial daily, Tata Chemicals is planning to create a new umbrella brand for its foods portfolio. The company's existing portfolio of pulses and spices under i-Shakti label will be migrated into a new brand 'Sampann' which will also house future launches in the staples and food segment. Reportedly, the company also plans to expand its footprint to 2.5 m outlets from current reach of 1.43 m outlets.

NTPC-SAIL Power Company has got environment clearance for expansion of its Durgapur captive power plant situated in West Bengal. The company is a joint venture between two state-owned firms, power major NTPC and the steel giant SAIL. The investment for this expansion is reported at Rs 3.6 billion. As per a leading financial daily, the joint venture company, among other conditions, has been asked to earmark a minimum amount of Rs 42.9 million as capital cost for CSR activities. Further, the company has also been asked to examine the feasibility of coal transportation.

The coal requirement for this expansion project has been estimated to be at 0.3 million tonnes per annum (MTPA). The same would be sourced from SAIL's Ramnagore Captive Coal mine. The project does not require any further land acquisition as per the future prospects.

It should be noted that SAIL, in a restructuring plan carried out in 2001, had transferred its Unit-II of captive power plants at Durgapur and Rourkela steel plant to one of its subsidiary- SAIL Power Supply Company. This subsidiary was later on converted into a 50:50 joint venture with NTPC in 2001.

Leading Indian pharma company Sun Pharmaceutical Industries has announced the commencement of a tender offer for acquisition of all outstanding shares of InSite Vision. The offer has been commenced through the company's indirect wholly owned subsidiary - Thea Acquisition Corporation. The acquisition of outstanding shares of InSite Vision will be for US$0.35 per share in cash, without interest and less any required withholding taxes. To recall, Sun Pharma had on 16 September 2015 announced its intention to acquire InSite Vision.

As per an article in Economic Times, Hero MotoCorp has unveiled two scooters named 'Maestro Edge' and 'Duet'. Duet is a full metal body scooter. The 110 CC Maestro Edge will compete directly against Honda Activa. The launch is scheduled for 13 October 2015. The scooter is priced at Rs 49,500 before local levies and insurance in Delhi. The launch of Duet will follow thereafter. Hero currently has two scooters in its portfolio - 'Pleasure' and 'Maestro'. Both the models were developed using Honda's technology. The new models have been developed in-house. Hence, it would be interesting to see how well the company is able to garner market share with its own technology.

SBI chairperson Arundhati Bhattacharya recently made a pitch for re-introducing so-called teaser home loans to help boost demand for credit, four years after withdrawing such loans amid concern that they could hurt the asset quality of banks. Vivek Kaul, Co-Editor of The Daily Reckoning is of the opinion that teaser home loan rates are indeed a very bad idea and how these loans were a major reason behind the financial crisis that had started in the United States in September 2008.

Going forward, global factors as well as the result season are likely to influence the markets. However, it makes more sense for investors to look out for stocks with strong fundamentals rather than focus on short term factors.

By the way, Asad Dosani, the editor of Profit Hunter, has already started disclosing the key details of his latest trading strategy to make "Income at Will" in a 3-Part Master Series. The strategy, that he has designed himself, is based on a method that is generally used by banks and ultra-wealthy professionals to earn regular income. As always, the strategy has been thoroughly back tested by Asad and shows a solid 98.3% success rate over a five year period!

Interestingly, the video # 1 has already got more than 6700 views. The 1st Part of this master series is LIVE Now and you can view it here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global markets close on a firm note". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!