- Home

- Todays Market

- Indian Stock Market News October 16, 2020

Sensex Ends 255 Points Higher; Metal and Banking Stocks Witness Buying Fri, 16 Oct Closing

Indian share markets witnessed positive trading activity throughout the day and ended today's volatile session higher.

Indian share markets rebounded, led by banking and metal stocks, a day after benchmark indices halted their longest winning streak in nearly six years.

At the closing bell, the BSE Sensex stood higher by 255 points (up 0.6%).

The NSE Nifty closed higher by 82 points (up 0.7%).

Tata Steel and HDFC Bank were among the top gainers today.

The SGX Nifty was trading at 11,770, up by 86 points, at the time of writing.

The BSE Mid Cap index ended up by 1.1%. The BSE Small Cap index ended up by 1%.

On the sectoral front, gains were largely seen in the metal sector and banking sector.

Energy stocks, on the other hand, witnessed selling pressure.

Asian stock markets ended on a mixed note. As of the most recent closing prices, the Hang Seng ended up by 0.9% and the Shanghai Composite ended up by 0.1%. The Nikkei fell 0.4%.

US stock futures are trading on a flat note. Nasdaq Futures are trading up by 16 points (up 0.1%), while Dow Futures are trading down by 27 points (down 0.1%).

European stock markets opened on a strong note today, amid a slew of positive corporate news that outweighed investor concern about new restrictions to curb the pandemic. In the previous session, European stock indices posted their largest losses in more than three weeks.

Speaking of the current stock market scenario, note that Indian share markets have climbed back to their highest levels since the pandemic began.

The Sensex breached the 40,000-mark earlier this month. Meanwhile, the Nifty went past the 12,000-mark earlier this week on Monday.

The smallcap index is up more than 60% since 23 March.

As per Richa Agarwal, lead smallcap analyst at Equitymaster, there could still be a lot of steam left to this smallcap rebound rally.

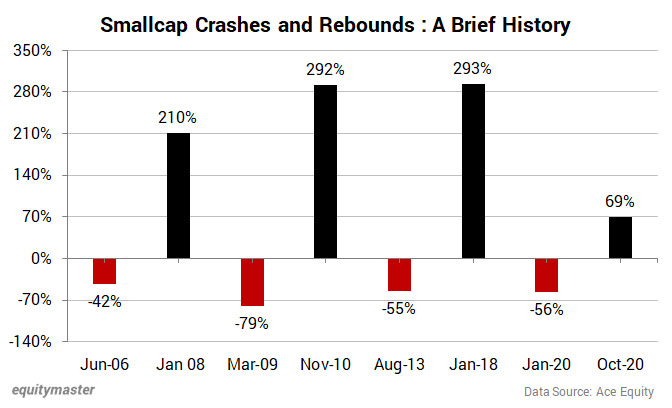

Have a look at the history of previous smallcap crashes and rebounds over the last two decades...

Every big fall in the smallcap index was followed by a sharp up move, a minimum gain 200%. Twice the rebounds were just shy of touching 300%.

Richa believes if you focus on the quality of business, margin of safety in valuations, and an optimum asset allocation, you are likely to create huge wealth for yourself.

Moving on, the rupee was trading at 73.35 against the US$.

Gold prices are trading down by 0.1% at Rs 50,650 per 10 grams.

Domestic gold prices traded flat with a negative bias on the Multi Commodity Exchange (MCX) following a muted trend in the international spot prices on uncertainties over the stimulus package in the US and firm dollar.

Note that gold prices have moved up by more than 25% over the last one year. The yellow metal is considered a hedge against inflation and a weakening dollar. With the flood of money by governments and central banks expected to stoke inflation, investors are buying gold.

Also, ahead of the festive season, the Indian government has come up with another tranche of sovereign gold bonds that opened for subscription on Monday. The RBI on behalf of the government will issue gold bonds at Rs 5,051 per gram of gold.

To know how gold prices will perform ahead, tune in to the video below, where India's #1 trader Vijay Bhambwani tells you why the bull market for gold and silver still has a long way to go...

In news from the mutual funds space, as per a leading financial daily, the markets regulator has restored the cut-off time for equity mutual fund purchases and redemptions to 3 pm, effective Monday.

However, for debt and conservative hybrid funds, the truncated cut-off time will continue.

Earlier this year in April, the regulator had reduced the cut-off time for availing the same day's net asset value (NAV) for mutual fund schemes, other than liquid and overnight, to 1 pm from 3 pm following the pandemic-induced disruptions to financial services.

The regulator's restoration of cut-off time for equity mutual fund purchases and redemptions is based on representations from Association of Mutual Funds in India (Amfi) on 29 September and 9 October.

"Considering that the banking operations are now gradually getting back to normal after the lockdown imposed was withdrawn by the local authorities, and since the stock exchange trading is functioning normally, it is proposed to restore or revert to the normal cut-off timings of 3 pm," Amfi had said in its communication.

Moving on to stock specific news...

Amber Enterprises India and IFB Industries were among the top buzzing stocks today.

Shares of both the consumer electronics companies rallied up to 15% intra-day today after the government banned import of air conditioners with refrigerants.

Amber Enterprises India share price surged 15% to hit a 52-week high of Rs 2,300 on the BSE. The company is a market leader in Indian Room Air Conditioner (RAC) industry and air conditioning industry for mobile application such as railways, metros, buses etc.

IFB Industries share price rallied 14% to Rs 746.

Other consumer electronic companies including Blue Star, Johnson Controls-Hitachi Air Conditioning India, Voltas and Whirpool of India ended up in the range of 2-6%.

As per reports, the government on Thursday banned imports of air conditioners with refrigerants with a view to promote domestic manufacturing and cut imports of non essential items.

"Import policy of air conditioners with refrigerants is amended from free to prohibited," directorate general of foreign trade said in a notification.

Reports stated that this is in line with the government thinking of reducing import dependence in this segment. Majority imports of in this segment come from China and Thailand.

In an investor presentation, Amber Enterprises India had said that various initiatives by the government under Atmanirbhar Bharat will help boost the local manufacturing.

We will keep you updated on the latest developments from this space. Stay tuned.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 255 Points Higher; Metal and Banking Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!