- Home

- Todays Market

- Indian Stock Market News October 21, 2021

Sensex Falls Over 500 Points, Dow Futures Down by 105 Points Thu, 21 Oct 12:30 pm

Share markets in India are presently trading on a negative note.

The BSE Sensex is trading down by 555 points, down 0.9%, at 60,704 levels.

Meanwhile, the NSE Nifty is trading down by 146 points.

Kotak Mahindra Bank and Grasim Industries are among the top gainers today. Reliance and Dr Reddy's Lab are among the top losers today.

The BSE Mid Cap index is trading down by 0.7%.

The BSE Small Cap index is trading up by 0.5%.

On the sectoral front, stocks from the software sector are witnessing most of the selling pressure.

On the other hand, stocks from the power sector are witnessing most of the buying interest.

US stock futures are trading lower today, indicating a negative opening for Wall Street.

Nasdaq Futures are trading down by 61 points (down 0.4%) while Dow Futures are trading down by 105 points (down 0.3%).

The rupee is trading at 74.78 against the US$.

Gold prices are trading up by 0.1% at Rs 47,459 per 10 grams.

Gold prices in India were trading higher in Indian markets today following a positive trend seen in international spot prices as soft dollar made the metal cheaper for buyers holding other currencies.

To know more about gold, check out our article on how to invest in gold here: How to Invest in Gold?

Moving on to stock-specific news...

Among the buzzing stocks today is Tata Communications.

Shares of Tata Communications rose over 3% in an otherwise weak market today after the company's net profit jumped 10.6% year on year (YoY) to Rs 4.3 bn for the September 2021 quarter.

However, the company's net revenue was down 5.2% YoY at Rs 41.7 bn.

Sequentially, the company's revenue grew 1.7% while profit came in higher by 43.7% on account of a gradual recovery across both data and voice segments.

Commenting on the results, AS Lakshminarayanan, managing director and chief executive of Tata Communications, said,

- Delivering a sequential growth on a quarter-on-quarter basis after three-quarters of decline is a positive indicator which we will continue to build on.

The second quarter was marked by recovery with favourable underlying trends as economic activities normalise.

The company's EBITDA (earnings before interest, taxes, depreciation, and amortization) for the quarter stood at Rs 11.1 bn due to employee expenses and a reversal of provisioning for doubtful debts due to better collection efforts.

The company said its net debt at the end of the quarter stood at Rs 77.6 bn, down by Rs 2.4 bn sequentially and Rs 8.7 bn compared to the corresponding period last year, on the back of a better working capital mix and improvement in operating profit.

This came despite a dividend payout of Rs 4 bn during the quarter.

How the company performs in the next quarter remains to be seen. Meanwhile, stay tuned for more updates from this space.

At the time of writing, Tata Communication shares were trading up by 4.1% on the BSE.

Speaking of the stock markets, Brijesh Bhatia, Research Analyst at Fast Profits Report shares his view on housing finance stocks, in his latest video for Fast Profits Daily.

Moving on to news from the food & tobacco sector...

Jubilant FoodWorks Net profit rises 58% YoY, Beats Estimate

Jubilant FoodWorks reported a 58% YoY rise in net profit at 1.2 bn for the September 2021 quarter, which was above analysts' expectations.

The company reported a 36.6% YoY growth in revenue to Rs 11 bn, which was also above the Street's estimate.

During the quarter, the company saw a 43% jump in cost of raw material. The growth in input costs was significantly higher than the growth in revenues.

Jubilant Food said that it undertook a one-time loss of Rs 12.5 m to support its employees affected by the Covid-19 pandemic during the quarter. The same one-time cost was Rs 56 m in the previous quarter.

The company reported a 33% year-on-year increase in operating profit at Rs 2.9 bn in the reported quarter. However, the operating margin fell 67 basis points YoY to 26% on account of higher input costs.

We will keep you posted on more updates from this space. Stay tuned.

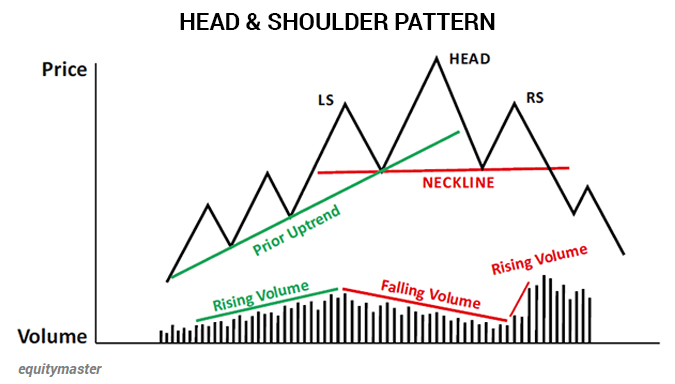

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the editions of Profit Hunter here: It's When You Sell that Counts

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Falls Over 500 Points, Dow Futures Down by 105 Points". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!